At the moment, there are no entries available for display

The Bank prioritises customer satisfaction and trust to establish lasting relationships, ensuring profitability, brand reputation, market presence, and sustainability. Customer-centricity is central to DFCC’s strategies and operations, focusing on meeting customer needs to enhance product development, service delivery, and competitiveness. The Bank utilises advanced systems to gather customer feedback, enabling continuous improvement and better service delivery.

Customer Capital encapsulates the loyalty, trust, and satisfaction of customers, along with their potential lifetime value and the Bank’s ability to meet their needs. This Capital signifies the ongoing revenue streams generated by loyal customers and their referrals, as well as the Bank’s capacity to retain them. For DFCC Bank, understanding and enhancing customer capital is crucial as it directly influences profitability, brand reputation, and market positioning, fostering long-term sustainability and a competitive advantage in the financial landscape. It also serves as a pivotal metric in assessing the Bank’s overall performance and growth trajectory.

Customer Centricity

Customer centricity lies at the heart of DFCC Bank’s approach to enhancing customer satisfaction and loyalty. This guiding principle shapes every facet of operations, ensuring a steadfast commitment to delivering an exceptional experience to our valued customers.

By prioritising customer needs, the Bank is able to tailor its services, build stronger relationships, and gain a competitive edge in the highly competitive financial market. Having a highly focused customer-centric strategy enables DFCC Bank to place greater emphasis on personalised services, streamline processes for convenience, and actively seek customer feedback. This two-way communication helps in understanding and addressing customer needs efficiently. Moreover, the Bank engages in extensive employee training to ensure a customer-focused culture, reinforcing their commitment to delivering tailored financial solutions and fostering enduring relationships.

A number of initiatives have been undertaken by DFCC Bank to boost customer satisfaction and loyalty. A number of research tools have been utilised in implementing these initiatives. Additionally, a complaint management system has been made accessible to all branch staff, ensuring that inquiries and complaints are handled within specified timelines. Monitoring service levels of critical functions facilitates process improvement, and periodic service refresher training for frontline staff helps maintain high standards across the branch network. The Bank uses the following service-related research tools to assess service standards, implementing necessary training to address identified gaps.

- Net Promoter Score (NPS) to assess the likelihood of customers recommending the Bank

- Net Easy Score (NES) to gauge the simplicity and efficiency of the customer journey, and experience with a product or service.

- Customer Satisfaction Score (CSAT) to assess satisfaction levels for specific interactions, helping businesses identify areas for improvement.

- Mystery caller and mystery shopper programme.

- In addition, certain activities commemorating the importance of customer service were carried out during the Customer Service Week. These included service training, bank-wide programmes, and forums.

The Bank employs various channels and processes to collect and address customer feedback, ensuring alignment with customer needs and expectations. This includes:

- Customer Surveys: Regular surveys are conducted online, over the phone, or in person at branches to gather feedback on customer experiences with products and services.

- Customer Service Interactions: Opportunities for direct feedback arise during phone calls, emails, or live chat interactions with Bank representatives. In addition branches now offer QR codes and missed call facilities, allowing customers to easily share their service experience.

- Social Media Monitoring: The Bank monitors social media platforms to track customer mentions, comments, and messages, addressing any concerns promptly.

- Complaint Handling: Formal processes to manage customer complaints, focusing on investigation, resolution, and implementing corrective actions.

- Focus Groups and Interviews: We engage in focus groups and or interviews with select customers for deeper insights into specific issues.

- Data Analysis: Analysing various data sources helps identify trends and patterns, guiding improvements in products, services, and customer experience.

After collecting feedback, and analysing the results, the Banks responds in a number of ways, including:

- Resolution: Addressing complaints swiftly and effectively, the Bank provides solutions or redress when necessary.

- Continuous Improvement: Utilising feedback, the Bank identifies areas for enhancement in products, services, processes, and overall customer experience. Prioritisation of action items considers feedback severity, frequency, and impact on customer satisfaction.

- Communication: The Bank keeps customers informed about actions taken in response to their feedback, underscoring their commitment to addressing concerns and improving the customer experience.

- Training and Development: In response to feedback, the Bank may offer additional training to staff, ensuring improved customer service delivery and alignment with customer needs and expectations.

In order to ensure a seamless and personalised customer experience across touchpoints, the Bank has implemented measures such as enhancing digital platforms with improved user experience. DFCC has also revamped the online account opening process, enabling customers to open accounts from anywhere via video call. These initiatives collectively contribute to an improved and tailored customer experience across various interactions.

Impact of the Customer-centric Approach

DFCC Bank has continued to sustain its unwavering commitment to customer-centricity, a cornerstone of our operations and success, which has yielded noteworthy impacts on both our financial performance and market positioning.

- Strengthened Customer Loyalty: Through personalised services and tailored solutions, we fortified relationships, resulting in heightened customer loyalty and increased retention rates. Satisfied customers remained steadfast, contributing to the stability of our customer base.

- Enhanced Financial Performance: Our customer-centric approach translated into improved financial metrics, marked by higher revenue and profitability. Effectively meeting customer needs led to increased product and service usage, thereby bolstering revenue streams.

- Minimised Customer Churn: Proactive engagement and attentive service significantly reduced customer churn rates. Addressing concerns promptly and aligning solutions with their financial goals fortified the relationships with customers.

- Identified Cross-selling Opportunities: Selling Opportunities – Understanding our customers’ financial journeys allowed us to identify new cross-selling opportunities, introducing targeted offerings and capitalising on existing relationships for additional revenue.

- Positive Brand Reputation: Our dedication to customer satisfaction cultivated a positive brand reputation, positioning DFCC Bank as a reliable financial partner committed to our customers’ success, thereby enhancing brand equity and attracting new clients.

- Market Differentiation: In a competitive landscape, our customer-centric approach served as a distinctive factor, setting us apart by prioritising customer needs and delivering exceptional experiences, thereby strengthening our market position.

- Effective Risk Management: Understanding customer behaviours facilitated more effective risk management. Aligning products and services with customer profiles mitigated risks associated with non-performing loans, ensuring a healthy loan portfolio.

Customer Experience

The Customer Experience Unit at DFCC plays a pivotal role in ensuring customer satisfaction and loyalty by focusing on enhancing the overall experience for customers throughout their journey and interactions with the Bank. It functions as a central hub dedicated to understanding, managing, and improving interactions between the Bank and its customers. This unit conducts comprehensive analyses of customer feedback, complaints, and satisfaction surveys to identify pain points and areas for improvement.

Key responsibilities of the Customer Experience Unit involve designing and implementing strategies to enhance customer interactions across various touchpoints, ensuring consistency and quality in service delivery. They collaborate closely with other departments to integrate customer feedback into product development, service design, and operational processes. By fostering a customer-centric culture, this unit aims to drive positive customer perceptions, loyalty, and advocacy, ultimately contributing to the Bank’s reputation and long-term success.

Complaint Management System (CMS)

A Complaint Management System is pivotal for a customer-centric bank as it facilitates a responsive and proactive approach to customer issues. It enables swift identification, resolution, and analysis of complaints, fostering improved service delivery and customer satisfaction. By addressing concerns promptly, the Bank demonstrates attentiveness to customer needs, building trust and loyalty. Additionally, the system provides valuable insights for process enhancements, ensuring continual improvement in services, vital for sustaining a customer-centric approach.

The Customer Experience Unit has been tasked with the specific purpose of managing customer complaints received through various channels, including social media, the Bank’s own website, online banking platforms, emails, calls to the contact centre, direct contact, or letters.

Trends in customer complaints are discussed and decisions are made on process changes required, training gaps identified, and the corrective action taken.

Assessing Customer Satisfaction

At present, the evaluation of the Net Promoter Score (NPS) is conducted internally, for products such as credit cards and propositions such as DFCC Pinnacle, aimed at identifying customer sentiments and drivers. There are plans to upgrade the service-level monitoring system, which will incorporate additional service-level dashboards that will assist in improving the service offerings.

Customer Service Ambassadors

When handling complaints and inquiries from multiple branches across the island, the coordination becomes challenging. There’s a necessity for ground-level intervention to enhance services, identify gaps, and conduct refresher training to improve service quality.

The Customer Service Unit manages the administration of 139 “Customer Service Ambassadors” who are appointed one per branch. They play a crucial role in identifying service deficiencies and organising refresher training for new staff. The Ambassadors take charge of training new employees on phone etiquette, service efficiency, and ways to improve customer experience. Their performance is evaluated based on specific Key Performance Indicators (KPIs).

In the Bank’s service-related programmes, priority is consistently accorded to the involvement of Customer Service Ambassadors. Their insights and experiences take precedence, as demonstrated in a forum held last year, where these Ambassadors were given a prominent platform alongside guest speakers to discuss customer service.

The Customer Experience Unit addresses service gaps, particularly in instances of multiple complaints from a specific area, unit, or branch, by conducting physical visits. Online training sessions are also conducted for new staff members; this includes online refresher training to cover service gaps. Moreover, the Customer Service Ambassadors participate in an annual external training programme. Region-specific training is based on complaints received and incorporates insights from research tools.

Housing Loans

DFCC Bank offers versatile home loan solutions tailored to meet diverse housing needs. Whether customers aspire to purchase, build, or renovate a home, invest in a block of land, acquire a condominium property, or upgrade an existing residence, our comprehensive range of home loans provide the best option.

With competitive interest rates, we provide the flexibility of choosing between fixed and variable rates, allowing customers to align their repayments with their financial capabilities. Our streamlined process ensures efficiency and convenience. Customers can obtain a pre-approved housing loan within a swift turnaround time of just 3 working days. This pre-approval offers the freedom to make investment decisions confidently, secure in the knowledge that financing is secured.

Our team of experienced officers, stationed across our extensive branch network, is dedicated to assisting customers throughout their entire journey. From the initial discussion to the loan disbursement, our experts will provide the guidance and information, saving valuable time and simplifying the process.

Leasing Facilities

With a three-decade tenure in the leasing industry, DFCC stands as a stalwart equipped to fulfil the diverse leasing needs of customers. Our seasoned professionals guarantee exceptional service quality coupled with competitive interest rates, ensuring a seamless leasing experience.

DFCC Leasing accommodates a broad spectrum of clients, encompassing entrepreneurs, SMEs (including proprietors, partners, and private limited companies), individual fixed-income earners, professionals, and both private and public limited corporate entities. Our tailored features are designed to optimise the leasing experience of these diverse clientele.

Our commitment to providing personalised service ensures that each client receives dedicated attention, tailoring solutions to meet individual needs. Flexible repayment plans are crafted to align with diverse financial requirements, facilitating convenient and stress-free payments. Our streamlined procedures demand minimal documentation, simplifying the application process and saving valuable time. Competitive interest rates, combined with expedited service, ensure a swift and cost-effective leasing journey. With an island-wide branch network, our services are easily accessible nationwide. We bring the convenience of service directly to your doorstep, enhancing accessibility for your comfort. Moreover, our experienced team offers professional leasing advice, empowering informed decision-making.

Personal Loans

Personal loans offer several benefits to individuals, providing financial flexibility for various needs without requiring collateral. These loans facilitate major purchases or unexpected expenses. Personal loans often have fixed interest rates, making budgeting easier. Additionally, timely repayment can positively impact credit scores, potentially enabling access to better loan terms in the future, thereby aiding in financial planning and stability. Personal loans can consolidate high-interest debts into a single, manageable payment.

Ethera Saviya

An exclusive loan programme tailored for skilled workers aiming for overseas employment in nations such as Israel, Italy, Japan, and members of the Gulf Cooperation Council (GCC). This initiative covers pre-departure expenses and supports business development endeavours for eligible individuals.

DFCC Green Loans

Sri Lanka’s IT/BPM sector stands as a leading contributor to foreign currency inflow. To sustain and expand this industry, DFCC Bank has launched an exclusive green loan programme. This scheme is aimed at SLASSCOM member firms and their employees, enabling them to acquire Sustainable Power Generation Equipment, fostering the industry’s development within the present landscape.

Garusaru Loans

The DFCC Garusaru Loan is an individualised personal loan designed exclusively for retired government pensioners. This loan plan provides borrowing options of up to LKR 5 Mn, allowing for a repayment span of fifteen years. Borrowers who opt for this service through DFCC Bank can benefit from highly competitive interest rates, accompanied by a streamlined and convenient service. Within its Garusaru product range, DFCC Bank also presents the Garusaru Senior Citizens Savings Account, requiring an initial deposit of LKR 1,000.

DFCC Teachers’ Loans

The DFCC Teachers’ Loan is a specialised Personal Loan programme specifically crafted for school teachers employed in government, semi-government, or recognised private/international schools, or serving as executive/senior executives (Grade I, Grade II, Grade III, or Special Grade) in educational administration. This scheme offers loan amounts up to LKR 4 Mn with a repayment tenure extending up to 7 years and features competitive low-interest rates.

DFCC Mehewara Personal Loan

A dedicated and unique Personal Loan scheme has been tailored specifically for the valiant heroes serving in the Sri Lanka Army, Sri Lanka Air Force, Sri Lanka Navy, and the Special Task Force of the Sri Lanka Police. This specialised programme aims to offer financial support and assistance to these esteemed individuals, recognising their commitment and sacrifices in safeguarding the nation’s security and well-being.

DFCC Auto Loans

The DFCC Auto Loan offers the opportunity to purchase your dream vehicle with a flexible repayment schedule customised to align with your income. Positioned as the premier choice for vehicle financing, it ensures a comfortable repayment scheme adjusted to your cash flows and features a structured payment plan. This financing solution stands out for its tailored approach, making it an ideal option for acquiring your desired vehicle while managing your financial obligations conveniently.

DFCC One Loan

An exclusive loan programme uniquely designed to consolidate existing liabilities and cater to personal financial needs. This scheme enables the settlement of various debts such as loans, leases, credit card balances, and other borrowings. Additionally, it accommodates individual requirements, providing financial support beyond debt consolidation to address personal necessities effectively, offering a comprehensive solution to manage and fulfil both financial obligations and personal aspirations.

Personal Loans for Professionals

An exclusive Special Loan Scheme meticulously crafted for professionals engaged in stable fixed employment or self-employment. This versatile loan option serves multiple purposes, catering to personal needs and facilitating the acquisition of professional equipment or the expansion of business ventures. This tailored scheme provides financial support, empowering professionals to invest in their aspirations and elevate their career or business prospects.

DFCC Education Loans

Having appropriate educational qualifications can go a long way towards achieving one’s personal ambitions, including improved career prospects and greater income. This specialised loan scheme from DFCC aims to support individuals in pursuing diverse educational paths, whether it is higher academic pursuits, vocational training, or attaining professional qualifications. It offers tailored financial aid, enabling individuals to fulfil educational aspirations and advance towards a successful and fulfilling future.

Credit Cards

Our range of Credit Cards empower individuals and businesses with unparalleled flexibility, granting access to the lifestyle they aspire to achieve. These cards stand as symbols of prestige, ensuring recognition and acceptance across a spectrum of locations. DFCC Credit Cards not only provide this valued status, but also offer a lucrative advantage through a rewarding feature, allowing personal card users to earn a 1% Cash-Back on every transaction made locally and internationally, contributing to their savings with each purchase.

These cards are available in various categories such as the DFCC Visa Platinum, DFCC Visa Signature, DFCC Visa Infinite, and DFCC World Mastercard and Visa Corporate for businesses each accompanied by a diverse set of benefits. These privileges encompass exclusive deals and discounts at prominent establishments, the utilisation of cutting-edge contactless payment technology for swift and secure transactions below a specific threshold, and the option to access up to 75% of the credit limit as a loan on the personal cards.

Moreover, our personal Credit Cards facilitate hassle-free balance transfers from other credit cards to DFCC, simplifying financial management. With a strong focus on rewarding spending habits, providing convenience, and offering diverse financial options, our suite of Credit Cards aims to enhance the lifestyle of the users while ensuring seamless transactions and added value with every purchase.

Ranwarama Pawning

DFCC Bank’s Ranwarama Pawning Scheme stands as the optimal solution for individuals seeking immediate financial assistance. This scheme offers a secure and reliable method to acquire funds swiftly by leveraging gold assets. Pawning gold holds several advantages, such as providing quick access to cash without requiring credit checks or lengthy approval processes. Moreover, it offers a discreet way to obtain funds without affecting credit scores or financial standings.

The Ranwarama Pawning Scheme from DFCC Bank ensures a hassle-free experience, allowing customers to pawn their gold possessions, including jewellery or sovereigns, in exchange for a loan. This loan is granted based on the market value of the gold pledged, providing a convenient and viable source of emergency funds or fulfilling urgent financial needs.

Beyond its immediacy, pawning gold at DFCC Bank affords customers the flexibility to redeem their pledged gold items upon repayment of the loan and accrued interest within the stipulated timeframe. Additionally, DFCC Bank ensures the security and safekeeping of the pledged gold items throughout the pawning period, guaranteeing peace of mind to customers.

The Ranwarama Pawning Scheme not only serves as a prompt financial solution but also offers a secure and trustworthy avenue to unlock the inherent value of gold assets during unforeseen circumstances or urgent monetary requirements.

Lines of Credit

DFCC Bank’s dedication to nurturing the SME sector in the nation goes beyond mere financing. The Bank is deeply committed to empowering entrepreneurs by offering not just financial support but also essential knowledge and guidance. Recognising the pivotal role SMEs play in economic growth, DFCC Bank strives to equip entrepreneurs with the necessary expertise to elevate their businesses. This comprehensive approach aids in fostering sustainable growth and innovation within the SME landscape, contributing significantly to the country’s economic development.

SMELoC – TEA Smallholder Credit Line and JFPR Grant

This is an Asian Development Bank (ADB) funded line of credit to support tea small holders. This facility is provided to landholding of 10 Acres to 50 Acres, with a recommendation letter from the Tea Small Holdings Development Authority (TSHDA) or the Sri Lanka Tea Board (SLTB). The maximum loan amount is LKR 30 Mn.

Tea Small Holders with a land extent not exceeding 10 Acres, for the purpose of new planting and replanting are eligible for a 10% Grant (JFPR). The maximum loan amount is LKR 5 Mn.

SMELoC – SME Component and We- Fi Grant

This is an Asian Development Bank (ADB) funded line of credit for registered Small or Medium-sized Enterprises (SMEs) with an annual turnover less than LKR 750 Mn and less than 300 employees if in the manufacturing sector or less than 200 employees if in the service sector.

The following criteria should be fulfilled to be a “Qualified grant Enterprise” under SMELoC – We- Fi Grant.

51% of the enterprise ownership shall be controlled by women or at least 20% of the enterprise ownership is controlled by women. A Woman is either the Chief Executive Officer (i.e. the most Senior Manager) or Chief Operations Officer (i.e. Second most senior manager); and at least 30% of the Board members are women; where a board exists.

Environmentally Friendly Solutions – E-Friends II-RF

Environmentally Friendly Solutions Fund II (E-Friends II) Revolving fund, also known as E-Friends II-RF, is offered in collaboration with the Ministry of Industries. This credit line is set up by the Government of Sri Lanka to assist industrial enterprises in Sri Lanka in finding solutions to the environmental problems, such as industrial pollution caused by their manufacturing and energy consumption. The main objective of this credit scheme is to improve the environment and meet the environmental safety standards.

E-Friends II – (RF) – General Loan Scheme

The General Loan Component supports the industrial enterprises in addressing environmental concerns stemming from their manufacturing and energy usage. The funds can be utilized to mitigate industrial pollution, improve the environment via waste reduction, resource recovery, energy conservation, and pollution management, enabling businesses to adopt eco-friendly practices for sustainable operations.

E-Friends II – (RF) – Technical Assistance Loan Scheme

Technical Assistance Loan (TA Loan) supports projects funded by E-Friends II (RF) General Component loan scheme to facilitate consultancy and technical services to investigate the environmental problems and for waste minimisation, resource recovery and savings, and pollution control and abatement measures and associated design, supervision of installation and operation of the equipment financed under the fund.

SMILE III Revolving Fund-RF

The Small and Micro Industry Leader and Entrepreneur (SMILE) Promotion Project, also known as Smile III Revolving Fund , is offered in collaboration with the Ministry of Industry and Commerce. This credit line is set up by the Government of Sri Lanka to support the manufacturing and industry-related service sectors.

SMILE III (RF) – General Loan Scheme

SMILE III RF General Loan Scheme is offered in collaboration with the Ministry of Industries and Commerce to support the manufacturing and industry-related service sectors. This credit line supports Small and Medium Scale sole proprietorship, partnership, cooperative society, limited liability company, or any other privately owned enterprise to start-up businesses.

SMILE III (RF) – Technical Assistance Loan Scheme

The SMILE III (RF) TTAS is designed to support training costs on upgrading staff’s accounting, managerial, and technical skills, consultancy cost, quality control and laboratory equipment. These facilities are available for Small and Medium Scale sole proprietorship, partnership, cooperative society, limited liability company, or any other privately owned enterprise to start-up businesses.

New Comprehensive Rural Credit Scheme – (NCRCS)

This loan scheme is an interest subsidy and credit guarantee scheme implemented by the Central Bank of Sri Lanka (CBSL) to support cultivation of agricultural crops and production of seeds and planting materials. NCRCS has been introduced with the primary purpose of uplifting the socio-economic conditions of micro and small scale farmers who engage in cultivation of seasonal (short term) crops.

Smallholder Agribusiness Partnerships Programme – (SAPP)

The Smallholder Agribusiness Partnerships Programme (SAPP) has been implemented by the Ministry of Agriculture – Sri Lanka and Central Bank of Sri Lanka (CBSL). The programme aims to facilitate rural smallholder farmers in terms of building the commercial partnerships, providing access to finance, improving technical knowledge and financial literacy, and introducing mechanisation to agriculture.

Manusavi Loan Scheme for Sri Lankan Migrant Workers – (MLSMW)

This loan scheme has been implemented by Central Bank of Sri Lanka (CBSL) and Sri Lanka Bureau of Foreign Employment (SLBFE). The main objective of the Loan Scheme is to encourage Sri Lankan migrant workers to remit their foreign exchange earnings through formal channels and to utilise their earnings for productive purposes. The eligible sub-borrower shall be a Sri Lankan citizen employed abroad with a valid employment contract for a fixed term not less than one year.

Digital Products and Services

DFCC Bank’s Digital Products and Services play a pivotal role in modern banking by providing convenient, accessible, and secure financial solutions. These digital offerings empower customers to conduct various banking transactions, manage accounts, transfer funds, and access services anytime, anywhere. They contribute significantly to enhancing customer experiences, promoting financial inclusion, and adapting to evolving technological landscapes, ensuring efficiency and ease in meeting diverse banking needs in today’s digital era.

DFCC Virtual Wallet (Hybrid Mobile Banking App)

The DFCC Virtual Wallet empowers customers to conduct transfers between DFCC accounts, as well as other bank accounts and credit cards via CEFTS. It facilitates the addition of DFCC Credit Cards, enables balance inquiries, bill payments, mobile reloads, and institutional payments. Self-registration can be carried out by downloading the app onto the customers mobile device and using the debit card, ensuring convenience and accessibility for banking anytime and anywhere according to customer preferences.

DFCC iConnect

The Banks’ electronic banking platform for Corporates continued to make waves in the Payment and Cash Management sphere in 2023 by being voted the Market Leader by the prestigious Euromoney Awards for the third consecutive year. Beyond mere accolades, it signifies our steadfast commitment to reshaping banking norms with innovation and unwavering focus on customer needs. Boasting advanced features and an intuitive interface, DFCC iConnect empowers users to effortlessly manage their finances anytime, anywhere. This accolade underscores our dedication to leveraging technology for customer-centric solutions, reaffirming our position as trail blazers in the financial landscape in Sri Lanka.

DFCC Chatz/DFCC Video Chatz

DFCC Chatz is an interactive and multi-channel chatbot which transforms communication dynamics. It ensures a smooth customer journey by accommodating queries in the user’s preferred language, guiding them through personalised procedures. Accessible across diverse platforms like the DFCC Bank website, Facebook, Messenger, Viber, and WhatsApp, DFCC Chatz efficiently handles inquiries. Complex inquiries will be rerouted to a 24-hour live agent, ensuring comprehensive assistance and resolution.

MTeller

The Mobile Teller (MTeller) doorstep banking service involves a staff representative visiting customers to collect their daily cash deposits. This service allows customers the flexibility to make cash deposits at their preferred location within a 20 km radius of the servicing branch. Future enhancements are planned to introduce additional features that will further benefit customers through this channel, aiming to add more value and convenience to their banking experience.

eStatements

In its pledge towards environmental sustainability, DFCC Bank has introduced eStatements offering monthly consolidated statements and interactive credit card eStatements. This service is provided free of charge, enabling customers to save time previously spent waiting for mail deliveries and facilitating efficient reconciliations. By opting for eStatements, customers contribute to environmental sustainability while experiencing convenience and streamlined financial management.

DFCC Alerts

DFCC Alerts is a service that delivers account transaction and available balance details to customers via SMS or email, ensuring real-time updates on your day-to-day banking activities wherever you are. SMS Alerts are available for individuals, SMEs, and corporate customers, while corporate customers additionally benefit from email and trade alerts. This feature keeps customers informed promptly, enhancing their banking experience by providing immediate insights into their transactions.

DFCC Online Banking

DFCC Online Banking offers comprehensive financial control, providing an array of banking services conveniently accessible anytime, anywhere. This platform empowers users to oversee their accounts round the clock, enabling diverse functions such as establishing goal-based savings, opening fixed deposits and savings accounts, securing credit card blocks, configuring essential DFCC alert services, and personalising preferred user IDs for a tailored online banking experience.

DFCC MySpace (Digital Channels – ATMs, CRMs, CHDMS, Pay & Go Machines)

The DFCC “MySpace” concept unveils a range of banking facilities like ATMs, CRMs, Cheque deposit kiosks, and Pay-and-Go machines. These stations enable customers to conduct various transactions, including Cardless/Card-based cash deposits and withdrawals, credit card payments, bill settlements, and cheque deposits. Notably, DFCC Bank stands out by not levying fees on cash withdrawals made by its customers from DFCC ATM/CRM machines. Prioritising customer value enhancement defines DFCC Bank’s core purpose and existence in the banking sector.

Retail Liabilities (Deposits), Product Propositions

DFCC Bank offers a diverse range of deposits products to meet the varied needs of its customers. The DFCC fixed deposits are designed for those seeking higher returns over a fixed term, with options ranging from 1 month to 10 years, accommodating different investment preferences.

The savings portfolio includes general LKR savings products like DFCC Mega Bonus for general savings needs, DFCC Winner Savings for the workforce and professionals, DFCC Xtreme Saver account for clients seeking short-term savings with higher returns, DFCC Junior/Junior Plus to instil the savings habits in the younger generation, DFCC Teen Savings promoting financial literacy among teenagers,

DFCC Aloka Savings covering various financial needs of female customers, and DFCC Garusaru Savings exclusively for senior citizens. Additionally, DFCC Current Account is ideal for day-to-day transactions, facilitating cash and cheque deposits, and electronic payments. The Bank also provides various FCY accounts for foreign currency transactions.

New Product Propositions

DFCC Bank recognises the importance of offering new product propositions to stay innovative and meet evolving customer needs. Introducing fresh solutions enhances customer engagement, attracts a broader clientele, and strengthens the Bank’s competitive position. By continually innovating, DFCC ensures it remains at the forefront of the financial industry, providing valuable and relevant products that align with the dynamic preferences of its customers and fostering sustained growth in a competitive market.

In 2023, DFCC launched a novel offering, the DFCC Investment Planner, a savings-centric product tailored to address the enduring financial goals of customers. Primarily targeting those with long-term needs such as funding children’s higher education, marriage, parental medical expenses, and retirement, this product allows savings in both LKR and selected foreign currencies. It guarantees interest rates surpassing prevailing market rates. To facilitate easy planning, we’ve introduced a calculator enabling users to determine the monthly instalment they prefer. We assist customers in achieving their financial objectives over a 5, 10, or even extended years. High-net-worth clients benefit from personalised discussions, considering short-term commitments and long-term goals, aligning with their lifestyles and aspirations. Our aim is to provide investment solutions that precisely meet their diverse needs.

In 2023, DFCC introduced the DFCC Goal Savings proposition, presenting DFCC Savings Goals as a feature within DFCC Online Banking. This feature is designed to automate savings on a daily, weekly, or monthly basis, aiming to attain a predetermined financial target and realise desired goals within a period of fewer than 24 months.

DFCC Junior, the savings product for children, underwent a redesign, accompanied by the introduction of a new product named DFCC Junior Plus. For DFCC Junior, a novel gift structure was implemented, where various gifts are earned based on deposit amounts. This follows a slab system determined by deposits ranging from LKR 1,000 to LKR 2.5 Mn. The gifts encompass a diverse range, including gift vouchers, e-vouchers, and value credits. As for DFCC Junior Plus, it offers an unprecedented 10% interest rate on savings standing out as unmatched in the market.

We have introduced a special offer for Fixed Deposits (FDs) with an exceptionally appealing rate for 3-month terms, surpassing any rate offered by other banks. This initiative has proven highly successful, especially considering that some customers have become cautious about investing in fixed deposits due to uncertainties surrounding prevailing rates and other opportunities in the market.

We have implemented virtual account opening, allowing customers to complete this process without the need to physically visit a branch. This innovation is particularly appealing to the younger generation, who prefer handling all their transactions virtually. Even older customers, not as adept with IT, now prefer avoiding the inconvenience of traveling to a branch and enduring waiting times. Additionally, customers can engage with their product managers and account managers, obtaining services without the necessity for face-to-face interactions. The significant growth in mobile and internet banking, initiated during the COVID-19 pandemic and further accelerated by the fuel crisis, continues to gain momentum.

It is heartening to have introduced DFCC Pinnacle Junior as an extension of the Pinnacle proposition, specifically crafted for the younger members of the Pinnacle family. This initiative is designed to offer customised solutions for juniors, cultivating a culture of savings through Annuity products and special interest-based Savings accounts. Simultaneously, it supports their educational pursuits and extracurricular activities, including internships to guide them along their career path.

The objective is to enrich their knowledge, nurture future aspirations, foster the development of their creativity and skills, and promote networking skills among members. This initiative superficially aligns them to meet the challenges of the future by encouraging their participation in various educational forums.

Recognising the requirements of IT freelancers, we have expanded our support, allowing them the flexibility to categorise various income streams from multiple job providers as net income. We offer solution-oriented propositions and benefits, consolidating all services on a unified platform for their convenience.

Acknowledging that their primary income is not fixed from a single corporate or business entity, we appreciate and value the diverse skills and professional expertise of IT freelancers. Our approach is tailored to acknowledge and support the unique income structure associated with their diverse projects and clients.

DFCC’s mobile banking service, M-Teller, has achieved considerable success. This doorstep banking service is operated by Bank staff who accept cash deposits through a mobile device.

Performance of Savings Portfolio and Enhancements During the Year

We have exceeded the budgeted growth for our Fixed Deposits and CASA, achieving remarkable expansion. Moreover, DFCC Investment Planner, DFCC Aloka, DFCC Junior, and DFCC Xtreme Saver accounts have demonstrated extraordinary growth in the past year, surpassing a growth of LKR 40 Bn.

Savings Annuity product has exceeded anticipated growth, demonstrating substantial expansion. The Aloka community has experienced a notable surge, primarily fuelled by active participation from a considerable number of savers. This has led to a cumulative contribution that surpasses expectations, resulting in remarkable growth in savings. To adapt to market trends, adjustments have been implemented to better align with evolving preferences and demands.

Differentiating Liability Products from Competitive Offerings

Distinctive liability products are vital for DFCC Bank to stand out amidst competition. This differentiation attracts and retains customers but also enhances the Bank’s market positioning, in addition to staking its claim on profitable market niches. By offering unique features, tailored services, and competitive advantages, DFCC ensures its liability products meet diverse customer needs, fostering loyalty and sustaining a competitive edge. This strategic differentiation reinforces the Bank’s commitment to providing innovative and valuable financial solutions in a crowded market.

DFCC Bank carries out a diligent and comprehensive study of the market and assesses customers’ lifestyle commitments and needs, including latent, unmet needs. To ease the financial burden of customers, we offer flexible plans customised to individual affordability. Our approach involves addressing specific challenges and integrating valuable customer feedback to deliver personalised solutions. These not only cater to their needs but also yield significant financial advantages.

Going beyond traditional offerings, DFCC Bank provides holistic solutions, encompassing innovative payment choices and interest-free card instalment plans. These initiatives are crafted to enhance the ease of financial commitments, presenting customers with convenient and budget-friendly alternatives for managing their expenses.

Managing Risks Associated with Liabilities Products

DFCC Bank judiciously manages risks associated with liability products in order to safeguard the Bank’s financial stability, preserve customer trust, and ensure regulatory compliance. Effective risk management enhances the reliability of liability products, promoting sustained growth and reinforcing the Bank’s commitment to providing secure and dependable financial solutions. This approach safeguards both the Bank and its customers, fostering a resilient banking environment and sustaining long-term relationships.

The Bank launched an investment scheme involving a monthly commitment to aid customers in fulfilling their future obligations, available in both LKR and FCY. Customers were given the option of an annuity scheme, allowing them to select a monthly affordable instalment in either LKR or FCY, especially during periods of high deposit rates. For tenors exceeding 10 years, the Bank set fixed rates to support customers in their future aspirations and commitments. This offering extended to foreign currency, encouraging those with income in FCY to retain their funds in that currency, thereby supporting investment gains.

Additionally, the Bank introduced an attractive fixed deposit opportunity, providing a competitive 30% interest rate for a 5-year investment period. This initiative was designed to assist customers in meeting their commitments over the specified time frame. Importantly, customers were granted.

Branch Network

DFCC Bank’s branch network is vital for its continuing growth, representing the cornerstone of retail banking and managing a significant portion of the product portfolio. This extensive network not only ensures essential access to financial services to customers in the farthest corners of the country, but also fosters personalised interactions, contributing significantly to profit levels. It plays a pivotal role in serving diverse client segments across the country, reinforcing the Bank’s commitment to delivering accessible and tailored financial solutions to a wide range of customers, especially those belonging to marginalised and vulnerable sections. Branches also play a crucial role in improving the financial literacy of a cross-section of customers, and bringing the unbanked into the fold of the formal financial sector, and helping them escape the clutches of the informal sector.

While expansion of the branch network was put on hold last year due to strategic reasons, improvements were made at the Maharagama and Borella branches to enhance service quality for our customers. Two off-site self-banking units were installed at Havelock City Mall and Ruhunu Hospitals in 2023. The Colombo region remains a key contributor to the overall business growth of the branch network.

To enhance the customer experience in branches, the Customer Experience Unit was established to centrally monitor and address customer inquiries and complaints, ensuring consistency. The mystery caller programme was implemented across the branch network to ensure uniformity in responding to customer calls. The complaint management system was extended to all branch staff to handle customer inquiries and complaints within a defined service level agreement, maintaining consistent response timelines. Periodic utilisation of service-related research tools like NPS, NES, and CSAT helps assess our service standards, enabling necessary training to address identified gaps and provide a standardised offering across the branch network. Monitoring the service levels of critical functions is ongoing to enhance processes and offerings, and periodic service refresher training is conducted for frontline staff to uphold the established standards.

Branch performance is assessed against Key Performance Criteria, determined by the business potential of each branch. Anticipating the relocation or closure of branches/units with low business potential, alternative modes will be established to continue serving the existing customer base. Amendments to the network operations structure are planned for 2024 to enhance operational efficiency, service levels, and reinforce operational risk control aspects.

The branch network serves as the primary catalyst for retail banking business, including credit cards and SME business. It oversees over 70% of the Bank’s product portfolio, making a substantial contribution to profit levels. The branch network ensures access to the Bank’s financial services for diverse client segments across various regions of the country.

Multichannel Customer Touchpoints

To boost customer engagement, we have used multiple channels, including digital channels, to implement data-driven approaches and conduct targeted marketing campaigns. Analysing the resultant data enables us to tailor messages effectively to specific audiences, enhancing personalisation and engagement. Our communication methods include emails, SMS, in-app messaging, and outbound calls. Additionally, we have ensured that our branch network information is updated on “Google MyBusiness”, enabling customers to easily access relevant details through Google Search and Maps.

The following features were implemented in our digital platforms in order to improve customer engagement and usage.

| Channel | Feature Introduced and Promotions |

| Online Banking |

|

| Virtual Wallet (Hybrid mobile app) |

|

| DFCC MySpace |

|

| DFCC Website |

|

| DFCC Galaxy |

|

| DFCC Chatz |

|

| SMS Alerts |

|

| eStatements |

|

| MTeller |

|

As of 31 December 2023, a significant shift towards digital transactions was observed, with a notable 86% of total transactions occurring through digital channels, surpassing traditional branch counter transactions.

The following table outlines the increase in user adoption for DFCC Online Banking and Virtual Wallet when compared to the figures recorded in the year 2022.

The following information outlines the improvement in product performance for DFCC Online Banking and Virtual Wallet, as compared to the data from the year 2022.

Security Measures to Safeguard Data at Customer Touchpoints

DFCC Bank has enforced stringent security measures to safeguard customer information across digital touchpoints. These measures encompass robust encryption technologies, two-factor authentication systems, and regular security audits. Real-time monitoring and advanced intrusion detection systems enhance these defences. The Bank also promotes customer involvement in security through awareness campaigns and SMS alerts, emphasising its commitment to secure digital banking. To heighten awareness, DFCC conducts email and SMS campaigns targeting active banking customers and hosts an informative blog on its website, providing additional resources for customers to secure their online transactions.

Contribution of Multi-channel Approach to Customer Satisfaction

DFCC Bank has revolutionised customer experience by seamlessly integrating multi-channel touchpoints, delivering unparalleled convenience and extensive accessibility. Through Online Banking, Virtual Wallet, and ATM/CRM services, customers enjoy 24/7 access, streamlining financial management. The interactive DFCC Chatz chatbot further enhances the customer experience with 24/7 availability, trilingual support, and instant answers to queries. Customers also have the option to engage with a live agent. DFCC’s strategic improvement of digital banking products ensures a consistent, user-centric experience across various platforms. Ongoing feature evolution and the introduction of novel functionalities contribute to heightened customer satisfaction. Importantly, DFCC’s digital transformation strategy builds trust and loyalty, positioning it as a pioneering financial institution responsive to the dynamic needs of its active customers.

Products and Services Responsibility

DFCC Bank consciously ensures responsible and ethical practices in the development and offering of its financial products using, but not limited to, the following means;

- Designing or redesigning products through a structured process as per the Bank’s Product Development/Amendment Policy, in which a comprehensive analysis is performed covering various aspects to ensure product sustainability. The proposed product or new features are required to be properly streamlined qualitatively and quantitatively in collaboration with cross functional teams, for it to be feasible in its application.

- When designing, developing and deploying products, ensuring compliance with all the applicable laws and regulations for licensed commercial banks, including adherence to the guidelines in the Financial Consumer Protection Regulations Act, Prevention of Money Laundering Act, Convention on the Suppression of Terrorist Financing Act, Financial Transactions Reporting Act, the Financial Institutions (Customer Due Diligence) Rules etc., of the Central Bank of Sri Lanka (CBSL).

- When carrying out product promotions, ensuring that the promotional material and customer communications comply with the applicable regulatory requirements and the guidelines for the protection of customer rights as per the Customer Charter for Licensed Commercial Banks.

- Clear communication and explaining in detail to clients, the information on key features and functionalities of a product, interest rate, fees and charges, terms and conditions by credit staff and customer contact centre staff, in the language preferred by the client. Training is carried out to equip the staff with such competence. Trilingual information is also available in the Bank website and client documentation is available in either of the three languages upon request.

- As one of the 18 signatories to the 11 Sustainable Banking Principles launched by the Sri Lanka Bank’s Association (SLBA), DFCC Bank adheres to the principles.

- Considering the exposure to Environmental & Social (E&S) risks of its clients, in 2016 the Bank developed an Environmental & Social Management System (ESMS) for its lending activities.

- As an Accredited Entity of the Green Climate Fund (GCF), the Bank is committed to follow the International Finance Corporation (IFC) Performance Standards and maintain internal operations to accomplish GCF evaluation standards.

- DFCC Bank has maintains an “Exclusion List”– a list of prohibited activities which will not be considered for financing by the Bank.

- Disclosure of associated impacts generated from the business and material topics most relevant to the Bank and its stakeholders according to the Global Reporting Initiative (GRI) framework as well as information on stakeholder value creation through business activities.

- Disclosing the verified GHG emission of the Bank (Direct Emissions (Scope 1), Indirect Emissions (Scope 2) and Other Indirect Emissions (Scope 3).

- The Bank has a customer complaints and grievance handling process and there is a channel provided in the Bank’s website. There are also dedicated telephone lines provided for customer service such as the call centre, customer experience, recoveries etc.

- If the client is not satisfied with the response received from the Bank to the concern or complaint made, the client has the option to escalate it to the Financial Consumer Relations Department at the CBSL and to the Financial Ombudsman.

Marketing Communications

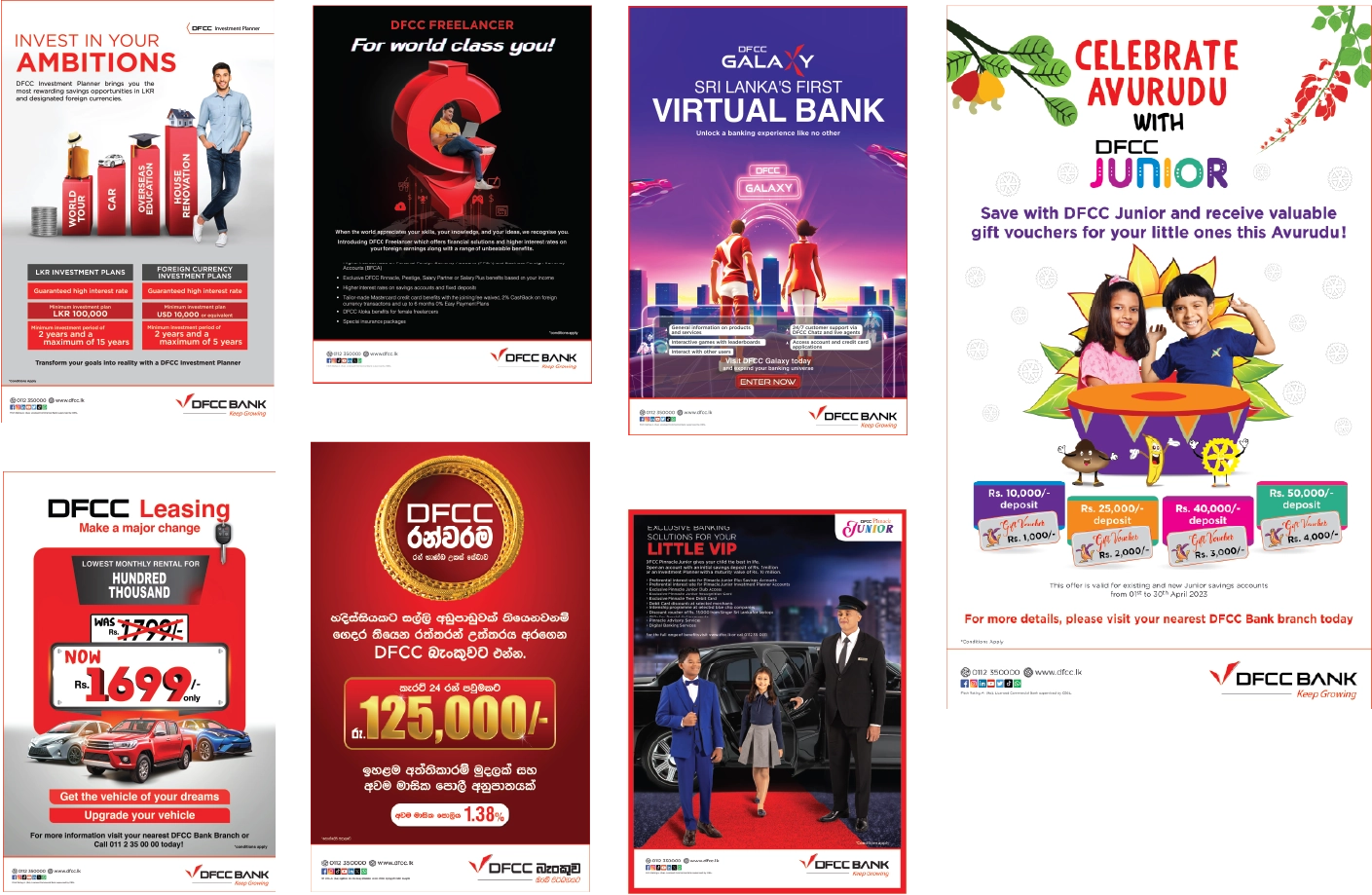

In 2023, DFCC experienced a dynamic period in its marketing and communications strategy, marked by notable advancements in brand equity, social media engagement, and public relations. These achievements unfolded within a fluctuating market environment shaped by socioeconomic shifts and changing consumer behaviours. DFCC remained steadfast in its commitment to innovation, crafting market strategies that resonated with our audience and bolstered confidence in our role as a financial partner. Throughout these endeavours, our focus on generating top-of-mind awareness remained paramount.

Brand Equity

During the past fiscal year, our marketing endeavours were strategically aligned to fortify our brand presence through brand-centric initiatives and innovative communication strategies. We adeptly utilised traditional and digital channels to amplify our reach and engagement.

DFCC Bank strategically fostered brand equity by emphasising its proactive stance towards technological advancements and its dedication to meeting the evolving needs of its digitally savvy customer base. Being digitally first in all its communications and initiatives underscored the Bank’s mission to provide seamless banking experiences by showcasing a commitment to leveraging cutting-edge technology. Through targeted messaging and innovative digital strategies, DFCC Bank positioned itself as a forward-thinking institution that prioritises customer convenience and embraces technological innovation to deliver best-in-class services.

The relaunch of DFCC Junior highlighted the Bank’s unwavering dedication to fostering financial literacy from an early age; by introducing specialised banking solutions tailored for young customers, DFCC reaffirmed its commitment to nurturing a financially savvy generation and positioned itself as a progressive institution that prioritises the future. This initiative demonstrated the Bank’s proactive approach to empowering its clientele and reinforced its reputation as a trusted partner in their financial journey.

DFCC Freelancer addressed the distinctive financial needs of platform-based tech workers, positioning the Bank as a responsive ally to the evolving freelancing economy. By offering tailored banking solutions, DFCC demonstrated its understanding of emerging customer segments and showcased its adaptability to changing market dynamics.

As Sri Lanka’s pioneering virtual bank, DFCC Galaxy spearheaded innovation in banking services and customer experience. This groundbreaking digital platform revolutionised banking by offering customers an immersive metaverse banking experience. By introducing such innovative solutions, DFCC reinforced its reputation as a leader in digital banking offerings, elevating brand equity and positioning itself as a frontrunner in the financial industry’s evolution.

DFCC Pinnacle Junior aims to enhance self-esteem and decision-making power among children and provides them with valuable tools to navigate their financial journeys confidently. Through this initiative, DFCC Bank reaffirms its position as an entity dedicated to nurturing a financially savvy generation. Moreover, by extending many of the privileges Pinnacle customers enjoy to DFCC Pinnacle Juniors, the bank emphasises inclusivity and demonstrates its dedication to providing comprehensive banking solutions tailored to the unique needs of its clientele.

As evidence of the efficacy of DFCC’s brand and communication strategies, the DFCC Brand Rating for 2023 experienced a notable ascent, moving up four positions to attain the 21st position from its previous standing at 25th.

Brand Rating Improved

| DFCC Bank’s Brand Rating | |||

| Position | Rating | Value (Mn) | |

| 2023 | 21 | A- | 5,885 |

| 2022 | 25 | A- | 5,721 |

| 2021 | 27 | A | 5,584 |

| 2020 | 28 | A- | 5,039 |

| 2019 | 25 | A+ | 6,334 |

| 2018 | 27 | A+ | 4,706 |

| 2017 | 39 | A+ | 1,660 |

| 2016 | 38 | A- | 1,684 |

Source – Brand Finance Sri Lanka 100 – 2023

A leap in Digital Marketing on DFCC’s Social Media channels

In addition to our brand equity initiatives, DFCC Bank took significant steps forward in social media engagement in 2023 and recorded significant achievements. Our strategic focus on digital channels, and content that resonates with customers and targeted campaigns, contributed to enhanced brand visibility and increased customer interaction across various platforms. Key social media achievements included:

| YouTube | TikTok | ||||

| Followers | 189,605 | 11,854 | 56,641 | 3,502 | 1,424 |

| Impressions/ Video Views | 62.1 (million) | 5.9 million | 912,267 | 306,000 | 53,936 |

| Reach | 52.7 million | 4.7 million | 362,847 |

Source: Fanpage Karma link to https://www.fanpagekarma.com/

Driving Brand Awareness Through PR:

DFCC Bank’s public relations efforts in 2023 also resulted in significant recognition and impact. Our strategic initiatives and proactive engagement with media outlets resulted in significant achievements.

DFCC Bank strategised its public relations with forward-looking approaches to building and maintaining positive relationships with the media and stakeholders. This earned the Bank dividends by securing fourth place in the public relations ranking within the banking sector. These achievements underscore DFCC’s commitment to driving brand equity and positive public perception through strategic marketing initiatives (including intensive use of social media) and proactive public relations efforts. As we continue to innovate and evolve, we remain dedicated to delivering unparalleled value to our customers and stakeholders, solidifying DFCC’s position as a leader in the banking industry.

The marketing and communications initiatives undertaken have made a substantial contribution, acquiring six out of the seventeen awards earned by the Bank.

Key Marketing Campaigns implemented during 2023