Our Business Model

Operating Environment

Global performance

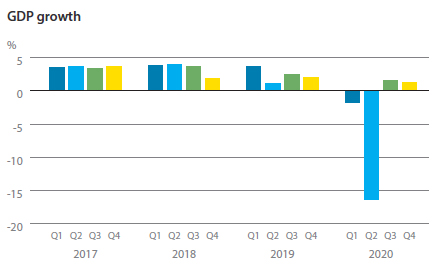

Global economic growth in 2020, was unavoidably derailed by the COVID-19 pandemic and is predicted to lead to a global recession comparable to the Great Depression and the two World Wars. Although global economic activity started recovering after the initial lockdowns were lifted in the middle of the year, the continued spread of the virus led to more lockdowns later in 2020 and interrupted economic recovery. Projections by the International Monetary Fund (IMF) indicate that the global economy declined by 3.5% in 2020. Advanced economies contracted by 4.9%, while emerging market and developing economies (EMDEs) contracted by 2.4%. However, the performance of EMDEs is primarily due to China’s exceptional rebound, whereas

the rest of the EMDEs were impacted by continuing outbreaks and slower recoveries.

Global outlook

The global outlook for 2021 remains uncertain although multiple vaccines have been produced and the rollout of vaccination campaigns in certain countries have commenced. The IMF projects a 5.5% recovery in the global economy in 2021 but the emergence of new variants of the COVID-19 virus followed by lockdowns and logistical difficulties with vaccine distribution, continue to pose risks to pandemic recovery efforts. Global trade volumes are projected to grow by 8.0% in 2021 with the services trade expected to recover at a slower pace, due to subdued cross-border tourism and business travel until transmission declines across the globe. Inflation is expected to remain subdued during 2021–22, with advanced economies projected to remain at 1.5% and emerging market and developing economies at just over 4.0%, which is lower than the historical average of the group. Major central banks are expected to maintain their current policy stances to support economic recovery, which would result in advanced economies largely remaining at their current levels while EMDEs gradually improve.

Local performance

Although the economy started to recover from the Easter Sunday attacks in the latter part of 2019, the COVID-19 pandemic brought an abrupt halt to that momentum as the Government took measures to control the spread of the virus. The country experienced capital outflows, exchange rate depreciation, and increased pressure on government finances. This led to the economy shrinking by 16.3% in the second quarter, its largest drop in history. Economic activity returned to positive growth for the first time in the year in the third quarter of 2020, at 1.5% as businesses adapted to the new normal and the Agriculture, Industry, and Services sectors reported positive growth.

The Central Bank of Sri Lanka (CBSL) expects the Sri Lankan economy to have contracted by 3.9% in 2020, whereas the IMF has projected a 4.6% contraction. Although tourism and financial inflows were significantly dampened by the pandemic, the external sector was boosted by workers remittances surpassing USD 7 Bn. The country’s official reserves were maintained at USD 5.7 Bn. by the end of the year.

Local outlook

The CBSL remains bullish on the Sri Lankan economy in 2021, anticipating a strong growth of approximately 5%-6%. The performance of the country’s sovereign bond yields and stock market indices indicates increased confidence from global and domestic investors in the Sri Lankan economy. Moreover, tourism and financial inflows are expected to pick up in 2021 as the country reopens its borders. Lending rates are expected to continue their decline from 2020 as a result of the excess liquidity in the domestic money market. The CBSL has stated that it will continue its accommodative monetary policy stance to continue the momentum in the economy’s recovery. Along with the incentives being offered for capital investment, the low interest rate regime currently in place is expected to improve economic growth prospects and support debt consolidation efforts. Furthermore, the CBSL expects inflation to remain with a targeted range of 4-6% over the medium-term, although external factors such as an increase in global petroleum prices or pressures from domestic supply-side factors could pose inflation risks.

Banking sector performance

The Sri Lankan banking sector was well positioned in capital and liquidity at the start of 2020 due to the implementation of international best practices and regulatory requirements that required banks to establish buffers to maintain adequate levels of liquidity and capital during turbulent periods.

The Year-on-year rate of asset growth of the banking sector declined in 2020 to 17.1% as at end December 2020 with total assets reaching LKR 14.7 Tn. by end 2020. Loans and advances (net of IIS) accounted for 62% of assets compared to 64.9% in the 2019.

The total value of Loans & Advances of the banking sector decreased to LKR 9.1 Tn. during the month of December 2020. Year-on-year credit growth declined significantly during December 2020, to 11.9% due to settlement of loans to the government and state owned enterprises. Total Loans of the banking sector declined mainly due to decrease in rupee loans. Rupee Loans & Advances (Net of IIS) represented 80.2% of the total loans and advances in 2020 compared to 79.9% in 2019.

Foreign Currency Loans & Advances (Net of IIS) came to 19.8% of the loans and advances of the sector, from 20.1% in 2019. Term loans accounted for 56.9% of total lending in 2019 which had increased to 57.6 in 2020. The construction sector accounted for 16.3% of total loans of the banking sector by December 2020, while consumption loans represented the largest share of lending at 18.3%.

The total NPL of the banking sector decreased by LKR 24.4 Bn. during the month of December 2020. As a result, the gross NPL ratio of the banking sector further decreased to 4.9% as at end December 2020. Total Provisions of the banking sector stood at LKR 274 Bn. as at end December 2020 and the total provision coverage ratio increased to 61.3% as at end December 2020.

Total investments of the banking sector increased to LKR 4.2 Tn. as at end 2020 which is a year on year growth in investments of 40.0% as at end December 2020.

Total Deposits of the banking sector increased to LKR 11.1 Tn. by end December 2020. Year-on-year deposit growth increased to 21.6% as at end December 2020, mainly due to increase in LKR deposits during the month.

Total borrowings of the banking sector decreased to LKR 1.69 Tn. by end 2020. Growth of borrowings decreased Year-on-year to 0.8% as at end December 2020. Total borrowings of the banking sector decreased mainly due to the decrease in FCY borrowings of large banks. The banking sector remained stable and maintained liquidity ratios above the minimum requirements during the year.