Banking on Value Creation

The Quality of Manufactured Resources

In the hitherto never before experienced environment of COVID-19, SDB bank’s Information Technology (IT) systems were the lifeline that ensured business continuity. The country wide curfews and later regional lockdowns and continuous travel restrictions would have totally disrupted all traditional banking services and activities, if not for the high level of IT preparedness of the Bank, which allowed the Bank to continue the provision of financial services to its diverse, and geographically widespread customers.

Contributing towards nation building, SDB bank is utilising technology to change the way people bank for the better. SDB bank was able to collect deposits from customers in any location and issue receipts immediately by using mobile devices. Following the automation of the loan process for greater expedience and customer convenience a number of new digital initiatives were introduced during the year under review.

Electronic signature

Electronic signatures were introduced for internal approvals and also for loan approvals for selected customers. While eliminating time lags associated with the collection of manual signatures, particularly from our regional network of branches, the digital signatures have moved the Bank closer towards the more environmentally sustainable, paperless business model envisioned by the Bank.

Adopting common QR Code for UPay digital payment app

In the first quarter of 2020, SDB bank was one of the first financial institutions to adopt the common QR Code for the country, LANKAQR, which was developed by the national payment network LankaClear.

The QR Code was integrated into SDB bank’s existing UPay digital payment app, making online payments easier and faster.

Developed by the Central Bank of Sri Lanka (CBSL), LANKAQR is a common Quick Response (QR) code standard, and its adoption by most major financial institutions in Sri Lanka is a progressive step on the path to Sri Lankans fully embracing a digital future of entirely cashless transactions. Apart from offering consumers and merchants the convenience of transacting at any merchant point bearing the LANKAQR logo, regardless of their bank or payment app, LANKAQR provides merchants with an accurate method to monitor the credit ratings of customers for loan approvals and other financial services.

SDB bank was actively involved in the launch of the LANKAQR Code from its inception. The first phase of the Rata Purama QR campaign was launched in Matale by the CBSL, with the participation of SDB Bank and other financial institutions and telcos, at the Matale regional office of the CBSL. This was followed by a town wide promotion of LANKAQR followed by a visit to SDB bank’s Matale branch by several top CBSL Officials.

SDB bank continued its active role during the second phase of the Rata Purama QR campaign as the Bank has actively campaigned to nurture an inclusive digital payment system for all Sri Lankans. LANKAQR, which is the standard for mobile phone and digital payments countrywide, is a key driver of financial inclusion across Sri Lanka. The LankaQR technology reflects SDB bank’s UPay platform, which introduced many innovations in the FinTech industry in Sri Lanka, aside from its core offering of anytime, anywhere payments for products services and lifestyle conveniences. Demonstrating SDB bank’s commitment, SDB bank’s CEO was appointed Chairman of the Working Group of Financial Institutions by CBSL, to lead the LANKA QR project island wide.

The second phase of the Rata Purama LANKAQR campaign was launched on 23 January 2021 and all banks in the country have been directed to adopt the LANKAQR Code by 30 September.

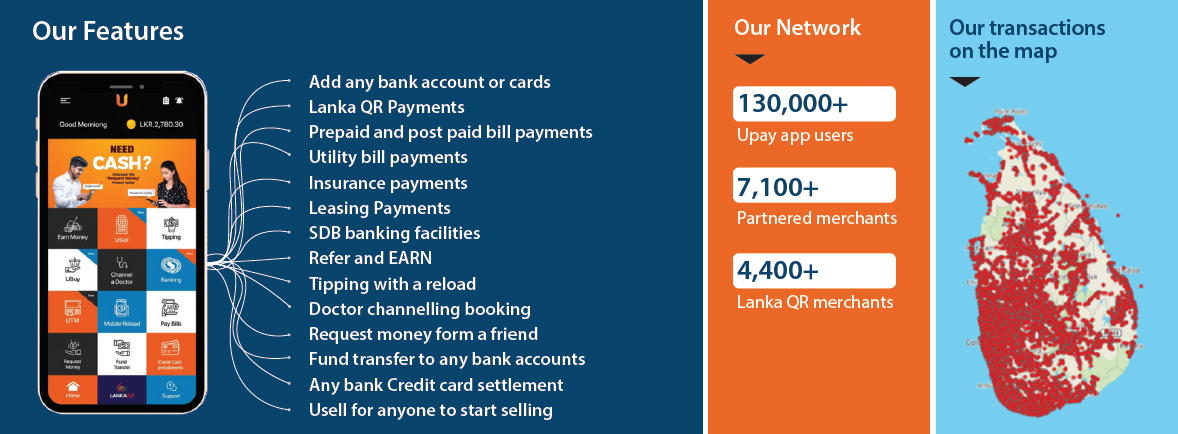

New features to UPay

UPay, which was acquired by SDB bank, is a multifaceted digital payment platform for secure bill payments, channel doctors, and top-up mobiles among other transactions. By registering multiple bank accounts and multiple cards to this app, customers simply link their bank accounts and credit/debit cards to the app, which allows them to automate, track and manage all recurring payments to vendors and service providers. The app allows them to seamlessly purchase products or services without having to physically handover cash or swipe a card. New features introduced during the year include, credit card settlements and transferring funds to another account based on a request received.

The latest development to the UPay app will further encourage grassroots communities towards a cashless society, directly contributing to the country’s development. We also believe that digital innovations of this nature are important in reaching out to the underbanked population, a goal that’s embedded at the very heart of SDB bank. This app also prepares us to meet the oncoming FinTech storm head on.

Business internet banking solution

Our Business Internet Banking solution is designed to facilitate corporate customers. This customer segment consists of firms, companies, trusts, partnerships, proprietorship concerns and others. Our internet banking platform provides them with a simple dashboard to keep track of their transactions. It also allows multiple users to manage the account. This allows designated officers in an organisation, or group, or company, to keep track of its financial position and transaction history while carrying out day-to-day banking activities including cash transactions, government payments, salary uploads and bulk transfers.

We also provide online assistance to these customers, with many of them attempting online banking for the first time through this platform. Internet banking provides them with 24/7 access to their bank accounts, flexible reporting and an alternative solution to conventional document processing. It is a convenient, comprehensive and highly secure corporate banking solution providing them with instant validation of incoming payments and real-time alerts of transactions. This service is also mobile-ready, meaning that it is able to take users to the next level of convenience.

Mobile banking solution

Our mobile banking app was further improved in 2020 by including the facility to open fixed deposits through the mobile phone. In the current environment of travel constraints, this new feature will support the Bank’s deposit mobilisation drive, while also making it easier and more convenient for rural communities to save money, particularly those further away from physical bank branches.

In a bid to heighten customer convenience and broaden their digital banking experience, we created a mobile banking app that is simple, fast and secure. Combining in-house technological know-how and our in-depth knowledge of the people we serve, we designed the app to provide a seamless, intuitive experience. The app allows customers to carry out a number of essential transactions, such as obtaining information related to their accounts, loans and fixed deposits, from the palm of their hand. It simplifies complicated and tedious banking transactions.

A significant milestone in the Bank’s fast-tracked digitalisation programme, the mobile banking app will change the way our customers bank. As recorded by the Department of Census and Statistics while more than one in five households in Sri Lanka own a computer or laptop, two out of every five people between the ages of 5 and 69 are digitally literate – able to use smartphones and/or tablets. As with many other developing countries in the region digital appreciation remains high in Sri Lanka though the availability of technology remains low.

The SDB mobile app allows transactions with own, or third party bank accounts, real-time interbank money transfers and the ability to check account/loan transaction history among others. Customers can obtain a detailed analysis of their transactions and make recurring fund transfers to other banks while creating and saving a payee through “Create Payee”. Our mobile app complies with high security standards in mobile banking. Starting from essential customer requirements, we have continued to introduce more features to provide a 360 degree experience for our customers. In addition to the UPay, SDB Business Internet Banking and SDB Mobile app we provide two other digital products namely SDB Debit card and SDB SMS banking.

Property

SDB bank maintains a profitable mix of owned and rented buildings aided by the Federation’s SANASA Engineering. Reflecting our keen focus on digital banking during the year under review, no new branches were opened. However, four branches were renovated, in line with the branding strategy. Our customers continued to enjoy access to our 94-strong branch network and nearly 5,000 ATM points through LankaPay. Our combined physical and digital presence takes us that much closer to the end consumer. Our direct connection with over 8,500 co-operatives will be a key factor in allowing us to make an internationally recognised mark in this sector.