Management Discussion and Analysis

Customer Capital

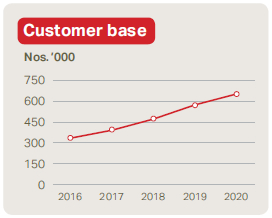

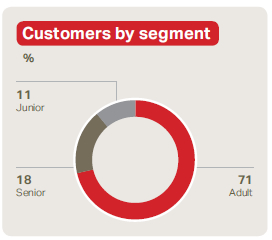

Over the course of 65 years, DFCC Bank has built meaningful relationships with its customers. These relationships have had a profound impact on all segments of Sri Lankan society and the country itself. With over half a million accounts, DFCC Bank continues to inspire its customers to reach new heights and give them the tools they need for financial management.

In the Bank’s journey to reach two million customers, customer centricity is one of the key strategic pillars defined in the Vision 2025 plan that will help the Bank to achieve this goal. Focusing on building and enhancing the customer experience is the crucial component of the Bank’s focus on customer centricity. Through various approaches and working closely together with its customers, DFCC Bank can continue to develop and offer innovative products and services to them while ensuring they remain satisfied with their experience.

Customer profile

Product portfolio

Savings accounts

DFCC Supreme Vaasi – Offers a superior rate of interest for businesses and individuals aged 18 years and above

DFCC Mega Bonus – Interest rates grow in tandem with the savings deposits for businesses and individuals aged 18 years and above

DFCC Xtreme Money Market Account – Offers the highest interest rate for Rupee and Dollar denominated savings based on the account balance for businesses and individuals aged 18 years and above

DFCC Winner – Offers the best interest rate for accounts with a minimum balance of LKR 2,500 and above for individuals aged 18 years and above

DFCC Teen – Savings account for teenagers who are between 13 to 18 years of age

DFCC Junior – Children’s savings account offering a range of gifts and preferential interest rate for children below 18 years of age

DFCC Junior Plus – Children’s savings account with a higher interest rate for children below 18 years of age

DFCC Garusaru – Offers an attractive interest rate with a range of other benefits for senior citizens above 60 years of age

Special Deposit Account

Offers highly attractive returns for funds received via inward remittances from abroad to Sri Lanka. Fixed Deposits can be placed under this account in multiple currencies including LKR.

Product propositions

Catering to different segments, distinct needs, wants, aspirations and life style to offer the best suited financial solutions such as savings accounts, current accounts, debit and credit cards, and personal loans.

DFCC Salary Plus

DFCC Salary Partner

DFCC Prestige

DFCC Pinnacle

Housing loans

DFCC Home Loans – Flexible and convenient housing loans at affordable rates for self-employed individuals, professionals, and salaried individuals

Personal loans

An entire range of personal loans catering to the needs of all categories of salaried employees and professionals.

DFCC Education Loans – Flexible and convenient loan facilities to fund the higher education of all individuals pursuing higher studies.

Garusaru Personal Loans – Special personal loan scheme for government pensioners

Leasing facilities

DFCC Leasing for brand new and unregistered/registered vehicles, machinery, plant and equipment for corporates, SMEs, entrepreneurs, professionals and individuals

DFCC Credit Cards

The only credit Card that offers 1% Cashback on every personal Card transaction 365 days of the year.

Bancassurance

Insurance and assurance solutions for corporates, SMEs, entrepreneurs, professionals, and individuals

Pawning services

Ranwarama Pawning – Gold-pledged advances for the mass market/individuals

Digital products and services

DFCC Virtual Wallet

DFCC iConnect

DFCC Pay App

DFCC Chatz/DFCC Video Chatz

M-teller

eStatements

SMS alerts

Internet banking

DFCC MySpace for corporates, SMEs, entrepreneurs, professionals, and individuals

Credit line/Subsidy scheme supported project loans

“Saubhagya” (Prosperity) Loan Scheme for Small and Medium Enterprises (SMEs)

Small and Micro Industries Leader and Entrepreneur Promotion Project III Revolving Fund (“SMILE III RF”) for SMEs

Small and Medium-Sized Enterprises Line of Credit – (“SMELoC”) for SMEs

Emergency Response Facility Working capital loan scheme for SMEs

Tea Smallholder Credit Line For tea smallholders to approve leaf production

Micro and Small Enterprises Development Loan Scheme (“Swashakthi”) for Micro and Small Enterprises

Loan Scheme for Resumption of Economic Activities affected by Disasters (READ) (“Athwela”) for small-scale businesses affected by a disaster

Environmentally Friendly Solutions Fund II – Revolving Fund (“E-friends II RF”) for pollution reduction and efficiency improvement initiatives

Smallholder Agribusiness Partnership Programme (“SAPP”) for out-grower farmers and youth entrepreneurs connected to the agriculture value chain

Rooftop Solar Power Generation Line of Credit (RSPGLoC) for rooftop solar power systems of up to 50 kW

New Comprehensive Rural Credit Scheme (NCRCS) for short-term cultivation

Other project loans

Term loans for corporates, SMEs, professionals and individuals

Working capital financing

Short-term working capital financing – overdrafts, revolving credit or short-term working capital loans for corporates, SMEs, entrepreneurs and current account holders

Medium, long-term loans to finance permanent working capital requirements for corporates, SMEs and entrepreneurs

DFCC Sahaya

A one-stop financial solution offering loans, leases, bank guarantees and other commercial facilities for MSMEs

Hire purchase facilities

Hire purchase facilities for vehicles for corporates, SMEs, entrepreneurs, professionals and individuals

Guarantee facilities

Bid bonds, advance payment bonds, performance bonds, bank guarantees for credit purchase of goods for corporates, SMEs, entrepreneurs, professionals and individuals

Loan syndication

Loans provided by a group of lenders which is structured, arranged and administered by one or several banks for corporate

Consultancy and advisory services

Provision of legal, tax, finance, market and other advisory services to start up a new business or revamp existing businesses for corporates, SMEs and entrepreneurs

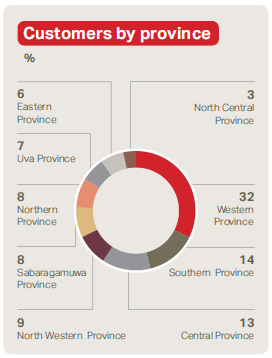

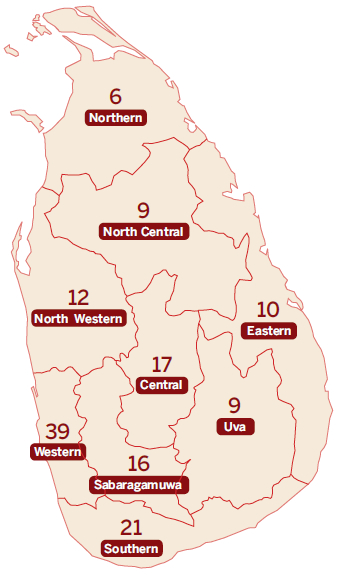

Branch network and service delivery

The Bank relocated the state of the art pinnacle centre at Horton Place Colombo 7 and the Kurunegala branch to our very own newly built five story building to coincide with its 65th anniversary. Furthermore, the branches in Kiribathgoda and Moratuwa were relocated to offer increased convenience to customers.

Customers also have access to the Bank’s Services through over 4,500 LankaPay ATMs across the island. Furthermore, as one of the most customer centric and digitally enabled banks in the country, the Bank’s reach to customers goes beyond traditional brick and mortar via the online and mobile banking services. A 24/7 Contact Centre is also available to customers along with the corporate website, which is accessible in English, Sinhala, and Tamil.

New products and services in 2020

DFCC Bank launched three new propositions in line with being the “Bank for Everyone” based on a client centric strategy, taking a more focused approach in segmenting the retail customers.

A strategic analysis was performed to ensure the propositions to partner with the customers’ life journey to fulfil their financial aspirations to reach their life goals at every stage.

All propositions allow customers to open any type of savings account of their choice. All proposition customers will receive a complementary branded international debit card with enhanced withdrawal and POS limits. They also have free access to all DFCC Bank ATMs and over 4,500 Lanka Pay ATMs. Through the Bank’s seamless banking solutions, customers can enjoy free digital banking services and have access to the DFCC Virtual Wallet, enabling them to transact at their convenience. Moreover, a lifetime free credit card is offered on eligibility with a host of privileges, including cash back on transactions and six months interest-free instalment plans for any transaction anywhere. Each proposition also offers special pricing on banking products, tariffs with exclusive fee waivers, and rewards and benefits.

Salary Partner and Salary Plus

The Salary Plus segment is focused on mass salaried customers with a view of assisting them with their financial requirements to uplift their living standards.

The Salary Partner proposition is aimed at young executives who constitute the upper mass segment of customers with the purpose of fulfilling the financial requirements to build and create their lifestyles.

Prestige and Pinnacle

The Prestige proposition offers customised efficient banking solutions creating aspirational value, a distinct brand identity, and exclusivity to cater to the mass affluent segment.

The Premier proposition was revamped and upgraded to the “Pinnacle” proposition to cater to high net worth individuals and their requirements on banking and dedicated relationship and portfolio management.

Pinnacle clientele will be served at the exclusive state-of-the-art Pinnacle Centre in Colombo 7 and at selected branches by dedicated Pinnacle Relationship Managers, supporting all financial requirements at a single point of contact and ensure exclusive services are experienced by Pinnacle clients with convenience. Additionally, dedicated Contact Centre Pinnacle agents are also available to assist Pinnacle clients 24x7, 365 days a year.

Pinnacle customers also get to enjoy the Pinnacle Infinite Credit Card which offers 3% cash back on fuel, utility payments, restaurant dining, and international transactions.

DFCC One Loan

A special personal loan was launched, and is designed to consolidate all existing commitments of customers in different financial institutions.

DFCC Teen account

Current generation of teenagers need security from many social forces, love and affection from who they associate with, independence from even their parents and feeling of achievement from what they do day in day out. As parents and guardians, we need to treat them with respect and look at them as adults, with some supervised controls. This is where DFCC Teen account comes in handy. It is our pleasure to introduce the latest addition to our product portfolio, DFCC Teen account.

This is a savings account introduced exclusively for the youth in the age group of 13 to 18 years. These are the next generation of banking clients who would go on to become loyal DFCC customers in the future. These youngsters will get their first ever banking experience through DFCC Teen account. This will be another step forward by DFCC Bank to serve all customers for their banking needs on the march to become the most customer centric commercial bank in Sri Lanka.

The DFCC Teen account comes with a suite of banking facilities such as access to the account from anywhere in the world through online banking, a branded debit card that allows them to withdraw up to LKR 5,000 per day, convenience of Tap and Pay up to LKR 5,000 per day, online purchases and POS transactions to the value of LKR 25,000 per day. There will be many exclusive discounts and offers at partner outlets. As a control mechanism parents will receive monthly transaction updates through eStatement and be alerted on each of their transactions via SMS. DFCC Bank is deeply committed to fostering the youth of Sri Lanka with a partnership that truly rewards and provide access to unforgettable experiences.

DFCC Pay app and merchant acquiring services

In line with the Bank’s journey on becoming a digitally enabled bank and the country’s Payment Systems Road Map, the Bank launched the DFCC Pay app to support the QR payment mode. Through the DFCC Pay app, customers can pay for goods and services through Visa QR, Lanka QR, and the local JustPay network. Similarly, the DFCC Pay Merchant App was introduced for merchants to accept and process these types of payments. The app helps to facilitate cashless payments, which have become increasingly important and convenient during the past year.

The Bank also introduced Android-based Point of Sales (POS) machines to process credit card transactions during the launch of the merchant acquiring services. The POS is a state-of-the-art portable machine that can process all major credit card transactions via tap-to-pay, CHIP reading, or swiping the magstripe. The cardholder’s signature can be entered on the machine’s display screen and the transaction receipt gets electronically saved. The machines are operated on a rental model basis.

Through these initiatives, the Bank will be reducing the stationery used in transactions by digitising payment slips and reducing the cost related to traditional transactions. DFCC Bank is also focused on enabling payment acceptance at all types of merchants, bringing its financial services to unbanked and under banked merchants and customers around the country in line with the national initiative.

Special Deposit Account

DFCC Bank was one of the first banks in the country to launch the Special Deposit Account (SDA). The Government and the CBSL introduced the SDA to increase foreign currency inflows to assist the country’s efforts in recovering from the COVID-19 pandemic. The Bank launched a campaign across multiple platforms including online, digital, and social media to encourage non-resident Sri Lankans to invest their funds in the country.

Customers could deposit their funds into a fixed deposit over six and 12-month periods in LKR, USD, EUR, GBP, AUD, JPY, SGD, CAD, and CHF. The SDA offered customers interest 1% above the normal rate for six-month deposits and 2% above the normal interest rate for 12-month deposits. Customers could freely convert or repatriate the funds upon maturity.

DFCC Sahanaya

Due to the negative impact of the COVID-19 pandemic on the local business sector and SME exporters, DFCC Bank launched the DFCC Sahanaya concessionary loan scheme as a part of its efforts to provide relief to export-related businesses. Through this loan scheme, amounting to approximately LKR 2 Bn, the Bank aims to aid in the revival of the export sector and sustain small businesses long enough to take advantage of future opportunities. Eligible businesses can avail of loans between LKR 5 Mn to LKR 25 Mn at an interest rate of 9% p.a. and a maximum loan tenure of four years. This scheme was launched to support the government initiative to revive the export related businesses and is granted by the Bank in addition to the concessionary loan schemes offered by CBSL.

DFCC Bank website

The Bank focused on continuously improving the interactive website during the year. Features introduced included an online application feature for credit card customers to apply online, a pop-up to inform customers of service disruptions during the pandemic and important notices, and a new income tax calculator feature. The site had 1.2 million sessions during the year. All branch locations were listed on Google to support local search and was optimised for Google Maps. Total views on Google Search reached 6.4 million and total searches reached 4.3 million.

DFCC Chatz

The Bank introduced an interactive, multi-channel chatbot to provide assistance to its customers via the corporate website, Facebook, and Viber. The chatbot can converse naturally with customers in English, Sinhala, and Tamil and assists in answering queries swiftly based on built-in algorithms. The chatbot further assists by helping customers connect with a live agent from the Bank’s 24-hour Contact Centre rather than making a physical call. 15,550 chat sessions were conducted during the year.

COVID-19: Supporting customers in unprecedented times

DFCC Bank took steps to provide relief to its valued customers affected by the COVID-19 pandemic, in line with the CBSL’s relief guidelines. As the Government took steps to protect citizens by slowing down the spread of the virus through extended curfews, this had an impact on the incomes of people, thus leading to increased financial burdens.

As the pandemic led to lockdowns imposed across the country, the Bank launched the “Bank on Wheels” service to provide its customers, as well as other bank customers, with ATM services at their doorstep through their Visa, MasterCard, AMEX, and JCB debit cards. The service was available at selected locations in Colombo, Gampaha, and Kalutara Districts.

To help provide its customers with some relief, the Bank provided financial concessions in the form of extensions on short-term loans and permanent/temporary overdraft facilities, and a temporary halt on returned cheque and stop payment charges.

The Bank also supported tourism, direct and indirect export-related businesses, information technology, plantations, and related businesses, SMEs in manufacturing, services, agriculture, trading, Self employed businesses and foreign currency earners with a six-month relief period up to 30 September.

The repayment period of leasing facilities for three-wheelers, transport vehicles for school children, motorcycles, and taxis was extended to 30 September.

Further concessions granted to above sectors from October 2020 up to March 2021 as per CBSL guidelines at concessionary rates.

DFCC Bank granted many financial concessions outside the CBSL debt moratorium schemes to facilitate clients affected by the COVID-19 first and second waves. The Bank has facilitated overall debt moratorium for appx. 30% of it’s advance portfolio covering different industry sectors to assist it’s clientele to revive their businesses owing to the out break of Covid-19. Further new working capital facilities of over LKR 10 Bn were granted at 4% p.a. concessionary rates under the Saubhagya Scheme to facilitate the clients who are affected by COVID-19 and interest concessions were offered to the existing facilities to reduce the debt burden. The Bank also granted new facilities under CBSL liquidity facility scheme to construction and other sectors.

Credit card customers also benefited from COVID-19 relief measures offered based on Central Banks directions. The payment due dates were extended, late payment fees were waived, the minimum payment percentage was reduced and local transactions up to a maximum of LKR 50,000 were subject to a reduced interest rate and during the latter part of the year interest rates were reduced to 18% p.a. These relief measures were provided in addition to the other measures that the Bank offered which were; 0% easy payment plans, a loan on card to obtain instant cash to 75% of the available credit limit and Card Balance Transfer scheme enabled cardholders to transfer the balance of other credit cards to a DFCC Credit Card and settle the amount in equal monthly instalments up to 36 months with low processing fees. These hassle-free and swift solutions were provided to cater for urgent financial requirements during the pandemic. To encourage cardholders to follow social distancing, the Bank popularised cashless and contactless transactions with its tap-to-pay Visa debit and credit cards for purchases below LKR 5,000 and the DFCC Pay app for cashless purchases via Lanka QR and Visa QR. Cardholders were also able to settle their credit card outstandings without visiting a branch through the Bank’s array of digital facilities including online banking, DFCC Virtual Wallet, Setting up Standing Instructions and CEFTS transfers from other bank accounts.

Furthermore, the Bank identified a segment of the population that depended on the monthly interest income from their fixed deposits to meet their monthly living expenses. Accordingly, the Bank introduced a special fixed deposit product that offered high interest rates to individuals over the age of 55. The product was well received by the market.

Customer centricity

Enhancing customer centricity is one of the three strategic pillars of the Bank’s Vision 2025 plan. It is how the Bank will achieve its long-term objectives of acquiring two million customers and becoming the most customer-centric bank in Sri Lanka.

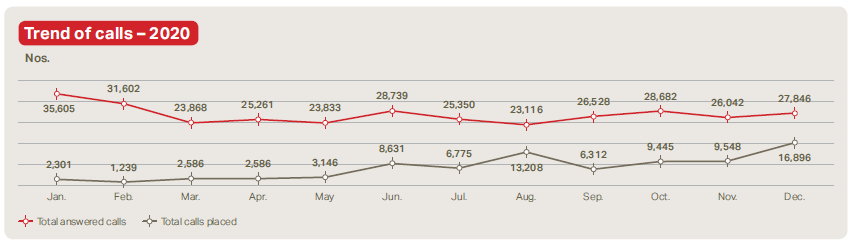

Contact Centre

One of the key means through which the Bank is enhancing customer centricity is by building an enhanced customer experience that is prompt, responsive, and courteous. In 2020, the Bank opened a state-of-the-art Contact Centre in Malabe that can host over 50 customer service agents. The Contact Centre is fully equipped to assist customers with their financial inquiries and activation of products 24 hours a day, 365 days a year. In addition, dedicated agents are appointed to cater to the high net worth segments, ensuring the best quality of service around the clock.

The Contact Centre continued to be operated 24 hours a day during the pandemic. Contact Centre agents worked in extended shifts across two locations. Remote working facilities were made available where possible to comply with safety protocols while ensuring continuity of service. During the year, the Contact Centre introduced video chats for customer support with digital products and the ability to onboard customers for online banking and Virtual Wallet via a call.

The Contact Centre is exploring the possibility of integrating WhatsApp alongside the current Chatbot capabilities in 2021. Further enhancements to existing systems, enhancing agent skills and product knowledge, and churn management will also be looked into in the coming year.

The Contact Centre serves as the first contact point for customers who call the Bank and thus is a critical service at the Bank. The Centre operates 24 hours a day, 365 days a year, handling inbound and outbound functions and ensuring the smooth functioning of the Bank’s operations.

404,780

Total number of inbound calls

72,797

Total number of outbound calls

3,519

Non-voice requests via Chat service

Inbound

| 2020 | ||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |

| Total queued calls | 40,957 | 40,259 | 31,025 | 43,305 | 32,601 | 44,347 | 31,971 | 24,862 | 27,667 | 29,772 | 27,815 | 30,199 |

| Total answered calls | 35,605 | 31,602 | 23,868 | 25,261 | 23,833 | 28,739 | 25,350 | 23,116 | 26,528 | 28,682 | 26,042 | 27,846 |

| Average answered call per day |

1,150 | 1,090 | 770 | 815 | 770 | 930 | 920 | 745 | 855 | 925 | 840 | 898 |

| Average talk time (MM.SS) | 2.41 | 2.36 | 2.31 | 2.37 | 2.50 | 2.51 | 3.32 | 3.23 | 3.12 | 3.20 | 2.56 | 2.51 |

| Average ACW time (MM.SS) | 9.38 | 9.39 | 10.07 | 12.01 | 10.03 | 17.01 | 15.07 | 13.00 | 12.33 | 12.15 | 15.07 | 15.09 |

| Average answer time (MM.SS) | 0.47 | 0.41 | 0.43 | 1.00 | 0.58 | 0.59 | 0.34 | 0.31 | 0.25 | 0.22 | 0.17 | 0.18 |

| ABN calls per month | 5,352 | 8,657 | 7,157 | 18,044 | 8,768 | 15,608 | 6,621 | 1,746 | 1,139 | 1,090 | 1,773 | 1,802 |

| ABN calls placed per month |

4,043 | 6,739 | 4,787 | 14,435 | 6,301 | 11,837 | 4,225 | 1,397 | 688 | 689 | 941 | 1,077 |

ACW: After call work ABN: Abandoned calls

Outbound

| 2020 | ||||||||||||

| January | February | March | April | May | June | July | August | September | October | November | December | |

| Total calls placed | 2,301 | 1,239 | 2,586 | 2,586 | 3,146 | 8,631 | 6,775 | 13,208 | 6,312 | 9,445 | 9,548 | 7,020 |

| Average calls placed per day (weekdays) | 115 | 62 | 130 | 130 | 160 | 430 | 340 | 660 | 315 | 475 | 477 | 650 |

| Average talk time (mm.ss) | 2.01 | 1.36 | 2.13 | 2.17 | 2.00 | 4.01 | 3.59 | 4.07 | 3.19 | 3.33 | 4.01 | 4.44 |

Customer Experience Unit

In addition to the Contact Centre, the Customer Experience Unit is a centralised unit that handles all customer complaints and inquiries that are directed to the Bank through multiple channels made available to customers.

The Unit is responsible for redirecting complaints and inquiries to the appropriate department or branch and ensuring the completion within the stipulated Service-Level Agreements (SLAs). In 2020, the Complaint Management System was launched to track complaints, inquiries, and service requests. Through this system, the Unit helps staff across the Bank to work towards achieving strict service levels.

The Customer Experience Unit conducts multiple programmes to evaluate and monitor the level of customer centricity of the Bank. One of these programmes was a Bank-wide Mystery Shopper programme that provided the Bank unique insights on customer’s satisfaction levels with the services received against their perception and expectations. Key areas of importance to strengthening customer experiences were evaluated by scoring the areas of customer care, sales drive, professionalism, transparency, and the cleanliness of the branch.

Similarly, periodic Mystery Caller programmes assisted the Bank in understanding the customers’ impressions and experience when they contact the Bank. The findings were used to improve the approach accordingly to deliver a better first impression and phone etiquette. To better understand the requirements of branches to serve customers effectively, the Unit conducted a Customer Centricity Survey. The survey evaluated the current state of customer centricity across the Bank’s branches and the initiatives that were undertaken to achieve the Bank’s goals. The findings of this survey will be analysed to design programmes to further the Bank’s customer centricity drive in 2021.

The Unit is also responsible for embedding the value of customer centricity in the Bank’s staff through training. In 2020, the Bank conducted 27 customer service training sessions for 1,185 staff members, which constitutes 57% of the overall staff. Additionally, monitoring the service levels within the Bank is integral to maintaining the customer experience at a high standard. The Unit identifies gaps in service across the Bank and conducts refresher trainings to help ensure that service level targets are met.

For 2021, the Unit will be looking into conducting root cause analysis of complaints and focusing on implementing preventive measures. The implementation of a “Voice of Customer” dashboard will provide insights into customer perception of the DFCC Bank brand and its products. A planned upgrade to the Complaint Management System will enable customers to receive complaint/inquiry/service request reference number via SMS.

The International Customer Service Week that is commemorated across the world was also celebrated at the Bank, with multiple programmes organised by the Customer Experience Unit. Service Ambassadors were appointed across the branch network to enhance customer service. Training programmes and Bank-wide communications were organised to inculcate and stress the importance of customer service. Branches were also visited for refresher trainings during this week.

Customer privacy

DFCC Bank considers the privacy of its customers to be of paramount importance and considers the protection of their privacy as integral to building trust and developing the relationship between itself and its customers. To aid in its efforts to safeguard customers’ privacy, the Bank utilises the latest digital infrastructure to secure its systems and processes and banking transactions. In the development of the new core banking system that will power the Bank’s new products and innovations, customer privacy is one of the foremost considerations in its design.

Customer privacy forms a core part of the Employee Code of Conduct. The Bank’s employees understand the importance of protecting the privacy of their customers and fulfil their role in upholding the secure systems and procedures of the Bank.

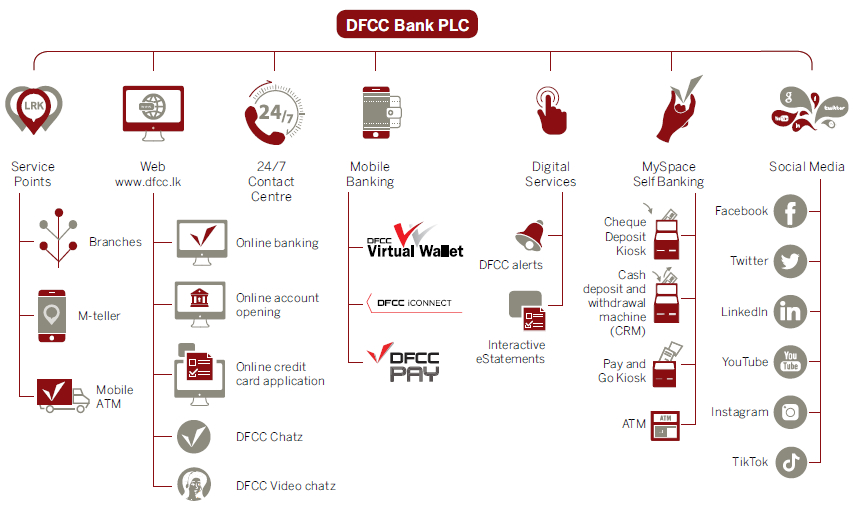

Multi-channel customer touchpoints

DFCC Bank reaches its customers through an extensive network of touchpoints ranging from its conventional branch network to its Internet and mobile-centric digital touchpoints which include DFCC MySpace, DFCC Virtual Wallet, DFCC Pay, and DFCC iConnect.

The Bank’s digital-first approach saw a significant boost in 2020 as customers had to social distance and rely on the Bank’s digital touchpoints for a virtual banking experience. Additionally, the Bank deployed a mobile ATM service to provide its customers with convenient access to ATM services during the Government-mandated periods of lockdown.

The Bank understands that each and every customer’s needs and wants are different. Thus, the Bank extends its services to its customers via multiple channels and avenues, ranging from its conventional Island-wide branches to its range of digital channel solutions. The Bank emphasised the need of the hour with respect to COVID-19 and initiated the “Salli Athing Allan One Nah” campaign under the DFCC Virtual Wallet. Also in line with customer needs and the CBSL campaign “CashWade”, the digital footprint and transactions of the Bank were significantly increased during the year with DFCC My Space, which includes ATM, CRMs, cheque deposit kiosks, and Pay & Go machines. Similar to individuals, large corporations were assisted through the acclaimed DFCC iConnect payments and cash management solution.

Banking to yourdoorstep

The Bank rolled out the Mobile ATM service to the Colombo, Kalutara, and Gampaha Districts to make it easier for customers to withdraw cash and pay bills conveniently during the pandemic.

Product responsibility

DFCC Bank’s approach to product responsibility starts at the initial stages of product design. The Bank strives to be ethical in its product design, adhering to all necessary compliance requirements before introducing a new product to its customers.

DFCC Bank recognises that modern customers are not only concerned with quality and service but also wish to be well-informed before making a purchase or starting a business relationship with a corporate entity. The Bank takes this responsibility seriously by providing transparent and relevant information to its customers. Information about products and services are available in all three languages and employees are available to provide more information where necessary. The Bank also conducts events across the country to educate current and potential customers about its products and services.

Marketing communications

DFCC Bank engages with customers and potential customers across multiple channels in English, Sinhala, and Tamil. A Board-approved Corporate Communications Policy and Social Media Policy define how the Bank engages with its customers. The Bank strives to ensure that information is accurate and complies with these policies, the Central Bank of Sri Lanka, and the Bank’s Customer Charter.In 2020, the Bank carried out various brand-building initiatives on ATL, BTL and digital including marketing and seasonal campaigns, event sponsorships, and customer engagement activities.