Banking on Value Creation

The Achievement of Financial Goals

Although the entire global economy almost ground to a halt in 2020 in the wake of the COVID-19 pandemic, and the Sri Lankan economy reported negative GDP growth, we are pleased to report the highest profitability to date by SDB bank, during the financial year under review. While effectively navigating the economic fallout from COVID-19, SDB bank not only successfully concluded the first digital Rights Issue in Sri Lanka, but also recorded the highest deposit base growth and the highest net increase in advances to date, closing the year with a stronger balance sheet and capital position. SDB bank maintained its credit rating unchanged at BB+ from Fitch Rating Lanka and at BBB- from ICRA Lanka.

Financial performance

The more conducive tax regime of 2020, coupled with the Bank’s emphasis on asset quality management, and expenditure controls, has generated encouraging outcomes, not only towards boosting the bottom line in the short term, but also towards instituting a more disciplined credit risk management framework.

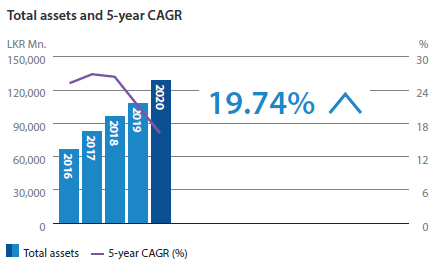

In spite of COVID-19 disruptions to economic activities during 2020, SDB bank continued to grow its business volumes. Total assets of the Bank grew by 20% year-on-year to LKR 129 Bn. fuelled by a LKR 15.9 Bn. growth in advances and a LKR 20.7 Bn. growth in deposits. The loan to deposit ratio for the year improved to 115% from 127% in 2019, while the savings to deposit ratio also improved to 23%, from 22% contributing towards reducing the Bank’s cost of finance for 2020, compared to 2019.

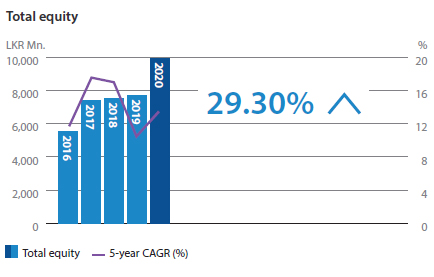

Total equity of the Bank increased to LKR 9.9 Bn. as at 31 December 2020, from LKR 7.67 Bn. in 2019, boosted by an additional LKR 1.5 Bn. from our successful Rights Issue in November 2020. The additional capital injection ensured the Bank was in compliance with capital adequacy requirements for the year.

The Bank reported a total comprehensive income of LKR 834.9 Mn. for the year 2020 which reflects an increase of 279% over the previous year, owing to impairment provisioning, effective cost control, debt repayment levy and NBT on financial services. The Bank’s total operating profit before impairment and taxes grew by 11% to LKR 2.4 Bn. in 2020, compared to LKR 2.16 Bn. reported in 2019.

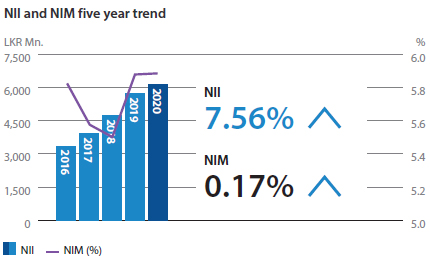

Net interest income (NII)

The declining interest rate trend in financial markets in 2020, coupled with the application of the Effective Interest Rate Method on interest income from lending subject to the moratorium, caused the net interest income (NII) for the year to decline from its potential level.

However, NII increased by LKR 430.6 Mn, to LKR 6.12 Bn, from LKR 5.69 Bn. in 2019. The Bank’s lending portfolio coming under the moratorium totalled LKR 20.9 Bn. in 2020. Meanwhile, total interest expenses decreased by 1% to LKR 9.31 Bn. from LKR 9.38 Bn. The net interest margin (NIM) remains same at 5.89%.

Non-interest income

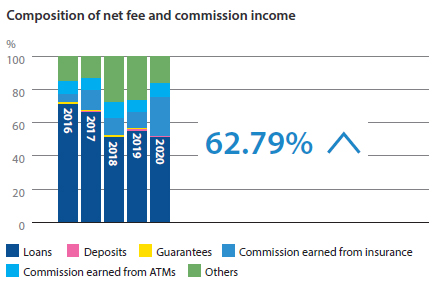

Non-interest income comprises net fee and commission income, net trading income, and other operating income. The net fee and commission income are closely linked to transactional banking volumes, which are a function of economic activity and competition for banking services. Net trading income is a function of trading volumes and market volatility which affects trading spreads. Other operating income consists of other banking activity-related revenue, including gains from sale of property, plant and equipment, dividend income and income derived from the Bank assurance agreements.

Net fee and commission income grew by 63% to reach LKR 376 Mn. from LKR 231 Mn. The growth in net fee and commission income was mainly due to the growth in the gross loan book, of 18% to LKR 103.7 Bn. for the year. In addition, the Bank’s investments towards digital transformation to improve access, navigation and usability for all of our customers across our businesses, have also created new incomes in the form of digital fees. The digital fee income from debit cards and UPay transactions increased by LKR 18 Mn. year-on-year, in 2020.

Net gains from trading amounted to a profit of LKR 5.2 Mn., reflecting gains from Government Securities during the year. Gains from financial instruments at fair value through profit or loss increased by 134% to LKR 268.7 Mn. Other operating income reflected a decrease of 39% compared to the previous year.

Total non-interest income increased by 61% to LKR 705 Mn.

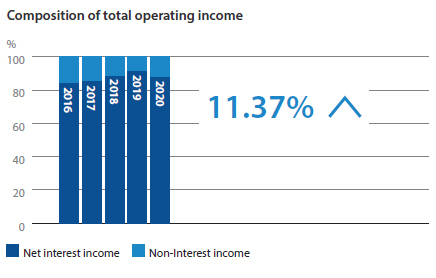

Total operating income

Total operating income grew by 11% to LKR 6.83 Bn. from LKR 6.14 Bn. Net-Interest Income and non-interest income contributed 90% and 10% respectively, to operating income.

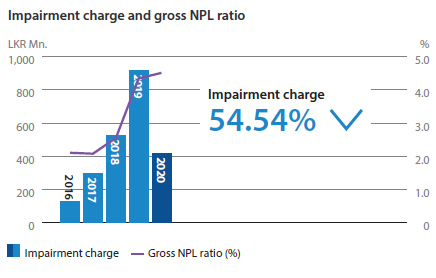

Impairment for loans and other losses

SDB bank’s impairment charges for 2019 spiked by 75% to LKR 917 Mn. Consequently, the Bank introduced improvements to pre and post credit evaluation protocols and improved collection mechanisms, while also rescheduling and restructuring existing credit facilities in line with customer repayment capacities. These initiatives contained expansion of the gross NPL ratio at 4.5% for 2020, from 4.38% in 2019, despite the highly unfavourable economic environment. In 2020, the Bank also conducted an impairment model revalidation by grouping products based on their risk levels. This exercise had a one-time favourable impact towards reducing impairment provisioning, due to the reclassification of some products.. As a result, the impairment cost for 2020 saw a sharp reduction to LKR 417 Mn.

Exposures under Moratorium

In line with the CBSL circular No. 05 of 2020, moratoriums were granted to eligible customers who were affected by the pandemic, in both interest and capital servicing, as our focus during the year shifted from collections to supporting customers during the crisis and ensuring their resilience and commercial sustainability. Approximately 24% of the Bank’s portfolio was under moratorium during the 3rd quarter of 2020 and at the end of the financial year, the loans under moratorium reduced to approximately 20% of the Bank’s total portfolio, which was mainly due to settlements of loans. Further, 2% of the Bank’s portfolio was under the extended moratorium based on CBSL Circular No. 10 of 2020.

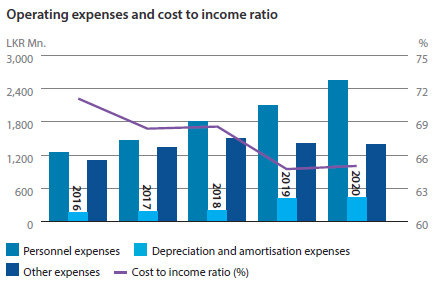

Operating expenses

The Bank’s operating expenses comprise personnel expenses, depreciation and amortisation, and “other expenses”, which incorporates office administration and establishment expenses.

In 2020, against the uncertain environment in the wake of the Covid-19 pandemic, the Bank implemented a stringent cost control strategy to contain costs across all operational aspects, including limiting new recruitments to essential positions. As a result, total expenses were maintained well below the budgeted levels for the year. This cost saving was also supported by lower operational costs due to the work from home model adopted during the Covid-19 restrictions on movements and also the rapid digitisation of internal operations, including facilitating digital signatures, which has significantly reduced administration costs. Total administration expenses for 2020 declined by 1.4% year-on-year to LKR 1.4 Bn. However, personnel expenses, and depreciation and amortisation have increased by 22% and 5%, respectively due to the annual salary increment, increase in staff allowances and new capital expenditure. The Bank’s cost-to-income ratio was 64.9% in 2020.

Taxation

The removal of the Nation Building Tax and the Debt Repayment Levy was another contributory factor towards SDB bank’s growth in profits in 2020. The total tax (excluding income tax) pay out declined from LKR 664 Mn. to LKR 571 Mn. in 2020. Total income tax expense came to LKR 576.6 Mn. in 2020.

Profitability

While the Bank’s profitability declined in 2019, due to increased impairment charges and the additional taxes, particularly the debt repayment levy, in 2020, both these elements declined, boosting the bottom line. Profit before tax increased from LKR 585 Mn. in 2019 to LKR 1,413 Mn., which is a growth of 141%. Profit after tax improved by 230% from LKR 253 Mn. to LKR 836 Mn.

Meanwhile, the Bank’s return on assets and return on equity improved to 1.19% and 9.51% in 2020, from 0.57% and 3.35% respectively.

Other comprehensive income/expenses (OCI)

Other comprehensive expenses amounted to LKR 1.33 Mn. from LKR 33.15 Mn. After charging other comprehensive expenses, total comprehensive income for the year was LKR 835 Mn. from LKR 220.25 Mn. in 2019.

Financial position analysis

Total assets

The Bank’s asset base which had crossed the LKR 100 Bn. mark in 2019, expanded by 20% in 2020 to LKR 129 Bn. This growth was fuelled by growth in loans and advances. Cash and cash equivalents and placements with banks recorded an increase against 2019 due to increased money market savings. Investment in financial assets recognised through profit or loss has increased. However, the investment on financial assets classified under amortised cost has decreased.

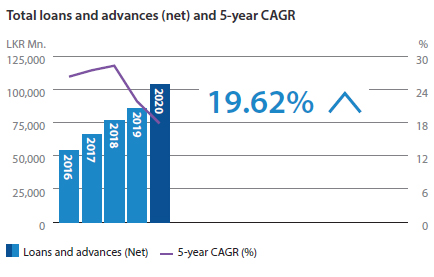

Loans and advances

Loans and advances represent the largest asset class on the Bank’s balance sheet, which accounted for 80% of the total assets. It provides the Bank’s biggest source of revenue in the form of interest income, and creates cross-selling opportunities to earn transactional fees and insurance-related revenues. Growing loans and advances within the Bank’s accepted risk levels is therefore essential to growing revenue. Total gross advances for the year grew to LKR 103.7 Bn. even underlower economic activities following COVID-19 containment measures and recorded growth rate is 18%.

Asset quality

During 2020, the Bank focused on improving asset quality and successfully contained the deterioration trend observed within the past two years, when the NPL ratio spiked from 2.56% in 2018 to 4.38% in 2019. The risk management framework and lending criteria were further streamlined and recovery initiatives were redoubled. These measures have contributed towards curbing NPL expansion in 2020, despite increased upward pressure on the NPL portfolio due to COVID-19 market disruptions. The gross NPL ratio was contained at 4.54%, which is below the industry average of 4.9% for the year.

Total liabilities

The Bank’s total liabilities increased by LKR 19 Bn. on the back of deposit growth, to LKR 119 Bn. Customer deposits grew by 30% and accounted for 78% of total liabilities. The Bank raised LKR 1.5 Bn. by way of a Rights Issue and continued to utilise local, long to medium-term borrowings. Borrowings of the Bank have decreased by 9% from 2019, causing the cost of finance reduce from 9.95% at the start of the year to 8.3% by the end of the year.

Total deposits

SDB bank achieved the highest growth in deposits in 2020 with total deposits growing by LKR 20 Bn. to LKR 89.9 Bn.

Equity and compliance with capital requirements

With the inclusion of LKR 1.5 Bn. through the Rights Issue, SDB was compliant with Basel III capital requirements. This is in addition to the LKR 3.2 Bn. Tier II subordinated debt, raised in 2019. As a result, the Bank’s Tier I Capital, Total Tier I Capital and Total Capital Adequacy Ratios as at December 2020 stood at 9.85%, 9.85% and 13.38%, respectively. These ratios stood above the minimum ratios prescribed by Basel III capital requirements.

Liquidity

The Bank maintained its liquidity position within the approved risk appetite and tolerance limits. Appropriate liquidity buffers were held in line with regulatory, prudential and internal stress testing requirements, taking into account the market conditions. Throughout the year the Bank maintained its statutory Liquid Asset Ratio well above the minimum threshold of 20% prescribed by CBSL. Further, the Bank maintained an average Liquidity Coverage Ratio of 125.21% and Net Stable Funding Ratio of 127.33% which was comfortably in excess of the regulatory minimum requirement of 90% and 100% respectively.

Dividends

For two consecutive years, the banking industry of Sri Lanka experienced an unpredictable business climate with increasing regulatory controls. The minimum capital requirements have become more stringent with the adoption of Basel III and the sector also accommodated new accounting standards, while dealing with unexpected market disruptions and a lending moratorium in 2020. However, in March 2020, the Board approved LKR 394 Mn. in dividend payments for 2019. For 2020, the Board of Directors have approved a dividend of LKR 2.25. per share, totalling to LKR 206 Mn.