- Stability and re-inforced AA-rating

- Professional and friendly staff

- Deep knowledge in project lending and complex lending areas such as energy financing

- Rich development banking heritage as the country’s pioneering development bank

- Subsidiary network in diverse disciplines

- Strong reputation built on ethics and trust

- Improvement in Customer Relationship Management (CRM) and Business Intelligence (BI) tools; the Bank is just starting to become more data-driven in terms of research and surveys

Strategic Direction and Outlook

Short, medium, and long-term goals of the Bank

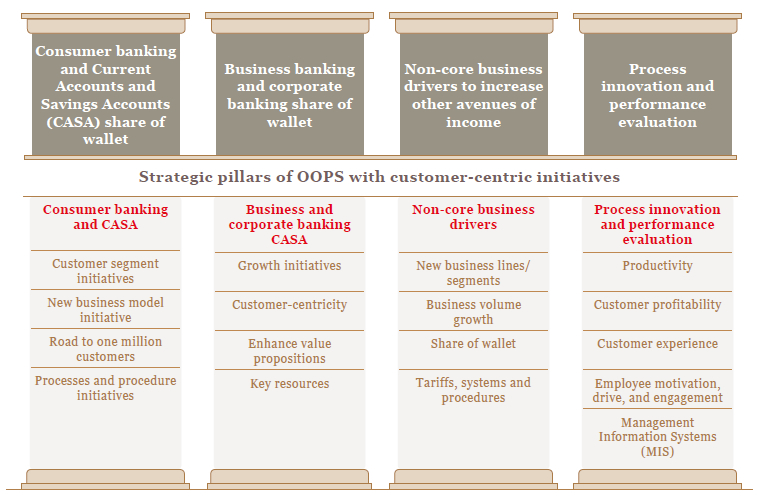

In 2017, DFCC Bank formulated short, medium, and long-term goals focusing on the period 2018-2020 and beyond, drawing inspiration from the core values of the Bank. Several Objective Oriented Planning Strategy (OOPS) sessions were held during 2017 to devise the key focus areas, which were revisited and revised during the period under review. Key factors taken into consideration included the Bank’s rich heritage in development banking, its focus towards the development of entrepreneurs and SMEs, and further establishing and expanding operations as a fully-fledged commercial bank.

The focus for 2018-2020 will be on the following areas:

DFCC Bank will continue to focus on enhancing customer experience through products and services that offer convenience, flexibility, and accessibility. The Bank will achieve this by harnessing the latest technologies to develop innovative products and service delivery processes that will ultimately culminate in increased customer engagement, loyalty, and retention.

As the Bank continues its efforts to broaden its customer base, several strategic initiatives derived through OOPS have been established in different customer segments. These initiatives include user-friendly online banking solutions and actively engaging customers through loyalty-building activities across customer touchpoints. As part of the OOPS initiative, the current business model of the Bank was re-evaluated, based on a nine-building block analysis methodology. This includes analysing customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partners, and cost structures as part of the Bank’s efforts to shift its perspective from organisation-centric to customer-centric.

The Bank focuses on enhancing productivity at branch level while reducing the paperwork of day-to-day operations as part of its efforts to move towards a modern paperless work environment and establish sustainable green banking solutions. To improve business processes, the Bank is implementing lean management principles, truly paperless processes, improved workflow tools, and automated task management.

The Bank is also improving MIS and innovation while focusing on customer profitability and employee motivation and engagement. The Bank carries out marketing and promotional activities in the city and rural areas, aiming to raise brand awareness and establish itself in the minds of retail banking customers.

SWOT analysis

DFCC Bank conducted a SWOT analysis to identify possible avenues that are available to the Bank to capitalise on its strengths, identify opportunities, overcome weaknesses, and face market threats.

- Ability to take on an advisory role to select segments based on over 63 years of experience

- Expertise in niche areas such as solar financing

- Ability to explore further synergies with subsidiaries and affiliated companies

- Potential to enhance value by focusing on digital and customer-centric offerings

- Gaps in speed of service compared to competitors

- Risk-averse mindset

- Bureaucratic processes and procedures

- Most systems less agile

- The Bank’s vision needs to be deeply embedded across the Organisation

- Sub-optimal organisation structure

- Communication gaps between layers of staff

- Rate of industry disruption

- Heavy competition in commercial banking and digital space from more established banks

- Not recognised in the market for commercial/retail banking

- Non-Bank Financial Institutions (NBFIs) encroaching on DFCC’s turf

- Tighter regulations leading to increased data requirements by CBSL

Outlook for 2019 and beyond

DFCC Bank has set for itself the “Big Hairy Audacious Goal” of becoming the Bank that offers the best customer experience in banking with a target of achieving five million customers by 2025. This target was formulated by the Management with the guidance of the Board of Directors and assistance from an external strategic management consulting firm.

In arriving at such a goal, the Bank foresees the future of banking to rely on advancement in emerging technologies and challenges from changing customer requirements, human resources and regulatory framework.

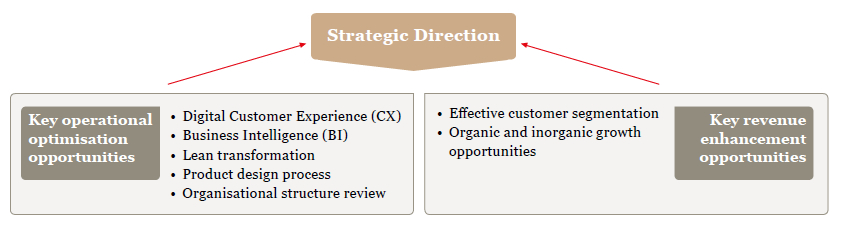

DFCC Bank’s strategic direction revolves around customer-centricity and a strong focus on digital. The Bank aims to optimise resource allocation in these areas whilst also focusing on key operational optimisation opportunities and key revenue enhancement opportunities.

In driving digitalisation, the Bank will focus on improving the company website, adopting an omni-channel strategy, and focusing on the customer conversion process to deliver an enhanced digital customer experience.

DFCC idea hub

The formation of the DFCC idea hub in 2017 aimed to bring together various stakeholders from the Bank to collaborate and innovate. The objective of this committee is to work together, brainstorm ideas, and evaluate new fintech solutions. This enables the Bank to gain an early understanding of the general applicability of creative solutions to enhance the Bank’s customer experience through varied products and services, and customer engagement propositions. The committee has been successful in churning out several great initiatives which has and will continue to create a distinct difference in the market for the DFCC brand.