The significant accounting policies set out below have been applied consistently to all periods presented in the financial statements of the Group, except as specified in Note 6.

These accounting policies have been applied consistently by Group entities.

Set out below is an index of the significant accounting polices:

|

|

Note |

| A . |

Basis of consolidation |

5.1 |

| B. |

Foreign currency |

5.2 |

| C. |

Interest |

11 |

| D. |

Fee and commission |

12 |

| E. |

Net trading gain/(loss) |

13 |

| F. |

Net gain/(loss) from other financial instruments at fair value through profit or loss |

14 |

| G. |

Dividend income |

16 |

| H. |

Leases |

59 |

| I. |

Income tax |

22 |

| J. |

Financial assets and financial liabilities |

5.3 |

|

– Recognition and initial measurement |

5.3.1 |

|

– Classification |

5.3.2 |

|

– Reclassification |

5.3.3 |

|

– Derecognition |

5.3.4 |

|

– Modification of financial assets and financial liabilities |

5.3.5 |

|

– Fair value measurement |

5.3.6 |

|

– Impairment |

5.3.7 |

|

– Designation at fair value through profit or loss |

5.3.8 |

| K. |

Cash and cash equivalents |

26 |

| L. |

Derivatives held for risk management purposes and hedge accounting |

29 |

| M. |

Loans and receivables |

31, 32 |

| N. |

Property, plant and equipment |

39 |

| O. |

Investment property |

38 |

| P. |

Intangible assets and goodwill |

40 |

| Q. |

Impairment of non-financial assets |

5.4 |

| R. |

Provisions |

50 |

| S. |

Financial guarantees and loan commitments |

57 |

| T. |

Employee benefits |

48 |

| U. |

Stated capital |

52 |

| V. |

Earnings per share |

23 |

| W. |

Segment reporting |

60 |

5.1 Basis of consolidation

5.1.1 Business combinations

The Group accounts for business combinations using the acquisition method when control is transferred to the Group. The consideration transferred in the acquisition is generally measured at fair value, as are the identifiable net assets acquired. Any goodwill that arises is tested annually for impairment. Any gain on a bargain purchase is recognised in profit or loss immediately. Transaction costs are expensed as incurred, except if related to the issue of debt or equity securities.

The consideration transferred does not include amounts related to the settlement of pre-existing relationships. Such amounts are generally recognised in income statement.

Any contingent consideration is measured at fair value at the date of acquisition. If an obligation to pay contingent consideration that meets the definition of a financial instrument is classified as equity, then it is not remeasured and settlement is accounted for within equity. Otherwise, other contingent consideration is remeasured at fair value at each reporting date and subsequent changes in the fair value of the contingent consideration are recognised in income statement.

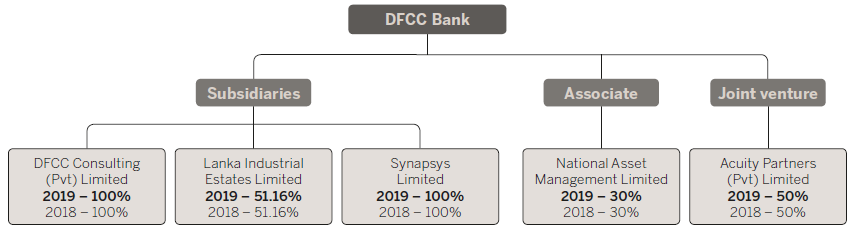

5.1.2 Subsidiaries

Details of the Bank’s subsidiaries, how they are accounted for in the financial statements and their contingencies are set out in Note 35.

5.1.3 Non-Controlling Interests (NCI)

Details of non-controlling interests are given in Note 56.

5.1.4 Loss of control

When the Group loses control over a subsidiary, it derecognises the assets and liabilities of the subsidiary, and any related NCI and other components of equity. Any resulting gain or loss is recognised in income statement. Any interest retained in the former subsidiary is measured at fair value when control is lost.

5.1.5 Interests in equity-accounted investees

The Group’s interests in equity-accounted investees comprise interests in associates and a joint venture.

Details of the Bank’s equity-accounted investees, how they are accounted in the financial statements and their contingencies are set out in Notes 36 and 37.

5.1.6 Transactions eliminated on consolidation

Intra-group balances and transactions, and any unrealised income and expenses (except for foreign currency transaction gains or losses) arising from intra-group transactions, are eliminated.

Unrealised losses are eliminated in the same way as unrealised gains, but only to the extent that there is no evidence of impairment.

5.1.7 Financial statements of subsidiaries, associate company and joint venture company included in the consolidated financial statements

The Financial Statements of DFCC Consulting (Pvt) Limited, Acuity Partners (Pvt) Limited, Synapsys Limited and National Asset Management Limited included in the consolidation have financial years ending on 31 December.

Financial statements of Lanka Industrial Estates Limited included in the consolidation has financial year ending on 31 March.

Audited financial statements are used for consolidation of companies which have a similar financial year end, as the Bank and for other a special review is performed.

5.2 Foreign currency

5.2.1 Foreign currency transactions

Transactions in foreign currencies are translated into the respective functional currencies of Group companies at the exchange rates at the date of the transactions.

Monetary assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rate at the reporting date. The foreign currency gain or loss on monetary items is the difference between the amortised cost in the functional currency at the beginning of the year, adjusted for effective interest, impairment and payments during the year, and the amortised cost in the foreign currency translated at the spot exchange rate at the end of the year.

Non-monetary assets and liabilities that are measured at fair value in a foreign currency are translated into the functional currency at the exchange rate when the fair value is determined. Non-monetary items that are measured based on historical cost in a foreign currency are translated at the exchange rate at the date of the transaction.

Foreign currency differences arising on translation are generally recognised in income statement. However, foreign currency differences arising from the translation of the following items are recognised in other comprehensive income (OCI):

- equity investments in respect of which an election has been made to present subsequent changes in fair value in OCI;

- a financial liability designated as a hedge of the net investment in a foreign operation to the extent that the hedge is effective; and

- qualifying cash flow hedges to the extent that the hedges are effective

5.2.2 Foreign operations

The Bank does not have any foreign operations that is a subsidiary, associate, joint venture or a branch. Therefore, there is no exchange differences recognised in other comprehensive income.

5.3 Financial assets and financial liabilities

5.3.1 Recognition and initial measurement

The Group initially recognises loans and advances, deposits, debt securities issued and subordinated liabilities on the date on which they are originated. All other financial instruments (including regular-way purchases and sales of financial assets) are recognised on the trade date, which is the date on which the Group becomes a party to the contractual provisions of the instrument.

A financial asset or financial liability is measured initially at fair value plus, for an item not at fair value through profit or loss (FVTPL), transaction costs that are directly attributable to its acquisition or issue. The fair value of a financial instrument at initial recognition is generally its transaction price.

5.3.2 Classification

5.3.2.1 Financial assets

On initial recognition, a financial asset is classified as measured at: amortised cost, FVOCI or FVTPL.

A financial asset is measured at amortised cost if it meets both of the following conditions and is not designated as at FVTPL:

- the asset is held within a business model whose objective is to hold assets to collect contractual cash flows; and

- the contractual terms of the financial asset give rise on specified dates to cash flows that are SPPI.

A debt instrument is measured at FVOCI only if it meets both of the following conditions and is not designated as at FVTPL:

- the asset is held within a business model whose objective is achieved by both collecting contractual cash flows and selling financial assets; and

- the contractual terms of the financial asset give rise on specified dates to cash flows that are SPPI.

On initial recognition of an equity investment that is not held for trading, the Group may irrevocably elect to present subsequent changes in fair value in OCI. This election is made on an investment-by-investment basis.

All other financial assets are classified as measured at FVTPL.

In addition, on initial recognition, the Group may irrevocably designate a financial asset that otherwise meets the requirements to be measured at amortised cost or at FVOCI as at FVTPL if doing so eliminates or significantly reduces an accounting mismatch that would otherwise arise.

5.3.2.1.1 Business model assessment

The Group makes an assessment of the objective of a business model in which an asset is held at a portfolio level because this best reflects the way the business is managed and information is provided to Management. The information considered includes:

- the stated policies and objectives for the portfolio and the operation of those policies in practice. In particular, whether Management’s strategy focuses on earning contractual interest revenue, maintaining a particular interest rate profile, matching the duration of the financial assets to the duration of the liabilities that are funding those assets or realising cash flows through the sale of the assets;

- how the performance of the portfolio is evaluated and reported to the Group’s Management;

- the risks that affect the performance of the business model (and the financial assets held within that business model) and its strategy for how those risks are managed;

- how managers of the business are compensated (e.g. whether compensation is based on the fair value of the assets managed or the contractual cash flows collected); and

- the frequency, volume and timing of sales in prior periods, the reasons for such sales and its expectations about future sales activity. However, information about sales activity is not considered in isolation, but as part of an overall assessment of how the Group’s stated objective for managing the financial assets is achieved and how cash flows are realised.

The Bank’s retail, small and medium enterprises and corporate banking business comprises primarily loans to customers that are held for collecting contractual cash flows. In the retail business the loans comprise mortgages, overdrafts, unsecured personal lending and credit card facilities. Sales of loans from these portfolios are very rare.

Certain debt securities are held by the Treasury in a separate portfolio for long-term yield. These securities may be sold, but such sales are not expected to be more than infrequent. The Group considers that these securities are held within a business model whose objective is to hold assets to collect the contractual cash flows.

Certain other debt securities are held by the Treasury in separate portfolios to meet everyday liquidity needs. The Treasury seeks to minimise the costs of managing these liquidity needs and therefore actively manages the return on the portfolio. That return consists of collecting contractual cash flows as well as gains and losses from the sale of financial assets. The investment strategy often results in sales activity that is significant in value. The Group considers that these financial assets are held within a business model whose objective is achieved by both collecting contractual cash flows and selling financial assets.

Financial assets that are held for trading or managed and whose performance is evaluated on a fair value basis are measured at FVTPL because they are neither held to collect contractual cash flows nor held both to collect contractual cash flows and to sell financial assets.

5.3.2.1.2 Assessment of whether contractual cash flows are Solely Payments of Principal and Interest

For the purposes of this assessment, ‘principal’ is defined as the fair value of the financial asset on initial recognition. “Interest” is defined as consideration for the time value of money and for the credit risk associated with the principal amount outstanding during a particular period of time and for other basic lending risks and costs (e.g. liquidity risk and administrative costs), as well as profit margin.

In assessing whether the contractual cash flows are SPPI, the Group considers the contractual terms of the instrument. This includes assessing whether the financial asset contains a contractual term that could change the timing or amount of contractual cash flows such that it would not meet this condition. In making the assessment, the Group considers:

- contingent events that would change the amount and timing of cash flows;

- leverage features;

- prepayment and extension terms;

- terms that limit the Group’s claim to cash flows from specified assets; and

- features that modify consideration of the time value of money.

Equity instruments have contractual cash flows that do not meet the SPPI criterion. Accordingly, all such financial assets are measured at FVTPL unless the FVOCI option is selected.

5.3.2.2 Financial liabilities

On initial recognition, the Bank classifies financial liabilities, other than financial guarantees and loan commitments, into one of the following categories:

- Financial liabilities at amortised cost; and

- Financial liabilities at fair value through profit or loss

5.3.2.2.1 Financial liabilities at amortised cost

Financial Liabilities issued by the Bank that are not designated at fair value through profit or loss are recognised initially at fair value plus any directly attributable transaction costs, by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the EIR. Subsequent to initial recognition these financial liabilities are measured at amortised cost using the effective interest method.

Deposit liabilities including savings deposits, current deposits, fixed/time deposits, call deposits, certificates

of deposit and debentures are classified as financial liabilities measured at amortised cost.

The EIR amortisation is included in “Interest expense” in the income statement. Gains and losses too are recognised in the income statement when the liabilities are derecognised as well as through the EIR amortisation process.

5.3.2.2.2 Financial liabilities at fair value through profit or loss

Financial liabilities at fair value through profit or loss include derivative liabilities held for risk management purposes.

5.3.3 Reclassifications

Financial assets are not reclassified subsequent to their initial recognition, except in the period after the Group changes its business model for managing financial assets. Financial liabilities are not reclassified as such reclassifications are not permitted by SLFRS 9.

5.3.4 Derecognition

5.3.4.1 Financial Assets

The Group derecognises a financial asset when the contractual rights to the cash flows from the financial asset expire, or it transfers the rights to receive the contractual cash flows in a transaction in which substantially all of the risks and rewards of ownership of the financial asset are transferred or in which the Group neither transfers nor retains substantially all of the risks and rewards of ownership and it does not retain control of the financial asset.

On derecognition of a financial asset, the difference between the carrying amount of the asset (or the carrying amount allocated to the portion of the asset derecognised) and the sum of (i) the consideration received (including any new asset obtained less any new liability assumed) and (ii) any cumulative gain or loss that had been recognised in OCI is recognised in income statement. Any cumulative gain/loss recognised in OCI in respect of equity investment securities designated as at FVOCI is not recognised in income statement on derecognition of such securities.

Any interest in transferred financial assets that qualify for derecognition that is created or retained by the Group is recognised as a separate asset or liability.

5.3.4.2 Financial liabilities

The Group derecognises a financial liability when its contractual obligations are discharged or cancelled,

or expire.

5.3.5 Modifications of financial assets and financial liabilities

5.3.5.1 Financial assets

If the terms of a financial asset are modified, then the Group evaluates whether the cash flows of the modified asset are substantially different.

If the cash flows are substantially different, then the contractual rights to cash flows from the original financial assets are deemed to have expired. In this case, the original financial asset is derecognised and a new financial asset is recognised at fair value plus any eligible transaction costs. Any fees received as part of the modification are accounted for as follows:

- fees that are considered in determining the fair value of the new asset and fees that represent reimbursement of eligible transaction costs are included in the initial measurement of the asset; and

- other fees are included in income statement as part of the gain or loss on derecognition.

If cash flows are modified when the borrower is in financial difficulties, then the objective of the modification is usually to maximise recovery of the original contractual terms rather than to originate a new asset with substantially different terms. If the Group plans to modify a financial asset in a way that would result in forgiveness of cash flows, then it first considers whether a portion of the asset should be written off before the modification takes place. This approach impacts the result of the quantitative evaluation and means that the derecognition criteria are not usually met in such cases.

If the modification of a financial asset measured at amortised cost or FVOCI does not result in derecognition of the financial asset, then the Group first recalculates the gross carrying amount of the financial asset using the original effective interest rate of the asset and recognises the resulting adjustment as a modification gain or loss in profit or loss. For floating-rate financial assets, the original effective interest rate used to calculate the modification gain or loss is adjusted to reflect current market terms at the time of the modification. Any costs or fees incurred and modification fees received adjust the gross carrying amount of the modified financial asset and are amortised over the remaining term of the modified financial assets.

If such a modification is carried out because of financial difficulties of the borrower, then the gain or loss is presented together with impairment losses. In other cases, it is presented as interest income calculated using the effective interest rate method.

5.3.5.2 Financial liabilities

The Group derecognises a financial liability when its terms are modified and the cash flows of the modified liability are substantially different. In this case, a new financial liability based on the modified terms is recognised at fair value. The difference between the carrying amount of the financial liability derecognised and the consideration paid is recognised in profit or loss. Consideration paid includes non-financial assets transferred, if any, and the assumption of liabilities, including the new modified financial liability.

If the modification of a financial liability is not accounted for as derecognition, then the amortised cost of the liability is recalculated by discounting the modified cash flows at the original effective interest rate and the resulting gain or loss is recognised in profit or loss. For floating-rate financial liabilities, the original effective interest rate used to calculate the modification gain or loss is adjusted to reflect current market terms at the time of the modification. Any costs and fees incurred are recognised as an adjustment to the carrying amount of the liability and amortised over the remaining term of the modified financial liability by re-computing the effective interest rate on the instrument.

5.3.6 Fair value measurement

“Fair value” is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date in the principal or, in its absence, the most advantageous market to which the Group has access at that date. The fair value of a liability reflects its non-performance risk.

When available, the Group measures the fair value of an instrument using the quoted price in an active market for that instrument. A market is regarded as “active” if transactions for the asset or liability take place with sufficient frequency and volume to provide pricing information on an ongoing basis.

If there is no quoted price in an active market, then the Group uses valuation techniques that maximise the use of relevant observable inputs and minimise the use of unobservable inputs. The chosen valuation technique incorporates all of the factors that market participants would take into account in pricing a transaction.

The best evidence of the fair value of a financial instrument on initial recognition is normally the transaction price – i.e. the fair value of the consideration given or received. If the Group determines that the fair value on initial recognition differs from the transaction price and the fair value is evidenced neither by a quoted price in an active market for an identical asset or liability nor based on a valuation technique for which any unobservable inputs are judged to be insignificant in based on a valuation technique for which any unobservable inputs are judged to be insignificant in relation to the difference, then the financial instrument is initially measured at fair value, adjusted to defer the difference between the fair value on initial recognition and the transaction price.

Subsequently, that difference is recognised in profit or loss on an appropriate basis over the life of the instrument but no later than when the valuation is wholly supported by observable market data or the transaction is closed out.

If an asset or a liability measured at fair value has a bid price and an ask price, then the Group measures assets and long positions at a bid price and liabilities and short positions at an ask price.

Portfolios of financial assets and financial liabilities that are exposed to market risk and credit risk that are managed by the Group on the basis of the net exposure to either market or credit risk are measured on the basis of a price that would be received to sell a net long position (or paid to transfer a net short position) for the particular risk exposure. Portfolio-level adjustments are allocated to the individual assets and liabilities on the basis of the relative risk adjustment of each of the individual instruments in the portfolio.

The fair value of a financial liability with a demand feature (e.g. a demand deposit) is not less than the amount payable on demand, discounted from the first date on which the amount could be required to be paid.

The Group recognises transfers between levels of the fair value hierarchy as of the end of the reporting period during which the change has occurred.

5.3.7 Impairment

Details of impairment is given in Note 17.

5.3.8 Designation at fair value through profit or loss

On initial recognition, the Bank may irrevocably designate a financial asset that otherwise meets the requirements to be measured at amortised cost or at FVOCI or at FVTPL, if doing so eliminated or significantly reduces an accounting mismatch that would otherwise arise.

The Bank has not designated any financial asset upon initial recognition at fair value through profit or loss as at the reporting date.

5.4 Impairment of non-financial assets

At each reporting date, the Group reviews the carrying amounts of its non-financial assets (other than investment properties and deferred tax assets) to determine whether there is any indication of impairment. If any such indication exists, then the asset’s recoverable amount is estimated.

Goodwill is tested annually for impairment.

For impairment testing, assets are grouped together into the smallest group of assets that generates cash inflows from continuing use that is largely independent of the cash inflows of other assets or CGUs. Goodwill arising from a business combination is allocated to CGUs or groups of CGUs that are expected to benefit from the synergies of the combination.

The recoverable amount of an asset or CGU is the greater of its value in use and its fair value less costs to sell. Value in use is based on the estimated future cash flows, discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset or CGU.

An impairment loss is recognised if the carrying amount of an asset or CGU exceeds its recoverable amount.

The Group’s corporate assets do not generate separate cash inflows and are used by more than one CGU. Corporate assets are allocated to CGUs on a reasonable and consistent basis and tested for impairment as part of the testing of the CGUs to which the corporate assets are allocated.

Impairment losses are recognised in profit or loss. They are allocated first to reduce the carrying amount of any goodwill allocated to the CGU, and then to reduce the carrying amounts of the other assets in the CGU on a pro rata basis.

An impairment loss in respect of goodwill is not reversed. For other assets, an impairment loss is reversed only to the extent that the asset’s carrying amount does not exceed the carrying amount that would have been determined, net of depreciation or amortisation, if no impairment loss had been recognised.