Leadership

Implementing Strategy

Our strategic imperatives and achievements during the reporting year are narrated against the backdrop of the operating environment.

We strive to create value against an unpredictable socio-political, economic, and environmental backdrop, contending with ever-increasing market competition, tightening regulations, and fast-paced technological innovations. Our strategic imperatives are designed to capitalise on opportunities and mitigate risks arising from within our operating environment.

Operating environment

Global outlook

Following robust economic growth in 2017, which peaked at 4% and dropped slightly to 3.8% in early 2018, global economic activity declined to 3.2% in the second half of that year. This deterioration was a result of a combination of factors affecting the world’s large economies, including higher policy uncertainty, tightening financial conditions and sliding business confidence. In the Asia-Pacific region, China’s growth turned sluggish after regulations were tightened in the country and also following an increase in trade tensions with the United States.

In Europe, the economy slowed down more than expected, during the year under review, due largely to weaker consumer and business confidence, while external demand, especially from emerging Asia, also declined. Financial market sentiment weakened following trade tensions which negatively impacted business confidence.

Local outlook

In Sri Lanka, real GDP growth declined to 3.2% in 2018, compared to 3.4% in 2017, largely supported by service sector activities which grew by 4.7% and the recovery in agricultural activities which grew by 4.8%. While economic activity grew moderately, a slight increase in the unemployment rate and a drop in the labour force participation rate were recorded during the year under review. Tighter financial conditions from mid-April 2018 were aggravated by political uncertainties and Sri Lanka’s Sovereign rating being downgraded during the fourth quarter. Domestically, the trade deficit surpassed US dollars 10 Bn. for the first time in history with higher growth in import expenditure outpacing the growth in export earnings, which were at a record level in nominal terms.

An estimated increase in services exports was offset by the deficit in the merchandise trade balance, stagnant workers’ remittances, and rising foreign interest payments. As a result the current account deficit widened to 3.2% of GDP during the year. In order to address the widening trade deficit, the Central Bank and the Government implemented a series of measures to curb non-essential imports.

In response to these measures and the global financial markets becoming less favourable, the Sri Lankan rupee appreciated against major currencies during the fourth quarter of 2018. Investor sentiments improved with the resumption of discussions and the achievement of staff level agreement with the IMF on the programme under the Extended Fund Facility (EFF) arrangement in February 2019. The concerted effort of all stakeholders will be essential to expedite the current reform agenda.

An Integrated View of Our Business Model

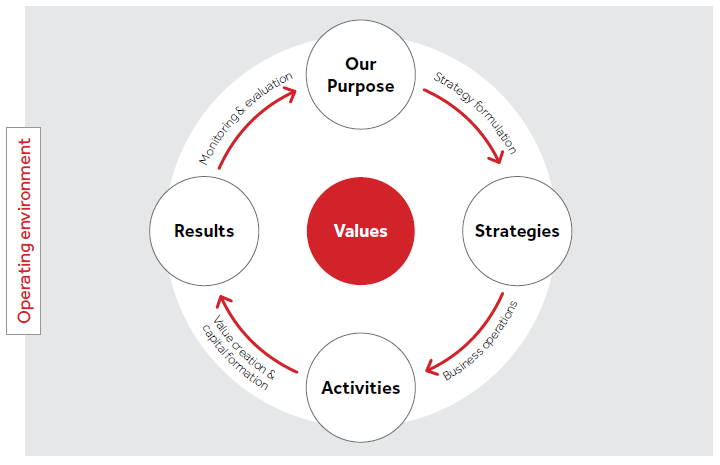

The figure below depicts how, guided by our values within an ever dynamic operating environment, our purpose and strategies are seamlessly integrated to create value for the benefit of our stakeholders.

Strategy

Our strategies are powered by the following key drivers.

Innovation

Innovation may be synonymous with new technology, but it is what our Company was founded on half a century ago. As one of five Corporate Values, innovation is part of our DNA. Combined with our reputation for integrity, innovative thinking has enabled us to contribute to nation building through our diverse businesses – including our renewable energy business.

Diversity

Diversification began as a form of organic growth, with the Company expanding responsibly from healthcare to agribusiness, consumer, and, more recently, renewable energy. With 50 years experience to count on, we are embracing inorganic growth where it is prudent to do so and where it strengthens our ability to create value. As always, our stakeholders’ best interests are at the heart of all we do.

Synergy

Synergy – the combined forces and performance of all our businesses together – has provided the Group and each of its members with greater momentum than each would have on its own. Over the years we have streamlined these synergies, leveraging the strengths and potential of each to capitalise on the opportunities and mitigate the risks of our operating environment.

Sustainability

Sustainability is woven into the very fabric of our ethos and has won us the trust of key stakeholder groups. It has been present in the way we govern and operate our business in pursuit of value creation. Just as we derive value from them, we also persevere to deliver value to all our stakeholder groups, including the environment and the communities within which we operate.