Creating Value

Integrity and Family

Capitalising on our relationship capital

Over the past five decades, our business has grown from a one-van medical supplies delivery service to a publicly listed company with responsibilities for creating value across a wide spectrum of stakeholders. Despite the chasm in time from then to now, the ethos that has guided us this far remains unchanged. When our founders drove around the Country in the Group’s first vehicle delivering medical supplies to Doctors in every nook and corner, we began building long-lasting relationships. As a result, these medical professionals became part of our family – often offering our people a room and a meal in their homes at the end of a long day.

Although Sunshine Holdings flourished since then and now covers sectors including healthcare, consumer goods, agribusiness, and energy, our Values and Mission remain the same. Even today, we continue to treat stakeholders like family. During the year, our continued focus on strengthening relationships, and improving quality and efficiency through well-placed strategies has yielded strong results across the Group.

Our healthcare business was the largest contributor to the Group’s top-line performance, accounting for 40% of total revenue, while our agribusiness and consumer goods sectors contributed 31% and 25% respectively.

In healthcare

Today our healthcare business includes consumer (in terms of Healthguard pharmacies), pharmaceuticals, and medical devices, and is but one sector in our four-sector portfolio. By diversifying our healthcare business into three clearly defined sectors we were able to pay greater attention to each, a strategy that has resulted in a robust year particularly for pharmaceuticals which makes up 60% of our healthcare business.

With 10.5% of the local healthcare market under our wing, we enjoy sub-category leadership in areas such as diabetes care, cardiology and immunochemistry.

Robust relationships with business partners including big international brands like 3M, Siemens, and Johnson & Johnson, continued to help us bring in best-in-class medical devices and pharmaceuticals to the country.

In consumer goods

In the consumer business too we have been making waves. With our current market share standing at 36%, we have enjoyed the market leader position in tea over the last three years. This is in spite of an extremely competitive environment. Our three brands of tea cater to different customer groups.

Through our partnership with an International Hotel Group, our premium tea Zesta, has been gaining a greater international following across 22 countries.

Watawala tea, which is number 1 in the market, Zesta which caters to the mass premium segment and Ran Kahata which caters to the budget-conscious consumer. Focusing on beverages, our Fast-Moving Consumer Goods (FMCG) business recently included Watawala Wathura and will soon comprise other products as well.

In agribusiness

Our agribusiness sector largely spans tea, palm oil and, more recently, dairy. While the year under review was profitable for palm oil, in general it was one of consolidation, with our senior leaders in this sector mapping every asset across all our estates from water resources to soil types to ascertain the most sustainable use for the land under our care. Watawala Dairy, for instance, is on the site of a formerly unproductive tea plantation. Other units of land considered un-arable were assigned for reforestation to contribute towards supporting biodiversity in the hill country.

Progress in agribusiness was boosted by our overseas partners Pyramid Wilmar Plantations Ltd., headquartered in Singapore, and Duxton Asset Management Ltd. Singapore. Sunshine divested a controlling stake in HPL to Lotus Renewable Energy Group in May 2019.

In energy

With diversification being a firm, long-term strategy, we began exploring the renewable energy sector in 2012 and now have a 6.6 MW capacity through three mini-hydropower plants. During the year under review, we also commenced a 500 kW rooftop solar project at Sunshine Tea.

Our renewal energy business sits squarely in the nation building space, with the potential to contribute significantly towards the annual 6-7% increase in power demand.

Our sound relationships with local players include the Ceylon Electricity Board and overseas partners including Global Hydro Energy GHE from Austria and JSF Corporation (Sakura Solar) are powering success in this sector.

Engaging stakeholders

As a listed conglomerate with businesses spanning four key sectors of the Sri Lankan economy, we are conscious of the impact our actions, products, and services have on our stakeholders. We are also keenly aware of how their perceptions and behaviour, in turn, can impact our ability to carry out our activities and meet strategic goals. Given this symbiotic relationship, we make every effort to identify, understand and engage with key stakeholder groups in order to meet their needs and balance the distribution of value created.

Our key stakeholder groups include –

- Investors

- Business partners

- Employees

- Customers

- Government, statutory and regulatory bodies

- Society and the environment

We maintain formal mechanisms to remain connected with our stakeholder groups (refer page 226), while still upholding many of the informal mechanisms such as one-on-one meetings, phone calls, and get-togethers that endeared us to them over the past 50 years.

Bolstering investor relations

Our decision to move from family-owned business to listed company was a conscious one. It was a way for us to signal to all our stakeholders – most importantly our investors – that we continue to be serious about value creation. Just as we derive value from our stakeholders, we also deliver value to them.

On the other hand, the fact that Sunshine Holdings is a majority family-owned business is considered a benefit. Our investors understand that with the family being keen to safeguard the long-term profitability of the Company, their investment is in good hands.

Indicating our commitment to growth, the newly acquired pharma agencies from Hayleys Consumer division are enhancing our revenue, while the recently announced intent to merge with CIC Healthcare division, CIC Holdings PLC promises additional profitability in the healthcare sector. Like Sunshine Holdings, CIC Holdings too imports pharmaceuticals and medical equipment, while producing healthcare and personal care products locally, including the herbal remedy “Samahan”.

As a public-quoted company, we are cognisant of our responsibility towards our institutional and retail investors. To every stakeholder, we extend the same level of integrity that we would extend to a family member. In addition, our Investor Relations team pays special attention to meeting and exceeding the needs of our local and international investors.

Members of the Board of Directors are also available for addressing the needs of investors as needed.

Strengthening ties with business partners

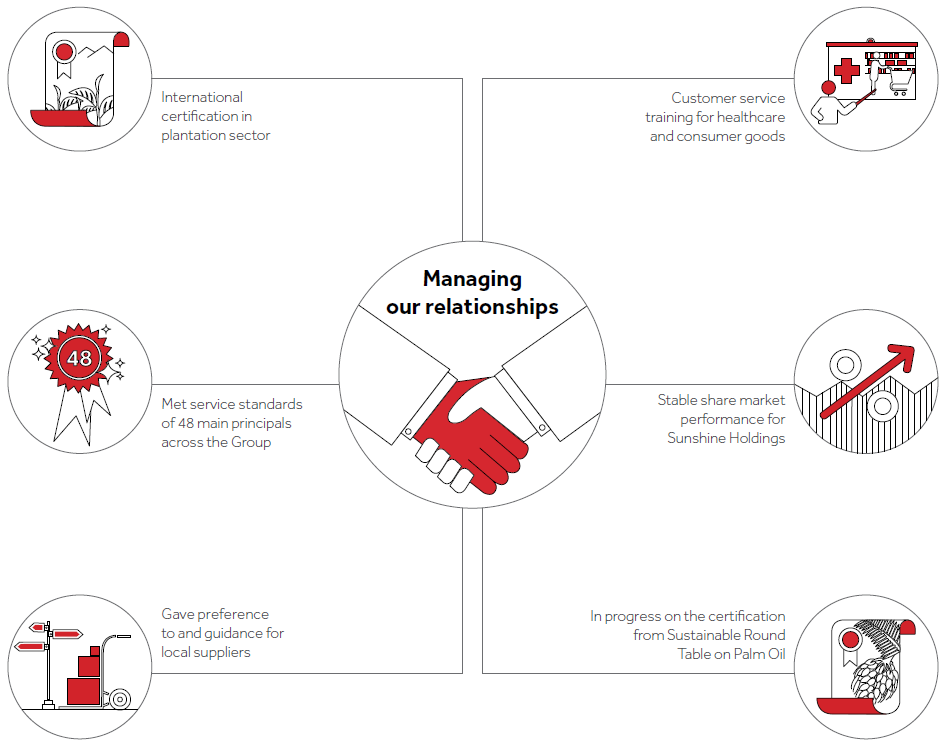

Our success is built on strong and mutually beneficial relationships with business partners including joint venture partners, franchising business partners and suppliers. This is why so many of our partnerships are decades old.

We have in place a stringent vetting process to ensure that the entities we partner with share our values – that like us, they will not compromise on quality and will, instead, uphold our stakeholders’ best interests. This automatically ensures that our business partners are best-in-class – whether they are local or international. In turn, their due diligence assessments show them that Sunshine Holdings is at the top end of the list when it comes to potential business partnerships.

Many of our relationships are decades strong and a testament to how cherished our ethos and values are.

Through this on-going engagement we are able to drive innovation, enhance diversification, leverage synergies and continue to operate our business in a sustainable manner.

With integrity a critical ingredient of Sunshine Holdings from its very beginning, we have made a name for ourselves as a trusted business partner. For example, during the year, one of our principals, 3M Global Channel Services – a Fortune 500 conglomerate, decided to appoint one party in Sri Lanka as their sole master distributor. Despite stiff competition in the market, Sunshine Holdings was selected as that partner. Thanks to our deep-seated values, today we are able to bring to Sri Lanka this principal’s entire range of products – a critical factor in our robust growth in the healthcare sector.

Through an ever-keener focus on compliance and quality we were also able to better address the needs of our principals. For instance, one of our biggest issues identified during the preceding year was the problem of medical devices being out of stock. The problem was a complex one that involved accurate forecasting, regulatory renewals and effective communication with our principals. During the year under review, we were able to reduce out-of-stock events from 10% to less than 2% by leveraging on strong relationships with principals and regulators such as the National Medicines Regulatory Authority (NMRA).

In Pharma we improved management information systems allowing our Senior Management the ability to log in online and monitor their sales and stock. We also implemented principal policies for their teams, deployed their field force management system and continued to strengthen relationships in a transparent manner. Ensuring that our principals receive regular reports on how the products are moving in the market is another useful addition to our relationship building strategy.

Joint venture partners

Our joint venture partners are Pyramid Wilmar Plantations Ltd., headquartered in Singapore and Duxton Asset Management Ltd., Singapore. The former partners with us for estate management operations and the latter for our most recent venture, the dairy farm business. Both are leading, internationally acclaimed entities, who have supported us with technical know-how, capital infusion, market insights and the best in international practices.

An example from the year under review, of the strengths and benefits of such relationships can be highlighted from our dairy sector business. With the help of Duxton Asset Management we had the benefit of two experts – a herd manager and an operations manager from South Africa – who helped to lay a solid foundation at Watawala Dairy Farm. Their practical expertise and work ethic was the boost the farm needed to make a flying start in an industry where, except for a few players, the technical expertise is limited to knowledge gained through trial and error.

During the reporting year, we imported 240 head of cattle from Australia and another 900 animals through the Government subsidy during the last financial year. The recent New Zealand-Sri Lanka deal, which saw the import of two thousand head of cattle so far, has resulted in many small farms being over-burdened by debt as a result of disease and poor milk production affecting the newly imported cows.

Watawala Dairy was largely able to avoid these pitfalls thanks to prior preparation which included training and development for employees, the proper feed being prepared and stored, and the necessary infrastructure being put in place before the imported animals arrived. (Refer page 33 under Suppliers for details of how we are improving the lives of smallholders who grow maize for our livestock feed.)

Business franchising partners

An extensive network comprising 48 main business franchises supports our healthcare sector operations, with many long-standing relationships with globally recognised and acclaimed principals in healthcare, such as Johnson & Johnson and Siemens.

In Sunshine Holdings they find a partner that is above board and stringent in its adherence to the letter and the spirit of the law.

In turn, these partnerships and high-quality products have strengthened and complemented our operations, reinforcing our leading position in the industry.

Just as much as we take it upon ourselves to ensure that the drugs we import are in optimal condition when they reach the customer, we also dispose of expired drugs to ensure that they are not abused or harming the environment. It is such best-in-class industry practices that have endeared us to investors and local and international business partners alike.

Suppliers

While the Sunshine Holdings Group works with a range of local and international suppliers we always give preference to local suppliers where possible, only engaging international suppliers when quality or range is a question.

We engage with suppliers who are thoroughly evaluated for sustainability practices. When concerns are identified we initiate regular dialogue with them, working towards resolving issues and encouraging best practices. Where it is not possible to wield a significant influence over the supplier we make every effort to resolve issues amicably. Wherever possible, we have sound contingency measures in place, especially for business-critical suppliers.

Our commitment to our suppliers runs deep within every sector. For instance, we have long partnered with Siemens to import diagnostics equipment for sizeable medical laboratories like those in the main national hospitals or large private hospitals. In the meantime, we identified the need for such services for smaller hospitals and labs as well. To meet this requirement, we partnered with Erba Lachema, which is part of a global company focused on creating a social impact in the world by delivering innovative, affordable and sustainable healthcare solutions.

While our first choice is always local suppliers we make every effort to help them ensure that their products and services are of the highest standards. A good example of this is our relationship with maize farmers in the dry zone. Watawala Dairy requires a superior feed for our herd of local and imported cows. This feed largely consists of maize or corn, in addition to imported grasses such as alfalfa. Reaching out to local smallholders is the most cost-effective solution for the Farm, but to ensure that the quality of the maize remains high we work closely with the farmers, advising on how to grow crops and even providing seeds when harvests have failed. By growing crops for us the farmers receive a higher income because they are able to sell not just the corn cob but the entire plant.

To ease their burden and ensure the freshness of the maize we have also invested in barns and baling machinery in the dry zone. As maize is seasonal our machines are used to harvest the maize and store the bales for use as needed. Our lorries which take the maize to Watawala Dairy also transport manure back to the smallholders as our contribution towards encouraging them to embrace a more organic method of farming.

Boosting employee engagement

By making it a point to recruit and retain people who live the Values of the Group we have created a dynamic and diverse workforce, one that continues to be our greatest strength and asset. Success in achieving this goal means having a team of people on the ground who live the Group Values, understand the needs of our customers and business partners, and are able to quickly learn and adapt to new technologies and new ways of thinking in order to succeed.

As a listed company we are keenly focused on meeting the needs of all our stakeholders. For us, creating value means delivering value to our stakeholders, just as much as we derive value from them.

In this spirit, we continue to attract and retain people with the same passion as our founders –

people whose lives reflect the Group Values of trust, integrity, responsibility, perseverance and innovation. This ethos also meant that we were already running a sustainable business long before the term was even coined.

Over the past two years we have made good progress in consolidating the Human Resources (HR) functions across the sectors. Centralising this function puts less of a financial burden on the sectors while still allowing them to enjoy the best support in HR.

Online performance management systems are the conduits for around 80% of our employee evaluations across the Group, ensuring timely evaluations, transparency, and greater accountability.

These biannual evaluations are against previously agreed performance goals and targets which are aligned with the Company’s goals and account for 70% of the employee rating. The remaining 30% is evaluated against a competency framework.

Numbering 9,680 the Group’s cadre strength has remained largely static over the last six years as we focused on building capacity through training and development. Typically a majority of employee contracts are full time with a few being time-bound. We also depend on outsourced employees for specific functions in order to be able to scale up or down depending on the dynamic needs of the business. Where a need is identified and there are no suitable internal candidates we recruit appropriate external expertise. A good example is the addition of a medical doctor to the management team of our medical devices division who is able to train and advise our people and speak to other medical professionals on the Company’s behalf.

ENCOURAGING DIVERSITY

Recruitment in 2018/19

| Gender | Contract type | Total | |||

| Male | Female | Permanent | Contract | ||

| Healthcare | 205 | 24 | 197 | 32 | 229 |

| Agribusiness | 22 | 3 | 20 | 5 | 25 |

| Consumer goods | 49 | 5 | 44 | 5 | 54 |

| Holding Company | 1 | 1 | 1 | 1 | 2 |

| Overall | 277 | 33 | 262 | 43 | 310 |

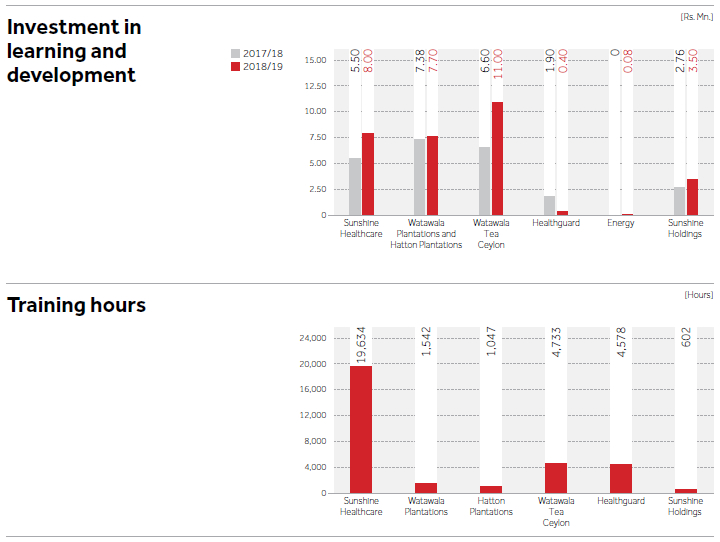

To support our diverse businesses and employees across the Group, we focused on four-key aspects during the year:

- Customised training and development – including leadership development programmes for our senior leadership

- Recruiting against competencies in a competitive market

- Benchmarking pay against the market

- Retaining high performers

As we work towards a culture that embraces learning, we continue to focus on our in-house centres of excellence in leadership and manager training and technical training for the employees of our Healthguard pharmacies. Other learning and development programmes are outsourced to give us the flexibility to scale up or down depending on the dynamic needs of our businesses.

As we continue to build capacity, we are focused on developing the skills and competencies of our people, providing adequate compensation, and rewarding and recognising them. Keenly aware of the Group’s strategic direction, our employees follow the Corporate Values as they gear themselves to be future ready while meeting and exceeding stakeholder needs. We strive to align the goals, skills and competencies of our people with our Corporate Strategy to ensure that every single employee is well and truly on this journey towards a prosperous and meaningful future.

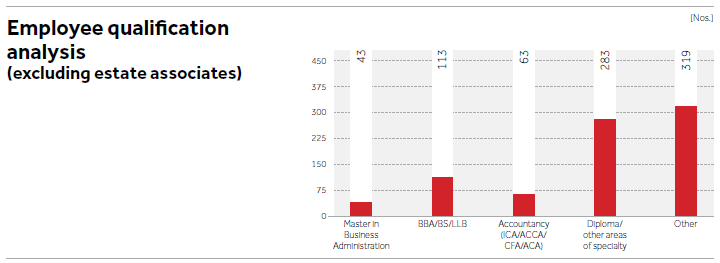

Excluding our estate associates, 60% of our employees possess academic, professional or technical qualifications.

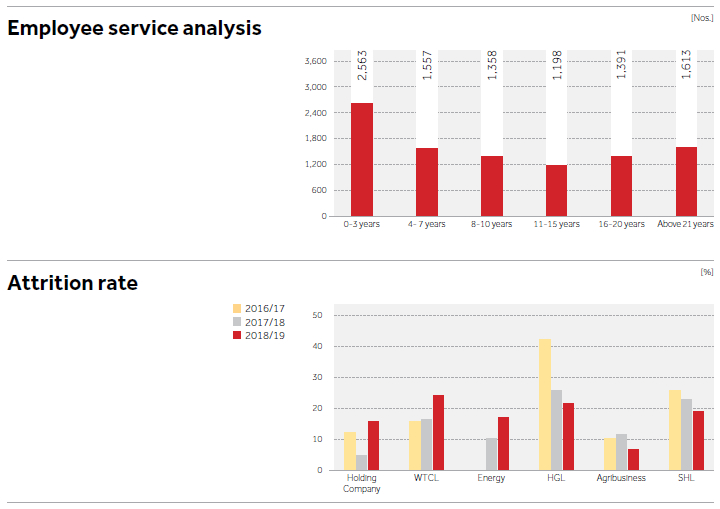

Retaining our talented and trained employees in a highly competitive market remains a priority for the Group. As illustrated in the service analysis chart below, 60% of our employees have been with the Group for eight years or more, with 17% having put in over 21 years. These numbers reflect the hard work we put into maintaining strong relationships with our people, including harmonious labour relations, by implementing best practices and a focused employee strategy. The three-year attrition rate summary below shows that our efforts have borne fruit.

Championing transparency and openness

While we ensure transparency in the way we communicate pay and benefits, we also encourage an open culture, where two-way communication is the norm rather than the exception. Towards this goal we utilise a number of employee communication tools to suit our diverse employee cadre.

These include:

- Town halls

- Emails and screensavers

- Notice boards

- Social media

- Employee opinion survey

The results of our annual employee opinion survey were encouraging with several indicators improving over the previous year. The attributes which received scores of over 80% included corporate image, employee engagement, understanding of Strategy and Vision, and the job itself. Attributes that scored below 50% included satisfaction with resources and facilities, and rewards and recognition. We have already begun addressing these points by refurbishing office interiors throughout the Group and paying greater attention to more focused, transparent internal communications.

We contributed Rs. 393 Mn. towards the Employees Provident Fund and the Employees Trust Fund.

Human Resources Compliance

The Sunshine Group is in compliance with the labour laws of Sri Lanka and the rules and regulations set by all relevant statutory and regulatory bodies. While complying with the minimum age of employment, the Group does not engage in child labour. It also does not use any form of forced or compulsory labour. We have diligently met all due remuneration, defined benefit plan obligations and incentives. The Group did not record any incidents of discrimination over gender, age or any other facet during the year under review.

At no time during the year was the Group fined or sanctioned due to non-compliance with laws, rules and regulations in labour management and relations.

We maintain an open-door policy across the business sectors and have implemented a structured grievance redressal mechanism.

Being future-ready

As a listed company there is greater onus on us to be more open and transparent – qualities that are not traditionally associated with a family business. Perseverance – continues in that context, as we work on continuous improvement. We are in this for the long term and have already proved that we have the staying power.

Looking ahead we have been preparing for the millennial generation who are entering the workforce in increasing numbers. We are aware that meeting their needs in terms of remote working and flexible hours will include embracing technology as much as changing the hearts and minds to be more open to generational diversity. Continuous learning, mentoring and coaching are already a part of our ethos across many sectors as is succession planning.

Meeting customer needs

In today’s fast-paced, hyper-connected world, consumers are spoiled for choice when it comes to customer service. This means that for our retail and consumer arms, the competition is not simply players in the local market. Our customers frequent the likes of AirBnB and Amazon. They are used to being served where they are, when they need it.

At Sunshine Holdings, we have not been sluggish in our efforts to cater to the ever-evolving needs of the customer. We employ a range of market research methods such as mystery shopper and in-store customer analysis to study customer habits, identify pain points and find viable, mutually beneficial solutions.

Our consumer goods sector, with its key players of Zesta, Watawala and Ran Kahata, had a tough but profitable year largely because we decided to stick to our strategy despite the turbulence and unpredictability of the operating environment. For most of the year consumers were cautious in their spending habits. In addition, across the board, traditional brands were losing market share to new players and regional brands. As a result, our competitors in the market decided to cut the prices of their mass premium teas.

It was a difficult decision, but ultimately we decided that our tea prices accurately reflected their quality. Instead of following suit, we continued to study the market and invested in the strength of our brands.

- Zesta – our premium

- Watawala – for the mass premium segment (leader for the third year in a row)

- Ran Kahata – for our budget conscious consumers

Our studies also showed that consumers preferred larger packs of tea. By quickly catering to this need and sticking to our strategy, we were able to remain profitable. Watawala, our mass premium tea, maintained its number one position in the market – as it has done for the past three consecutive years.

Our market research shows that consumers are increasingly gravitating towards supermarkets for their tea purchases even though many still depend on their mom and pop stores. With these smaller family run stores increasingly moving towards self-service formats, they remain firmly within our focus. Modern trade stores suffered during the year, particularly due to the uncertainties of the socio-political environment so we focused more on other channels.

Gondolas, category headers, light boxes and other methods were used throughout supermarkets to ensure that our brands stood out. Seasonal and monthly discounts have been essential to our success in the current market where the customer is easily swayed by price.

Identifying regions that we have been traditionally weak in, and where we were up against established players, we focused on understanding the consumers better. We invested in activations with families, mini-carnivals and numerous other activities to engage with our target market. The result after two months of intense focus was a 25% increase in sales in these areas showing real potential for further growth.

Spending time with families in target areas to find out how they brew their tea was an eye-opening experience as we realised that many did not employ the traditional methods of brewing.

Catering to consumer needs in healthcare

Through Healthguard, which makes up 15% of our healthcare business, we deal directly with the customer and have been doing so for the past 16 years. To strengthen relationships with customers we minimise the rotation of pharmacists, a strategy that has provided us with invaluable market insights.

For instance, we know that many patients prefer to ask our pharmacists for medication for illnesses like the common cold, rather than spend time in a Doctor’s waiting room. Our ethos goes against providing them with medication without a prescription but we do understand that this is a pain point for our customers. The solution? The oDoc app which puts a customer directly in touch with a physician.

Our oDoc app is just one of the innovations that are unique to Healthguard pharmacies. (Refer page 34 for more details on innovations that strengthen customer relationships.)

Likewise, through our strong relationship with principal Johnson & Johnson we were able to create a centre of excellence for surgeons in training. In this innovative wet lab these medical professionals are able to practice surgery using a dummy. The success of what began as essentially a corporate social responsibility project and being a training centre for upcoming surgeons.