The DFCC Group consists of DFCC Bank PLC and its subsidiaries; DFCC Consulting (Pvt) Limited, Lanka Industrial Estates Limited (LINDEL), Synapsys Limited, its joint venture company Acuity Partners (Pvt) Limited (Acuity) and its associate company National Asset Management Limited (NAMAL). LINDEL is a 31 March reporting entity whilst the others are 31 December reporting entities. For the purpose of consolidated financials, 12 months results from 1 January to 31 December 2019 were accounted for in all Group entities. Financials of the 31 March entity was subject to a review by its External Auditor covering the period reported.

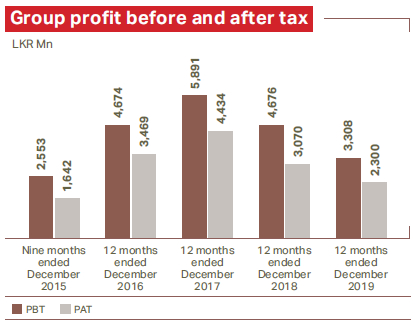

The Group made a profit after tax of LKR 2,300 Mn during the year ended 31 December 2019. This is compared to LKR 3,070 Mn made in the year 2018. DFCC Bank accounted for majority of the Group profit with profit after tax of LKR 2,074 Mn while LINDEL (LKR 177.6 Mn), Acuity (LKR 190 Mn), Synapsys (LKR 35.7Mn) and DFCC Consulting (LKR 11.6 Mn) contributed positively by way of profit after tax to the Group. In the previous year, Acuity, DFCC Consulting and LINDEL reported profit after tax of LKR 304.7 Mn, LKR 24.8 Mn and LKR 121.2 Mn respectively. Synapsys reported a profit of LKR 9.5 Mn. The associate company, NAMAL contributed LKR 1.3 Mn to the Group down from LKR 2.4 Mn in the year 2018. An Inter-company dividend of LKR 152.4 Mn was paid to DFCC Bank by LINDEL (LKR 73.9 Mn), DFCC Consulting (LKR 3 Mn) and Acuity (LKR 75.5 Mn) during the year.

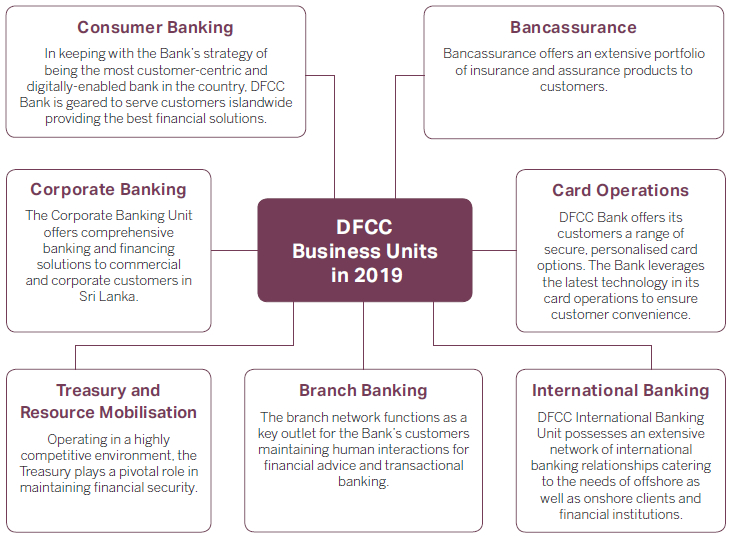

Consumer Banking

Retail banking

DFCC Bank is Sri Lanka’s retail financial supermarket and offers a comprehensive range of financial solutions to its retail customers specially designed to meet individual requirements. These flexible financial solutions include personal loans, overdrafts, housing loans, vehicle loans, leasing, pensioner’s loans, and education loans. A host of attractive deposit products are also available catering to individuals across target segments. Within the corporate structure, retail banking is divided into two separate units for assets and liabilities.

Assets

Housing

Housing loans form an integral part of DFCC’s retail lending portfolio and consumer banking offering. They are offered to executives, professionals, private and public sector employees, and entrepreneurs who look for financing for their new home. The unique selling proposition of DFCC’s housing loans is its attractive interest rates and superior service.

Performance in 2019

The housing loans portfolio witnessed a growth of 47% in 2019. The Bank carried out marketing campaigns and effected partnerships with leading property developers and institutions to reach a wide audience. The housing loan processes were streamlined to ensure quick turnaround times to provide an unmatchable service to customers.

The Bank capitalised on the increasing demand for condominium apartments to achieve desired growth targets. Customers were educated on the benefits offered by the Bank through forums organised in collaboration with property developers. Special housing loan packages with grace periods, flexible payment terms and benefits on early settlements, etc. were introduced to customers when purchasing condominium units.

The Bank also organised inter-branch competitions to boost the morale of staff to encourage them to enlist housing loan clients to DFCC.

Outlook

In keeping with the bank-wide strategy of being the most customer-centric and digitally enabled bank in the country, DFCC Bank is geared to serve customers island-wide, providing the best financial solutions when purchasing their homes. With digitisation in the fore-front, the Bank looks forward to developing many innovative home loan offerings to assist customers with varied needs.

Customers will also be provided service at their door-step with strict service level agreements with other internal departments providing seamless and a stress-free service to the customers.

Leasing

DFCC Bank continues to provide leasing solutions for both SMEs and individuals. Leasing is the strong hand of consumer assets at DFCC Bank and amounts to the largest portfolio among the consumer asset products.

Performance in 2019

Despite the challenging economic conditions, 2019 was an exceptional year for leasing where the bank successfully grew the leasing portfolio by 117%.

The Bank also entered into strategic partnerships with leading brands throughout the year with a focus on the category of commercial vehicles.

The leasing segment also focused on the fixed income and professional market segments with special offerings in terms of interest rates, extended tenures, as well as structured repayment plans. The inter-branch competition held during the second half of the year to boost the leasing portfolio was a major success, contributing largely to the growth of the portfolio.

Outlook

In 2019, the Bank used a two-pronged strategy to market the leasing product. The first being the extended branch network and the “fleet-on-street”. The branch employees and the sales team are geared to provide a superior service to customers which will strengthen the leasing portfolio in 2020.

Personal loans

Performance in 2019

In 2019, the personal loans portfolio witnessed a growth of 83% in comparison to 37% in 2018. The unit successfully optimised market segmentation and employed a strategy of identifying and providing true value to respective segments with tailor-made and flexible solutions. The solutions were structured to cater to the lower-middle income, middle income, and higher income brackets of employees in the Government and private sectors as well as self-employed professionals.

The vehicle loan for permit holders, the education loan, and the pensioner’s loan were launched in 2019. These introductions resulted in expanding the Bank’s market presence. The DFCC personal loan and the Speed loan were revamped to improve the overall process.

Partnerships with professional associations and reputed corporates during the year have ensured that the Bank explore new markets effectively. Spot promotions were conducted at strategic locations including major hospitals to take Bank’s services directly to the customers.

The digitised work-flow implementation was carried out in 2019 which led to the improvement of customer experience and service delivery.

Outlook

DFCC Bank looks forward to expand the Bank’s personal loan offering to match the varied needs and wants of our clientele. Multiple value additions will be done to the Personal Loan preposition including benefits on the DFCC Credit Cards, Service at the customers’ door step and many more. Measures are being implemented to provide an improved digital experience through web-based applications in the personal loans segment in 2020.

Gold-pledged lending

Performance in 2019

Pawning business recorded a remarkable growth of 43% in 2019. This commendable achievement was a result of extensive promotional campaigns with attractive rewards for customers pawning with DFCC. One such successful campaign was conducted in the Northern Region which

was well-received by the target segments.

Outlook

DFCC Ranwarama is now a leading competitor in the pawning industry of the country and the Bank has a clear strategy to further develop the product in 2020.

Liabilities and Trade Business

The Liabilities and Trade Business Development Unit is responsible for driving the growth of deposits and trade business across the Bank. The Unit develops and implements strategies and key initiatives to achieve set goals by closely working with the branch network and the sales team. The Unit also managed to engage all staff of the Bank including back office and department staff for deposit mobilisation activities which produced very positive results.

Liabilities

Performance in 2019

Key business initiatives were planned and implemented throughout the year to increase deposit mobilisation. Many campaigns were carried out with the inputs and engagement of all relevant stakeholders to promote DFCC Bank as a preferred bank for deposits. Special activities were carried out to coincide with World Children’s Day, World Elders Day and National Pensioners Day where the DFCC Junior Savings Account and Garusaru Senior Citizens Account were successfully promoted.

Growth of over 17% was achieved in overall branch banking liabilities as at 31 December 2019 when compared to 31 December 2018. Overall branch banking liabilities grew to LKR 126,876.5 Mn as at 31 December 2019 from LKR 108,315.3 Mn as at 31 December 2018. Special focus was given to CASA mobilisation. Further, in 2019, there was a significant growth in DFCC Junior accounts and the DFCC Winner account was also launched.

Outlook

Existing product propositions will be revamped to be in line with changing customer needs and new product propositions will be rolled out targeting untapped customer segments. Products will be bundled and offered to customers catering to multiple requirements.Me coniam

Trade business

Performance in 2019

A growth of over 19% was achieved in branch banking import limits during the year, while export limits recorded a negative growth of 5% in 2019 due to scaling down of limits by a few export clients. Utilisation remained at high levels due to close follow-up and monitoring. Trade facilities are structured by understanding customer needs and relationships of newly onboarded trade clients are managed carefully by branches and head office. Certain sectors were identified and high focus business initiatives were implemented after carrying out detailed analysis.

A drop was experienced in Branch Banking trade income compared to 2018 mainly due to unfavourable macroeconomic conditions. A special proposition was developed and rolled out targeting vehicle permit-holders. As a result, a number of permit LC’s were opened with DFCC Bank. Moreover, partnerships with leading vehicle importers were effected during the year.

Outlook

It is planned to engage key trade client segments by offering customised propositions to suit their business models and requirements. Partnerships will be formed with various trade forums to extend innovative financial solutions and superior service to their members.

Corporate banking

The Corporate Banking Unit offers comprehensive banking and financing solutions to commercial and corporate customers in Sri Lanka. The Unit operates under a two-tiered platform in which our dedicated team of relationship managers focus on large corporates as well as offer business banking propositions to medium-sized corporate clients. The Corporate Banking proposition includes financing business assets, multipurpose loans for mergers, acquisitions, cross border financing arrangements and transaction services across multiple sectors. The offshore lending portfolio continued to improve in the Maldives and East Africa in 2019.

Performance 2019

In 2019, the Corporate Banking Unit, along with other business lines of DFCC, was affected by challenges arising from the operating environment. The constitutional crisis in October 2018 and the Easter Sunday terror attack in Sri Lanka which had wider socio-political implications had profound effects across the economy. Further, external shocks from the US-China trade wars, continuing turmoil in the Middle East, depressed markets across Europe, and Russia weighed in heavily on Sri Lankan exporters.

Despite these challenges, Corporate Banking remained resilient and performed commendably. During first half of the year, decline in the asset book due to the settlement of a large offshore loan and the slowdown in demand for loans and advances were offset by a strong performance in the second half of 2019. Business managed to record a YoY asset growth of 6% for 2019.

Through the proactive management of distress loans, early restructuring, close monitoring, and implementation of a robust repayment framework, Non-Performing Advances (NPA) ratio recorded at 2.46% for the combined unit which was in 2018 recorded separately for Corporate Banking and Business Banking.

Non-Funded Income (NFI) recorded an increase of 16% from the previous year and remains a key focus area in line with overall business growth strategy of the Bank.

Strategic decisions were made to re-calibrate the deposit portfolio and reduce the concentration risk with focus on building a diverse and better balanced portfolio. The Corporate Banking overall deposit recorded a growth of 14% in 2019. The business unit continued to make noteworthy contributions to the Bank’s CASA base with the acquisition of several high volume CASA clients during 2019. Corporate banking CASA recorded a growth of 5% in 2019.

DFCC entered into a key transaction during the second half of the year with one of the oldest and most-established corporate entities in the Maldives through a Dual Tranche Bi-lateral Facility. This landmark transaction was the single largest bi-lateral deal arranged by DFCC. The new term loan was structured by DFCC to refinance the existing term borrowings and meet key capital investments. The Bank approved a further credit line for a new 353 key hotel project in Maldives, which is expected to be disbursed in 2020.

DFCC Bank’s state-of-the-art payment and cash management system, DFCC iConnect, recorded a growth in digital client base by threefold 289% in 2019. During the past year, DFCC iConnect has evolved into an important strategic tool for DFCC Bank to increase wallet share in the corporate sector and to achieve the Bank’s medium-term goal of becoming the best customer-centric and digitally-enabled financial service provider in the country.

Outlook

The business will continue to leverage on the strong balance sheet and commercial banking portfolio built over the years. The growth strategy will focus on business, risk, and people. Focus will be on net interest margins despite intense competition, increase the Net Fee Income, maintain low NPA, and maximise Return On Assets.

Potential growth areas include refinancing, recurring capital expenditure, and multipurpose loans. The business will target to deepen existing relationships and increase wallet share and seek reciprocity to become an important task on all mandates, especially with key State-Owned Enterprises (SOEs) given increased opportunities in Government of Sri Lanka-led infrastructure projects with the re-establishment of a strong pipeline following the political instability since October 2018. The business will aggressively pursue the international corridor connectivity to win more event-driven business in terms of capital raising and acquisition opportunities. The China-led BRI proposition, the South Asia and South East Asia corridors will remain a key focus areas for the business.

With an experienced team of dedicated relationship managers, DFCC Corporate Banking remains geared to provide tailored financial solutions to meet the needs of its local and global clients. With the DFCC iConnect platform and a host of other technology driven solutions, DFCC Corporate Banking is now well positioned to cater to the emerging demand for technology driven financial solutions with emphasis on customer-centricity and world-class service.

Treasury

The Treasury functions of the Bank are assigned to

three independent departments namely Treasury Front Office (TFO), Treasury Middle Office (TMO), and Treasury Back Office (TBO). The TFO is the business unit which interfaces with customers. The department generates income through investment and trading in Fixed Income Securities, Foreign Exchange and Money Markets, as well as exchange and interest income from customer-related transactions. The TFO reports directly to the Head of Treasury (HoT). The TMO is engaged in risk monitoring and reporting of TFO activities based on Board-approved limits, controls and regulatory guidelines. The TMO independently reports to the Chief Risk Officer (CRO). The TBO prepares, verifies, authorises and settles all transactions executed by the TFO. The TBO independently reports to the Head of Finance/Chief Financial Officer (CFO).

Performance in 2019

The challenges the country witnessed in 2018 continued to have an impact in 2019. The action taken by the regulator at the latter part of 2018 included measures to curtail imports of motor vehicles and non-essential consumer goods as well as increasing the margin requirements for imports done on Documents against Acceptance (DA) terms.

In this backdrop, the market witnessed liquidity levels at extreme negative territory with a record low of LKR 139,000 Mn in mid-January 2019. This triggered further corrective measures by the Central Bank of Sri Lanka (CBSL) in March 2019. This included reducing of the statutory reserve requirement (SRR) of licensed commercial banks from 6% to 5%. This 1% reduction resulted in a release of approximately LKR 50,000 Mn to LKR 60,000 Mn of liquidity to the market.

The above measures eventually improved the liquidity and inflation outlook. However due to lackluster private sector credit growth of 11.30% YoY in the first quarter of 2019, the CBSL revoked the import restrictions imposed in late 2018.

Easter Sunday terror attacks had a profound impact on the economy, primarily affecting the tourism sector. This also led to the out-flight of funds from both Equity and Government Securities markets. Long-term investments by the private sector were put on hold and private sector credit growth dipped below the level seen in 2018.

In this backdrop, the CBSL took immediate steps to stimulate the economy by imposing deposit caps on licensed commercial banks to promote lower lending rates and granting a moratorium to individuals and entities engaged in tourism and related industries. Further the CBSL reduced the key policy rates in May and August 2019 by 0.5% each to lower interest rates and encourage private sector borrowing. These measures resulted in the general lending rates in the market reducing, however as the transmission was taking longer than expected, in September 2019 the CBSL rescinded the deposit caps imposed and implemented lending rate guidelines to reduce interest rates within a specific time period.

The yields on Government Securities reacted during the year to the CBSL measures to stimulate the economy. The one year Treasury Bill rate reduced approximately 2.75% from year beginning level of 11.20% to end the year at 8.45%.

Compared to the significant rupee depreciation against the US Dollar witnessed in 2018, the rupee was relatively stable in 2019 on the back of lower demand for dollars as a result of the economic conditions mentioned above. The rupee strengthened to a high of 173.90 against the US dollar in April and gradually depreciated to the year ending level of 181.30 which is a year on year appreciation of 0.7%. Worker remittances, a successful issuance of an international sovereign bond and the IMF extended fund facility played a key role in the appreciation of the Rupee during the year.

During this challenging year DFCC Treasury managed to contribute significantly to the Bank’s bottom line through active trading in foreign exchange and fixed income securities. Although foreign exchange related transactions suffered a considerable drop in volumes compared to the previous year due to the challenges described above, DFCC Treasury was still able to make a positive contribution to the bottom line compared to the previous year.

Outlook

The Treasury Unit looks forward to more conducive market conditions that will help generate more opportunities through trading and investments in the year 2020.

Resource Mobilisation Unit

The Resource Mobilisation Unit falls under the direct purview of the Head of Treasury. Managing of all term funding of the Bank, inter alia, credit lines, syndicated loans and local and international debt issuances are done by Resource Mobilisation Unit. The Unit coordinates with Rating Agencies in their reviews of the Bank’s National and International Rating and works to secure ratings for debt issuances. The Unit also manages the Bank’s equity portfolios related to strategic and non-strategic investments, Unit Trust and underwriting activities.

Building upon the relationships the Bank has established over time, the Resource Mobilisation Unit actively engages with partner institutions to secure potential funding lines to support the Bank’s budgeted growth.

During the year under review, the Unit raised over LKR 22,000 Mn in medium to long term funds. These included local and external bi-lateral loans as well as listed senior debt. The Unit continues to engage with local and multinational partners to support the Bank’s balance sheet objectives.

Outlook

The Resource Mobilisation Unit believes that the recent country outlook revision (stable to negative) by rating agencies would not affect the external funding pipeline of the Bank.

DFCC Bank’s equity investment portfolio

As per the IFRS 9 guidelines, the equity portfolio is broadly divided into two categories. They are, investments measured at fair value through profit and loss (FVTPL) and fair value through other comprehensive income (FVOCI)

As at 31 December 2019, the combined cost of investments in DFCC Bank’s holdings of quoted shares [excluding the investment in the voting shares of Commercial Bank of Ceylon (CBC) PLC], unquoted shares and unit holdings amounted to LKR 1,744.23 Mn and corresponding fair value of the same portfolio stood at LKR 1,952.21 Mn.

Equity portfolio as at 31 December 2019

|

Cost* LKR Mn |

Fair value LKR Mn |

|||

|

Quoted share portfolio – FVTOCI (excluding CBC) |

987.55 | 969.46 | ||

| Quoted share portfolio – FVTPL** | 233.18 | 252.76 | ||

| Unit Trust portfolio** | 516.20 | 529.64 | ||

| Unquoted share portfolio | 7.30 | 200.35 | ||

| Total | 1,744,23 | 1,952.21 |

* Net of provision

** Cost reflects the original investment cost

The part of quoted share portfolio and unquoted share portfolio mentioned in the above table is carried at fair value through Other Comprehensive Income on the Statement of Financial Position while Unit Trust portfolio and part of the quoted portfolio have been categorised under fair value through Profit and Loss.

During the period under review, the Bank divested a part of its mature stocks in quoted shares, and Unit Trust investments, thus realising a capital gain of LKR 111.60 Mn. Further, the bank recorded unrealised

capital gains of LKR 19.58 Mn to the profit and loss statement through the portfolio categorised under FVTPL. Bank also made new investments in quoted shares to the value of LKR 318.74 Mn and LKR 1Mn in mandatory unquoted investment.

At the end of the financial year, corresponding fair value of the investment in CBC categorised under fair value through profit and loss (FVTPL) was LKR 4,524.66 Mn, while the investments categorised under fair value through OCI stood at LKR 7,843.23 Mn, against cost of LKR 3,348.62 Mn.

Further, the bank divested part of CBC shares of trading (FVTPL) category and realised LKR 5.57 Mn. Due to market value deterioration, net unrealised loss of LKR 939.19 Mn was charged to profit and loss account of the Bank.

Outlook

With the external factors expected to improve, equity market performance would support additional income generation through trading activities.

Branch banking

The branch network functions as a key outlet for

the Bank’s customers as it plays a vital role in maintaining human interactions for financial advice and transactional banking. DFCC’s physical presence continues to expand with an island-wide reach while the Bank grows its different customer segments which include the retail, SME, and MSME categories.

Performance in 2019

Branch Banking recorded a growth of 11% in loans and advances while consumer segment recorded 24% during 2019. Deposits grew by 17% in 2019 with a CASA ratio of 22% in the same period. The branch network was able to control credit quality and maintain a durable credit portfolio due to active monitoring and recoveries amidst challenging economic conditions of 2019. The Bank continued to grow its physical footprint, adding a super-grade branch at Colombo Fort and converting 27 postal units into branches in 2019.

Outlook

Branch Banking will renew its focus to cater to and capture customer segments of young professionals, the affluent middle class, and high-income earners in 2020 through new products, value-added services,

and campaigns.

Customer preference and needs will be prioritised with new deployments of My Space areas, cash recycle machines, ticketing systems, and potential locations for branches, and other physical infrastructure. The Bank will also invest in digital infrastructure to transform customer service propositions.

Premier banking

The DFCC Premier Banking Unit was established in 2012 which provides an exclusive service offering to affluent customers maintaining deposits of over LKR 10 Mn. The dedicated team of professionals at the Unit provides

a seamless, personalised banking experience to the Premier customers.

Performance in 2019

In 2019, the Unit recorded an increase of 17% of the client base and a growth of 19% of deposits and 52% of advances. To enable our clients to experience Premier Banking at their convenience, 12 new relationship officers were recruited within the year and deployed to key locations within the country.

DFCC Premier Banking Unit continued to provide their clients with delightful opportunities to witness acclaimed signature events. In 2019, DFCC Premier Clients were hosted at notable events such as the Galle Literary Festival, DFCC Bank Cup for 2019 New Zealand – Tour of Sri Lanka, Indonesian ENAK dinner at Flow at Hilton Colombo Residencies, and breakfast meetings and evening cocktails with property developers to enable our clients who wish to acquire property for investment or residential purposes.

Outlook

An exciting year awaits for DFCC Premier Banking with the relaunching of its value proposition with added features, benefits, and privileges, and relocating the DFCC Premier Centre, thereby enabling customers to carry out, build, and enhance their financial portfolios at ease experiencing an unparalleled service.

SME’s and MSME’s

With DFCC Bank’s roots as a specialised development bank, being a growth partner in catalysing outcomes for businesses of all sizes is a natural aspect among the Bank’s focus areas. The Bank recognises that today’s SME could be the big business of tomorrow and plays the part of financier and growth partner to help support their sustenance and expansion.

In line with the Bank’s strategy to foster financial inclusion, the MSME Division was established in 2016. Through this arm, the Bank supports small entrepreneurs and self-employed citizens to operate and grow their businesses from ground up.

Performance in 2019

In 2019, LKR 3,694 Mn of concessionary loans were extended under SMELoC, Saubhagya, Jaya Isuru, and Ran Aswenna, Rooftop Solar Power Generation Line of Credit (RSPGLOC) schemes.

“Vyapara Sahaya”, a series seminar for entrepreneurs was launched in October, 2019. The first seminar was conducted by a renowned business consultant addressing nearly 60 entrepreneurs from Colombo suburbs.

While serving the MSME segment DFCC Bank utilises production chains in farming, dairy, fruits, and vegetables as well as in estate crops like tea to connect with small-holders and micro-scale farmers. 2,100 new customers were served by the MSME Unit in 2019.

During the year, the MSME Unit organised 18 Sahaya Hamuwa programmes conducted by senior personnel from the Central Bank of Sri Lanka throughout the island. This programme helps many stakeholders in the economy as it intends to raise literacy and capacity levels among MSME’s in financial awareness and financial management.

Outlook

DFCC will continue to build its SME and MSME clientele by identifying potential customers in growth sectors, cultivate relationships, and spread insight through seminars and workshops. DFCC Bank has developed new MSME loan schemes to tap into budding entrepreneurs who are skilled and have expertise in their respective fields.

The Bank will take a streamlined approach to serving and nurturing SME and MSME clients by facilitating outreach into our service regions by leveraging our island-wide branch network and dedicated teams.

International banking

Performance in 2019

In 2019, the business volumes handled by the Unit consists of Letters of Credit (LC), import bills (DA/DP) amounted to LKR 73.4 Bn recording moderate growth of 47% compared to 2018. However, export bills volume handled during the year increased to LKR 7.9 Bn an increase of 31.6% compared to year 2018.

In 2019, remittances volume continued to grow recording a total turnover of LKR 226 Bn for the year 2019, an increase of 10% compared to 2018. This volume increase has contributed towards the growth of fee and commission income related to remittances during the year; compared to 2018.

The Trade Services and Remittance Unit was relocated to the newly refurbished Lake House Building in the heart of Colombo. The new location’s close vicinity to Colombo Fort and Sri Lanka Customs has made collection of documents from the bank much more convenient thus making consignment clearance process faster. Further, spacious, state-of-the-art premises ensures that all the divisions of the Unit operate in a coherent and organised environment leading to improved efficiency.

During the year, measures were taken to conduct training programmes to branch staff with a view of improving their knowledge on this specialised field. The employees of the Unit also participated in various forums organised for trade customers.

During the year, DFCC Bank Trade and Remittance Department won “USD Straight through Processing Excellence Award 2018” from HSBC USA. This was in recognition of handling USD payments via HSBC New York enabling HSBC to process payments straight through.

Outlook

Continued improvements to its internal processes and digitisation initiatives have led to greater heights in customer service. The team of dedicated professionals at the Unit continues to exceed customer expectations in this competitive environment.

Card operations

DFCC Bank continued to invest in the card business with the introduction of the chip-enabled debit cards with pay wave technology and consolidated the number of products to two, namely Classic and a new Platinum card for the affluent base.

The Bank was first in the market to be certified for Visa Quick Response (QR) and developed a common Mobile app called “DFCC Pay” to support the processing of QR payments. Subsequently, the Bank received certification for Just Pay and Lanka QR to support the national digital transaction initiative. The Bank enabled JCB card ATM acquiring during the latter part of the year again to support the national digital transaction initiative.

Another first from DFCC Bank was the introduction of the interactive credit card e-statement which provides the customer in depth insight into spending patterns whilst also enabling the cardholders to convert transactions into flexi-plans and look up promotions at the click of a button.

Further, credit cards were enabled with the facility of transacting on the internet securely through a verification of the transaction via a onetime password thereby offering more security and convenience to cardholder’s online shopping experience.

DFCC Bank cardholders were able to enjoy some of the highest discount offers throughout the year at popular merchant locations ranging from supermarkets, clothing outlets, restaurants, electronics and household items, e-commerce sites, and hotels. A special campaign was launched in the month of April, “10 Times Cash-Back rewards” for credit cardholders.

During December season, DFCC Credit and Debit Card offers were promoted under theme “Load all your gifts on your DFCC Card this season” and up to 50% discounts were given at partner merchant outlets.

The cards business grew at a rapid pace during the year. There were 18,230 new credit cards issued compared to the 7,515 total cards in force at the end of year 2018. The cardholders spending bypassed LKR 3 Bn for the year which confirms that the DFCC credit card is resonating in the customers’ minds. This resulted in the cards portfolio balance growing from LKR 495 Mn in year 2018 year end to LKR 1.5 Bn by 2019 year end which is also a significant indicator of the cardholder stickiness towards the DFCC credit card brand.

The Bank issued 40,978 new debit cards during the year and initiated a project to convert all mag stripe debit cards to CHIP enabled cards by the year end.

Outlook

The Bank will continue to focus on the card business both from an issuing and acquiring point of view and will use and introduce different modes to process card transactions. In addition, the Bank will actively support the Government lead national payment plans and be a contributor towards the Central Bank driven digital road map initiatives.

Bancassurance

The Bancassurance business was established in 2014 with an extensive portfolio of insurance and assurance products to customers. The unit was instituted under the drive to diversify DFCC’s operations to generate the other income segment while safeguarding bank’s mortgage assets, customer wealth, and their well-being. Within the past five years, the Unit has grown exponentially to contribute a bigger dividend to the Bank.

The product portfolio includes long term solutions like life insurance, pension plans, higher education plans, protection covers, and wealth management solutions. The short-term products include asset cover products such as motor insurance, fire insurance, marine covers, machinery covers, and hospitalisation covers etc. DFCC Bancassurance ensures hassle-free claim settlements, bespoke insurance packages, and free consultations to its customer base as well as product customisation to match specific needs and requirements of customers.

The Bancassurance team creates awareness on personal well-being, wealth planing, wealth management, mitigating risks associated with business – life and healthy living to its customers. Life insurance is provided in partnership with AIA Insurance Lanka Ltd, DFCC Bank’s long-term life insurance partner. General insurance solutions are sourced through all reputed insurers in Sri Lanka.

The Unit organised events and programmes throughout the year on matters such as health, wealth management, higher education planning, and parenting. Wealth management forums were organised for identified DFCC customers from regional branches. The AIA “Vitality” programme, a health boot camp was conducted on premises of selected DFCC corporate clients for the benefit of the employees.

Presentations were organised on Non-Communicable Diseases (NCD) to DFCC customers, which were conducted by expert medical professionals on the subject.

Performance in 2019

In 2019, the Bancassurance team facilitated 14,978

non-life policies and was involved in successfully negotiating claims amounting to LKR 126 Mn for both life and non-life policies. The number of life covers initiated through this unit amounts to 2,196 policies.

Outlook

The main focus in 2020 will be to promote health and protection based long-term covers with an objective of ensuring long-term well-being and security of our customers. The Unit will introduce new products to suit many different protection and health needs of our customers at a very affordable price and higher protection limits.