|

The Bank’s performance over the

past decade has been driven by its strong capacity to innovate and

re-engineer products to enhance customer convenience. The Bank’s goal has been to simplify banking, expand delivery channels and enable our broad range of customers to access our products with ease.

In our attempts at product innovation, we have aimed to develop products that cater to

the specific needs of our wide customer base. We have focused on expansion of web-based delivery channels which in turn enhance the quality and accessibility of our physical infrastructure.

Enhancing Delivery Channels

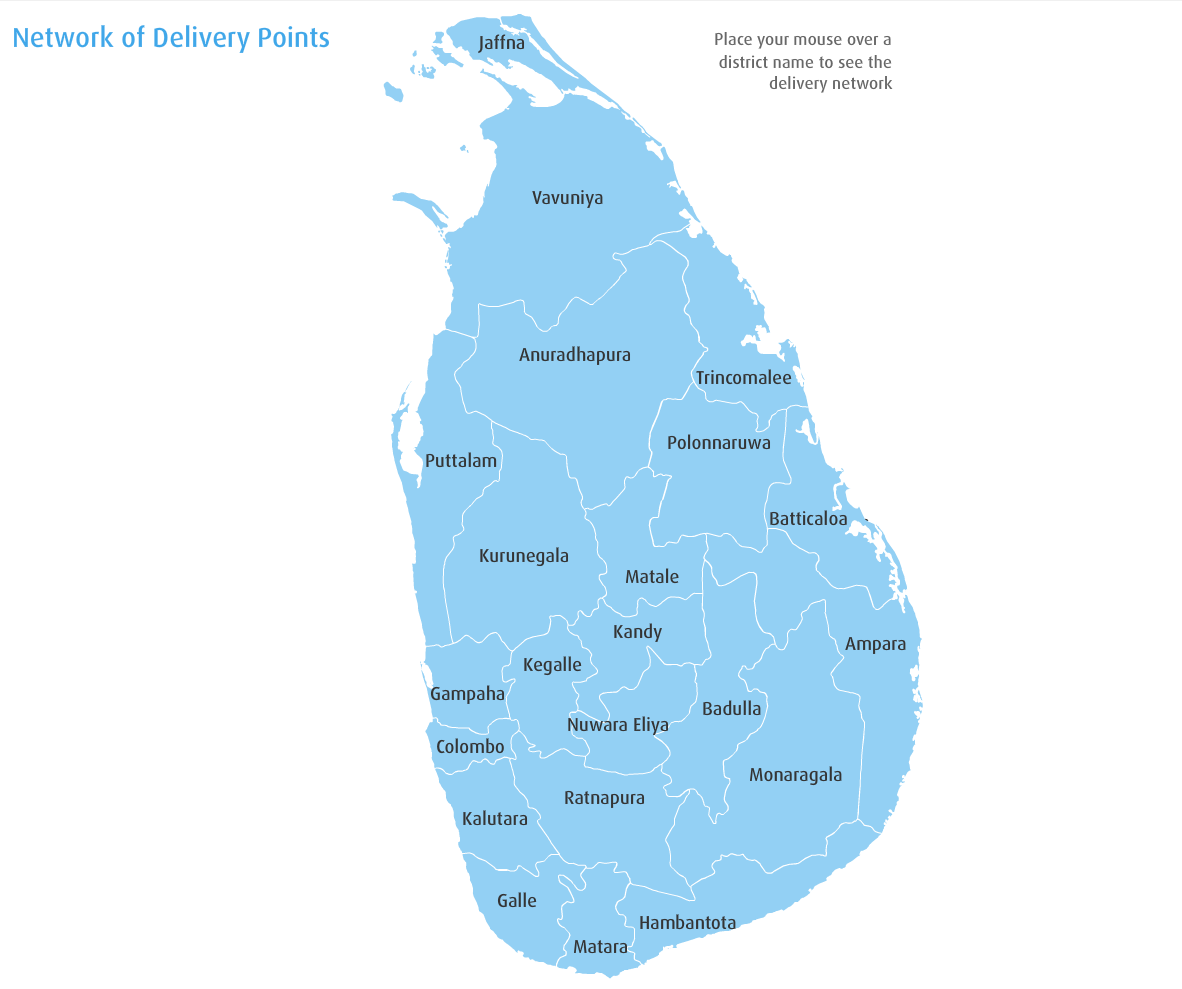

The Bank opened seven new delivery points in 2008. The total number of delivery points at the end of 2008 was 181. The Bank continued to expand its supermarket service points with a view to providing more options for its customers. The Bank will look at opportunities in the North and the East of the country as these areas slowly return to normalcy.

Customer convenience has also been enhanced by extended hours of service at an increasing number of branches. Some of the Bank’s branches now offer Saturday banking and holiday banking to many of our customers.

Apart from its conventional delivery channels, the Bank has also ventured into new areas. Pawning is one area which the Bank will pursue more aggressively in the future. Over the limited period of our engagement in this activity, we have already generated satisfying results. Products tailored for the SME sector will also receive priority in the coming years as the Bank begins to explore this market segment thoroughly.

The Bank also launched several derivative products with a view to making Sri Lanka a financial hub and hope to continue to look at opportunities in this market segment too. The lack of appropriate knowledge and a legal framework for such products may hamper our ability to develop them.

Product Innovation

Product innovation has been a key driver of the Bank’s growth in the past decade and will continue to figure in our future growth plans.

The Bank launched two SMS-based products: Com SMS and Com eLoad.

Com SMS enables customers to monitor the movements in their bank accounts and carry out a variety of transactions. Com eLoad allows customers to reload prepaid mobile connections with a simple SMS. In 2007, ‘Com-e-Load’ won a Silver Medal for the Financial Category at the National Best Quality Software Competition.

‘Paymaster’, is the first total payment solution offered to corporate clients in Sri Lanka, and was initially launched in 2007. ‘Paymaster’ is a seamless and comprehensive electronic payment mechanism that replaces paper and

cash transactions, reducing processing time and costs. It also eliminates the risk associated with the transfer of cash. Paymaster enables settlement of suppliers, disbursements of dividends or interest, payment of insurance claims or agent commissions and the payment of salaries and bonuses.

A new savings account, branded as ‘Super Saver’ carrying a premium interest rate was launched last year. The Bank saw the need for a specially tailored high-yielding Savings Account.

Maintaining Superiority

in Technology

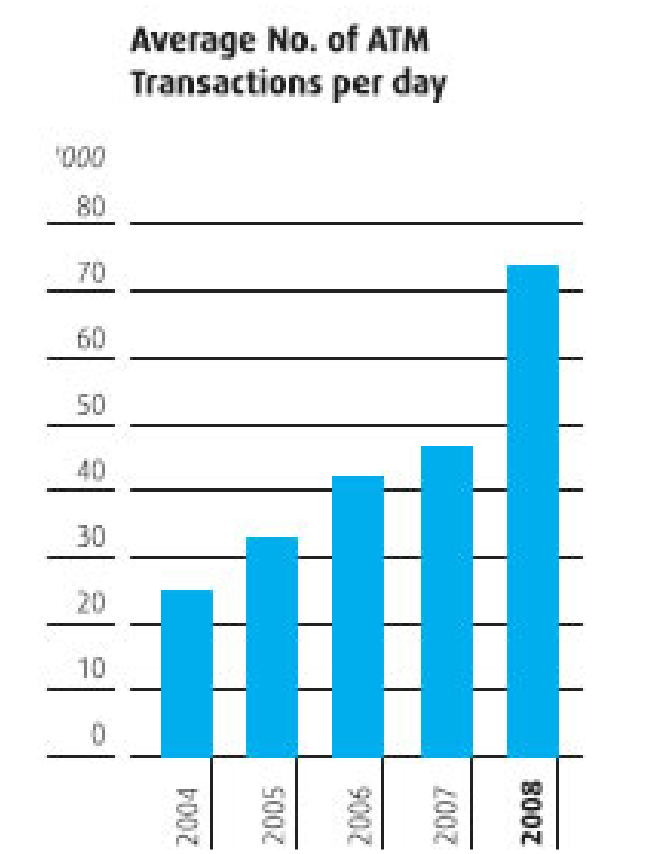

Our customers now have access to 333 ATMs in Sri Lanka. The Bank’s ATM network continues to grow. Last year we established ATMs in 24 new locations around the country of which 15 ATMs were installed in large corporate customer locations. In addition we added a further 20 ATMs to existing locations.

Approximately 74,000 transactions amounting to Rs. 285 million take place on average every day through the Bank’s ATM network. Through the use of Visa/Master ATM switch, customers of other banks and financial institutions also have access to the Bank’s ATMs, resulting in additional revenue and brand visibility.

All ATMs comply with MasterCard and Visa international security standards of Europay Mastercard Visa International (EMV) and the Triple Data Encryption System (TDES) standard.

Speedy and Efficient Delivery

Establishment of more regional offices play a major role in speeding up the decision making process. Regional credit centres have been formed with a special emphasis on following up with and assisting customers who encounter difficulties in repaying their loans.

The instant process of issuing ‘Visa Debit’ cards, opened up a new dimension in customer convenience.

Telephone and Internet Banking have revolutionised customer convenience in banking services enabling customers not just to access the Bank with ease but also to do so at a lesser cost and greater speed.

Future Strategies

- Expanding credit and support services to the SME sector

- Implementing a payment gateway

- Continuing to open branches in

new locations

- Re-engineering internal processes and internal controls in order to increase the operational efficiency

- Further increasing the credit and

debit card base

- Penetrating untapped opportunities in Internet Banking

|

|

|

|

| |

|

| |

|

| |

Customers of the Bank can now access the Bank

and its products in multiple shapes and forms

- ATM Network

- Internet Banking

- Wide Network Bank Branches

- Supermarket Service Points

- Trade Finance related services

- Instant Money Transfer Service

- Mobile Phone Banking

- Mobile Phone reload facility

- The Total Payment Solution

- Visa/Maestro Debit Card

- Instant Debit Card

- Weekend/Holiday Banking

- Convenient Banking Hours

- 365 day banking at select venues

- Business Promotion Officers

- Priority Banking

- Special facilities for Disabled Customers

|

|

|

|

|