At the moment, there are no entries available for display

Natural Capital is a vital component which refers to the natural resources we obtain from both renewable and non-renewable sources. DFCC’s Natural Capital strategy is part of its overall sustainability strategy which has been described under “DFCC’s Approach Towards Sustainability” on Strategic Direction and Outlook.

Alignment with UN SDGs

Our Approach

As a service sector entity, DFCC uses natural resources relatively minimally. Natural resources are needed for a number of the Banks’s operational components. However, in comparison to other industries (e.g. production based industries), we have a relatively lower direct environmental impact. Nevertheless, we have pledged to control adverse effects on the environment while quickening our pace to reach the objectives outlined in the sustainability strategy (refer page 50). DFCC’s Approach to Natural Capital Management is summarised as follows:

Despite the turbulent and uncertain situation that followed in the wake of the economic, social, and political crises of 2022, DFCC remains committed to its sustainability strategy. We are also mindful of our stakeholder expectations in this regard and continually monitor and revise our strategies to keep up with them. The Bank has also consistently sought to align itself with sustainability guidelines and best practices pertaining to the banking sector. The adoption of good ESG practices reflects DFCC’s recognition of the interconnectedness between environmental, social, and governance factors to obtain long-term financial performance, as well as our role in contributing to a more sustainable and inclusive economy.

DFCC Bank – The First Sri Lankan Direct Access Entity of the Green Climate Fund

A landmark event in our sustainability journey has been our accreditation by the Green Climate Fund (GCF), making DFCC Bank the first Sri Lankan entity, and one of 120 in the world, to be accredited by this fund.

In July 2023, DFCC Bank became the first and the only Sri Lankan entity to obtain Accreditation of the Green Climate Fund (GCF) – the world’s largest fund for climate action. Having undergone the rigorous process to secure GCF Accreditation, DFCC Bank has joined the ranks of 120 institutions worldwide that are at the forefront of combating climate change and building a sustainable future. With DFCC Bank now joining this esteemed group, it reinforces the Bank’s reputation as a leading player in sustainable finance, as well as its commitment to tackling climate change and promoting sustainability. The GCF Accreditation allows DFCC Bank to access concessionary funding for projects with a value of up to USD 250 Mn per project from the GCF, enabling the financing of climate mitigation and adaptation projects across Sri Lanka. We expect to leverage this accreditation to mobilise climate finance and spearhead impactful projects that address the urgent climate challenges facing Sri Lanka.

This will be a great impetus for climate-friendly projects in Sri Lanka. This accreditation is a testament to DFCC’s commitment to sustainability.

Best Practices During 2023

Resource Efficiency

Energy Management

GRI

302-1, 4

We determine that the primary cause of the Bank’s carbon footprint is the energy used in our regular business activities. In order to assure resource efficiency, we therefore rank “managing energy consumption” as our top priority. The main uses of energy for DFCC are the lighting and cooling of office buildings, the operation of equipment in these spaces, and the vehicles used for transportation. The source of electricity is the national grid and rooftop solar to a limited extent. The Energy Subcommittee together with the Premises and Administrative Services department has taken measures to improve the energy efficiency of the Bank by monitoring the consumption of all energy sources, including fuel and electricity.

DFCC strives continuously to limit the consumption of finite resources while adopting green measures and processes with a strong belief that even moderate use of natural resources contributes to resource depletion. Accordingly, the following key initiatives were implemented during the year:

- On 14 November 2023, the Bank installed a 150 kWp rooftop solar system at the Head Office which has an estimated monthly production capacity of 17,000 kWh which amounts to 27% of the total electricity consumption of the Head Office.

- Installation of two electric bike charging points at the Head Office car park.

- LED lighting solutions replacing florescent lights in branches.

- Installation of motion sensor lights in washrooms of the Head Office.

- Numbering switches and lights in work areas to enable the staff to easily switch on only the required lights.

- Maintaining temperature settings of the air conditioning at a standard temperature.

- Obtaining master utility bills for the Bank to increase the efficiency of centralised tracking.

Solar energy generation during 2023

| Branch/location of the building | System capacity (kWp) |

Electricity generation from solar/savings (kWh) |

| Kurunegala | 50.00 | 80,834 |

| Negombo | 27.00 | 40,140 |

| Ramanayaka Mawatha | 36.40 | 46,960 |

| Head Office | 150.15 | 22,690 |

| 263.55 | 190,624 |

GRI

302-2, 3, 305–1, 2, 3, 4, 6, 7

Energy consumption for the year 2023

| Electricity consumption | |

| Head Office | 684,590 kWh |

| Ramanayake Mawatha | 703,962 kWh |

| Heating consumption | No |

| Cooling consumption | No |

| Steam consumption | No |

| Standards, methodologies, assumptions, and/or calculation tools used |

None |

| Conversion factors used | None |

| Energy consumption outside the organisation | Not applicable |

| Reduction in energy | Solar power generation – 190,624 kWh |

| Energy intensity ratios | Electricity consumption Head Office – 1,906 kWh per employee (approx.)

Ramanayake Mawatha – 2,958 kWh per employee (approx.) |

| Fuel consumption (non-renewable sources) | |

| Standby generators – Head Office | Diesel 6,600 litres |

| Company-owned vehicles | Diesel – 44,315 litres |

| Petrol – 28,594 litres |

Emission Management

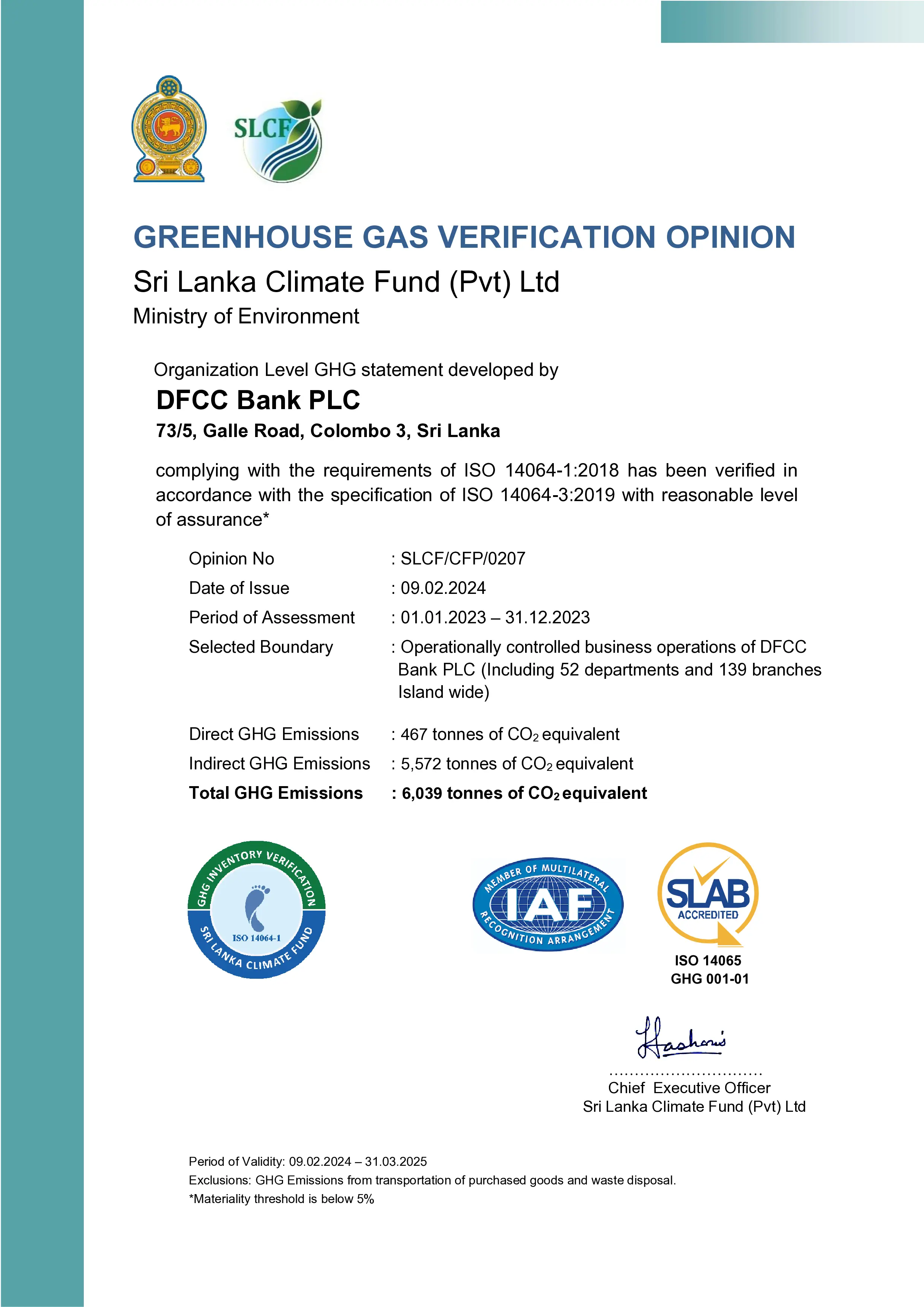

Emissions are calculated yearly based on the parameters in the Greenhouse

Gas (GHG) Protocol to determine the company’s annual carbon footprint for the financial period. In 2023, we carried out a GHG assessment in partnership with Randeewa Rasitha Associate (Pvt) Ltd. based on GHG protocol guidelines and ISO 14064-1:2018 standards. Verification for the GHG emission assessment is obtained from the Sri Lanka Climate Fund. As per the assessment, we did not identify any significant air emissions or emission of ozone depleting substances, pollutants and other hazardous compounds arising from our business operations.

Assessment Type: Organisational Greenhouse Gas Assessment*

Compliance: ISO 14064-1:2018; Greenhouse Gas Protocol – a corporate accounting and reporting standard (for calculation); ISO 14064-3:2019 (for verification)

Reporting period: 1 January 2023 to 31 December 2023

CO2 = 5678.516 tCO2e CH4 = 6.363 tCO2e N2O = 13.47 tCO2e

* Figures confirmed by Randeewa Rasitha Associate (Pvt) Ltd. and verified by Sri Lanka Climate Fund (Pvt) Ltd.

GHG Verification Certificate – Issued by

Sri Lanka Climate Fund

Carbon Conscious Certificate – Issued by

RR Associate (Pvt) Ltd.

Water Management

Pipe-borne water obtained from the National Water Supply and Drainage Board and local authorities fulfill our water requirement. Filtered water is provided to most of our employees and customers through a filtering system. Monitoring and controlling the use of water is another important aspect of the Bank’s sustainability strategy. The Bank seeks to inculcate the importance of water conservation in our employees through internal communication platforms.

Water consumption data as at 31 December 2023

| Consumption | Intensity ratios | |

| Head Office | 7,305m3 | Approximately 20.3m3 per employee |

| Ramanayake Mawatha building |

3,619m3 | Approximately 15.2m3 per employee |

Waste Management

DFCC has implemented a waste management strategy based on the 3R principle in order to reduce generation of paper, food, plastic, glass, and e-waste. We have introduced a proper system and provided facilities to branches for classifying, segregating, and recycling waste. Recycling is carried out in collaboration with third party recyclers. The staff are also encouraged to bring any e-waste they have in their homes for recycling.

Organic waste management

All organic waste generated, mainly through our employees, is disposed of using the services of the respective local authority.

E-Waste management

Generated e-waste, such as used printer cartridges and damaged electronic equipment are disposed with the assistance of an authorised e-waste collector.

Paper waste management

Paper waste generated is mainly cardboard and expired documents. Those are handed over to our recycling partner Neptune Recyclers for recycling. Documents of a confidential nature are shredded under the supervision of a Bank officer.

Promoting paperless operations

Major priority is given to reducing paper waste in line with our targets of becoming 100% paperless internally by 2024, and 50% paperless externally by 2025.

A number of initiatives towards minimising paper usage were implemented previously, such as installation of user codes and tracking copies/printouts taken by each user, streamlining of processes and awarding paperless certificates to departments to reduce paper usage by at least 85%, introducing shared Google files to branches to reduce the need for physical copies, removal of individual printers, and reducing paper towel usage. These initiatives were continued in 2023.

This year, DFCC embraced new technology in our journey towards being paperless. We started accepting digital signatures from customers and also started using digital signatures internally, further reducing paper usage. An innovative digital business cards solution was embraced, with which the Bank is working towards eliminating the use of paper business cards by 2024.

Another major milestone in our journey towards paperless digital operations was the launch of the fully fledged electronic KYC (eKYC) digital onboarding platform for our account opening. With this, new customers have the option of filling an online application and opening an account with DFCC without having to visit the bank or fill any documents. All processes are evaluated continuously by the Lean Management Unit towards further reducing or eliminating paper usage. As a result, the Bank annually saves over 2.2 million A4 papers which has resulted in saving over 132 trees annually (a tree is considered as a pine tree 45ft tall and 8in across).

Figures confirmed by Neptune Recyclers

Environmental and Social Management System – ESMS

The adoption of good ESG practices reflects DFCC’s recognition of the interconnectedness between environmental, social, and governance factors to obtain long-term financial performance, as well as our role in contributing to a more sustainable and inclusive economy.

Social and environmental compliance is the central component of DFCC’s Sustainability Strategy. The Bank’s major Environmental and Social (E&S) impacts tend to be indirect, arising from the provision of financial services to projects.

The Bank developed and implemented its own Environmental and Social Management System (ESMS) in 2016, which was revised in 2021 with the objective of incorporating E&S aspects as an integral part of project appraisal and follow-up activities. In 2023, the ESMS was further revised to incorporate all IFC “Performance Standards on Environmental and Social Sustainability” into the project appraisal stage to meet the requirements of the Green Climate Fund. The Sustainability Unit is responsible for the implementation of this ESMS. To ensure the implementation of the ESMS in the Bank, several training programmes were carried out by the Sustainability Unit throughout the year.

The Sustainability Unit strives to ensure that commercial customers with facilities above LKR 25 Mn obtain and comply with all relevant environmental clearances to operate, as per environmental laws and regulations of the country. The Sustainability Unit analyses and categorises facilities based on our own E&S risk categorisation framework and provides due diligence plans to monitor during the loan tenor. The following table summarises the E&S Risk Categorisations carried out for all term loans over LKR 25 Mn during this year. Moreover, the loan appraisal formats were updated to capture relevant data from the facility level, and the core banking system was developed to capture the data for future reporting. In addition, the Sustainability Unit also acts as the “Environmental Screener” for all loans funded through credit lines including the ADB SME line.

Summary of the E&S Risk Categorisations carried out for

all new term loans over LKR 25 Mn

as at 31 December 2023

| Category | Number of loans |

| Very High Impact (A) | 10 |

| High Impact (B) | 38 |

| Medium Impact (C) | 13 |

| Low Impact (D) | 10 |

| Very Low Impact (E) | 59 |

| Total | 130 |

Currently, we are in the process of carrying out a review of our ESG systems including the ESMS to meet the requirements of the statutory bodies and stakeholders. A change has been made in the current year, where the green loans are entered into the core banking system and tagged whereas it was formerly an entirely manual process.

Green Products and Services

Green financing

With an impressive three-decade record of green financing, DFCC Bank remains committed to financing and promoting green and low-carbon-intensive facilities. As a brand, we believe that focusing on sustainable economic growth, together with environmental and social due-diligence will assist the necessary paradigm shift from the “business as usual” approach. By encouraging our stakeholders and customers through supporting more green projects, DFCC believes that we can position ourselves as a leader in responsible business practices, attract environmentally conscious customers, and contribute significantly to the global effort towards a more sustainable and resilient future.

Green finance reporting

Considering the national importance of promoting sustainable financing initiatives and the need for providing a governance and risk management framework for licensed banks in respect of sustainable finance activities, the CBSL issued the Banking Act Direction No. 05 of 2022. In accordance with this direction DFCC reports its Sri Lanka Green finance Taxonomy (SLGFT) compliant green portfolio quarterly to the CBSL. As at 31 December 2023, DFCC has classified and reported LKR 10.96 Bn worth of loans which is 3.0% of the “gross loans and receivables from the customer portfolio”. The figure below depicts the total Green Finance Taxonomy compatible facilities belonging to the macro sectors specified in the SLGFT. In 2023 the Bank financed LKR 327 Mn of new green facilities.

Green deposits

On the liability side, we introduced a green deposit product. It is a special fixed deposit developed with the aim of mobilising new funds through corporates and individuals who are committed towards green and sustainable initiatives. We assure that the funds mobilised from the Green deposits will be reinvested by the Bank in green projects, complying with the SLGFT. An assurance is conducted in this regard by KPMG.

Employee Training on Environmental Aspects

DFCC believes that integrating sustainability into an organisation’s culture through training and awareness initiatives is essential for fostering responsible business practices, achieving long-term success, and making a positive impact on the

planet and society as a whole.

Training programmes for employees on E&S aspects during the year 2023

| Topic | Number of programmes |

Target group |

| Social and Environmental Management System – ESMS | 1 | Credit Staff |

| Green Taxonomy and E&S Categorisation of Loans | 3 | Branch Managers, Credit staff of MSME, Corporate Banking, IRM officers |

| Identifying/qualifying businesses that come under the Green Finance Taxonomy, Women-led enterprises, and Sustainable and Social Enterprises | 3 | Credit staff, Branch Managers |

DFCC is a pioneering signatory to the eleven “Sustainable Banking Principles” (SBP) of the Sri Lanka Banks’ Association (SLBA) under the Sustainable Banking Initiative (SBI) and is committed to adhering to these principles in its operations. In order to generate value for our stakeholders, DFCC consciously works towards attaining social, environmental, and economic sustainability while upholding the highest standards of governance.

Employee engagement in Environment Conservation

DFCC strives to make sustainability a way of life at the Bank which permeates all our activities. Corporate Social Responsibility (CSR) programmes related to the environment are initiatives undertaken to demonstrate the bank’s commitment to environmental stewardship, to minimise our environmental footprint, contribute positively to environmental conservation, and address environmental challenges. Through unique initiatives, we have offered the DFCC family various opportunities to participate in and gain exposure to significant environmental concerns. Most of our sustainability initiatives

are driven through the leadership of the sustainability champions represented by our employees.

Employee awareness on sustainability

Sustainability is a highlight in the weekly newsletter shared amongst staff.

DFCC “Life to Marine” – Marine & Coastal Ecosystem Restoration and Conservation Programme

“Life to Marine” is the DFCC environmental programme which focuses on conservation and restoration of marine and coastal ecosystems. We consider this programme a timely requirement to preserve marine biodiversity and to combat climate change.

Restoration of mangrove ecosystems – Preserving coastal blue carbon habitats

Protecting mangroves and restoring damaged ecosystems will eventually aid in combating climate change through carbon sequestration as they are some of the most carbon-rich ecosystems on the planet. DFCC has recognised this timely needed intervention as a responsible corporate citizen and partnered with the Sri Lanka Navy for the mangrove restoration programme. The project commenced by establishing a mangrove nursery at the Naval Detachment Karukupane (Kalpitiya) in July 2023. At the initial engagement, an opportunity was given to some of our 6E Sustainability Champions and branch staff to volunteer in seed collecting and planting activities and get background knowledge through an awareness session on mangroves conducted by an expert. Over a thousand seedlings from two different species of Rhizophora are being raised in the nursery for planting at the chosen site in the North Western province in 2024. This will be one of the signature initiatives of the Bank, which will also have a community outreach aspect. The Bank will streamline this project by implementing a long-term adaptive management approach that allows for adjustments based on ongoing monitoring and evaluation to address unforeseen challenges.

Beach Cleanup

A beach cleanup was organised to commemorate World Environment Day and World Ocean Day 2023, in collaboration with the Sri Lanka Navy and Eco Spindles (Private) Limited at Preethipura Beach, Uswetakeiyawa. Staff, families, customers and residents from the area participated in this event, which successfully raised awareness about the importance of minimising plastic and polythene waste in the ocean, aligning with the theme of World Environment Day 2023 “Beat Plastic Pollution”.

Guided Excursion to the “Diyasaru Park” Urban Wetland in Thalawathugoda

The annual guided excursion organised by the Bank was held in November with the participation of DFCC staff and families. This excursion was designed with the objective of improving awareness on the critical importance of urban wetlands, its ecosystem services and the associated biodiversity. The event was facilitated by the Sri Lanka Land Development Corporation (SLLDC) including an awareness session conducted by an expert on “how wetlands contribute to the liveability and resilience of cities” and a guided nature walk conducted by an ecologist with the assistance of a field team. The excursion was followed by a nature journaling event, which received high enthusiasm from participants. These kinds of activities contribute to the well-being and bonding of family members of DFCC and the experiences will provide opportunities for shared adventures and create lasting memories.

DFCC cleanup day

DFCC conducted its annual cleanup day, to coincide with World Cleanup Day on 16 September. The participating teams cleaned their office premises and surrounding areas and disposed of unnecessary clutter. Waste was segregated by category, at source and handed over to our partner companies, Neptune Papers (Pvt) Ltd and Cleantech (Pvt) Ltd for recycling.

Cleanup day – Collection summary

Paper

2,500 kg

PET Bottles

3 kg

Glass

32 kg

Metal

36.5 kg

Plastic

10 kg

E-waste

3.5 kg

Note: Waste collection included Head Office, Ramanayake Mawatha, Nawala, Lakehouse, Malabe, Kurunegala, Negombo, Galle, Matara figures are confirmed by Cleantech (Pvt) Ltd.