Stakeholder Engagement

We consider a ‘stakeholder’ to be any person, group or entity that is affected by, or that we expect to be affected by the Bank’s activities or their engagement with our organisation. Accordingly, we identify the groups listed below as our key stakeholders, all of whom have an expressed interest in our economic, social and environmental performance:

- Investors (including shareholders and analysts)

- Customers

- Employees (including employee associations)

- Government institutions (including legislators and regulators)

- Suppliers and other business partners

- Society in general

- The natural environment

The governance structure of the Bank demands active engagement with stakeholders to achieve our mission.

A constructive dialogue with stakeholders helps us to understand their expectations so we can better manage risk, innovation and process improvements. Maintaining an ongoing conversation also helps us to identify current and emerging issues, recognise opportunities to develop new products and services and improve performance while ensuring that our responses are in the best interest of our stakeholders.

Most of the Bank’s engagement efforts are conducted in the normal course of business, in day-to-day interactions with customers, suppliers and other stakeholders. We also carry out more structured engagements, as discussed below.

The Stakeholder Engagement Process

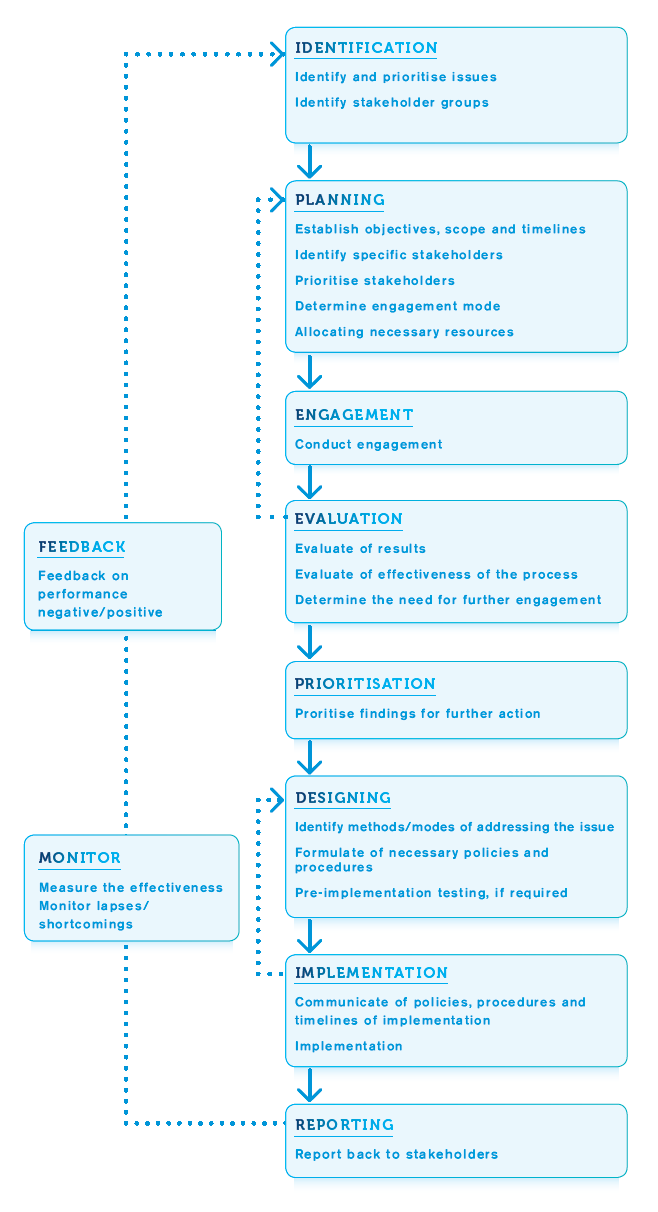

The process is designed to promote inclusiveness and ensure that any critical concerns are brought swiftly to the attention of the Board of Directors and senior management, prompting effective action. The Bank did not encounter any critical stakeholder concerns during 2014.

The Bank’s stakeholder engagement process is explained in the given diagram.

How We Connect with Stakeholder Groups

Dialogue with the Bank’s stakeholders is our primary method of understanding important current and emerging issues. For each of our stakeholder groups, we ensure appropriate engagement mechanisms are in place (as demonstrated in the chart below), so we can better understand their key issues.

1. Investors, Including Shareholders and Analysts

| Mode of Engagement | Frequency of Engagement | Key Topics Discussed and Concerns Raised | Methodologies Employed to Respond |

| Annual reports | Annually | Key topics discussed:

|

Concerns of existing and prospective shareholders are addressed (provided they are not related to commercial secrets) during the engagement process. Transparency, accountability and regular communications are among our top priorities. |

| Annual general meeting | Annually | ||

| Extraordinary general meetings | As required | ||

| Interim financial statements | Quarterly | ||

| Press conferences and media releases | As required | ||

| Investor presentations | As required | ||

| Announcements made to the Colombo Stock Exchange | As required | ||

| One-to-one discussions | As required | ||

| Participation at road shows | As required | ||

| Corporate website: www.combank.lk | Continuous |

2. Customers

| Mode of Engagement | Frequency of Engagement | Key Topics Discussed and Concerns Raised | Methodologies Employed to Respond | |

| Customer satisfaction survey | Annually | Key topics discussed:

|

Opinions and multiple expectations of customers, gathered through various forms of engagement, are considered in developing new products and services. Prompt communications to all staff through internal circulars – covering interest rates, as well as the terms and conditions that apply to our banking products – equips our employees to better handle a wide variety of customer requests. The Bank conducts annual customer surveys to obtain feedback on satisfaction levels and areas of potential improvement in existing services. Other measures to enhance customer satisfaction include improved information security, responsible marketing communications, innovative and environmentally friendly products and assisting in customers’ business development processes. To resolve customer complaints, a member of the Bank’s corporate management team has been named the Complaint Resolution Officer as part of the voluntary Financial Ombudsman program established by the Central Bank of Sri Lanka (CBSL). |

|

| Touch points | As required | |||

| Relationship managers’ engagement with corporate customers | As required | |||

| Complaint Resolution Officer | As required | |||

| Customer workshops | As required | |||

| Media advertisements | As required | |||

| Corporate website: www.combank.lk | Continuous |

3. Employees, Including Employee Associations

| Mode of Engagement | Frequency of Engagement | Key Topics Discussed and Concerns Raised | Methodologies Employed to Respond |

| Managers’ conference | Annually | Key topics discussed:

|

The Bank conducts training and awareness sessions and sends instructions via circulars to increase employee awareness of the latest developments in the industry. The performance-driven culture of the Bank rewards employees based on their achievement of defined targets. The Bank signed a collective agreement with the Ceylon Bank Employees Union before the deadline for concluding negotiations. |

| Relationship-building with employee associations | Annually | ||

| Special events such as quiz contests, children’s parties, staff get-togethers, art and sports events, etc. | Annually | ||

| Regional review meetings | Quarterly | ||

| Internal newsletter - Com Pulse | Quarterly | ||

| Operational updates to staff via email | Daily | ||

| Feedback from cross- functional training programmes | As required | ||

| Negotiations with employees and their associations | As required | ||

| Intranet site of the HR division | Continuous |

4. Government Institutions, Including Legislators and Regulators *

| Mode of Engagement | Frequency of Engagement | Key Topics Discussed and Concerns Raised | Methodologies Employed to Respond |

| On-site surveillance by the CBSL and the Bangladesh Bank | Annually | Key topics discussed:

|

The Bank has an ongoing dialogue with regulators. We have put in place systems and procedures to assure regulatory compliance in both letter and spirit, strengthening our relationship with other public and professional institutions. |

| Directives and circulars | As required | ||

| Filing of returns | Within statutory deadlines | ||

| Consultations | As required | ||

| Press releases | As required | ||

| Meetings | As required | ||

| Official email address: info@combank.net | Continuous |

* Government institutions include the Central Bank of Sri Lanka (CBSL), Bangladesh Bank, the Department of Inland Revenue, the Ministry of Finance, the Registrar of Companies, the Colombo Stock Exchange, the Securities and Exchange Commission of Sri Lanka, the Ceylon Chamber of Commerce, External Auditors and the Sri Lanka Accounting and Auditing Standards Monitoring Board, as well as professional organisations such as The Institute of Chartered Accountants of Sri Lanka and other Government groups.

5. Suppliers and Other Business Partners

| Mode of Engagement | Frequency of Engagement | Key Topics Discussed and Concerns Raised | Methodologies Employed to Respond |

| Supplier relationship management | As required | Key topics discussed:

|

The Bank maintains a list of registered suppliers. We encourage an ongoing dialogue to ensure that value is created for both our suppliers and our own business. Reliability and mutual trust are key to building strong relationships. |

| On-site visits and meetings | As required |

6. Society & Environment

| Mode of Engagement | Frequency of Engagement | Key Topics Discussed and Concerns Raised | Methodologies Employed to Respond |

| Widespread network of delivery channels | Continuous | Key topics discussed:

|

We contribute to local economic development through the full range of banking activities, from deposit taking and investments to personal lending and commercial finance, delivered via the Bank’s nationwide branch and ATM network. Committed to being transparent in our activities, we keep the public informed of our sustainable performance and other relevant developments. We also support local communities and some of the most needy members of society through sponsorship of the CSR Trust Fund, whose initiatives include scholarships for underprivileged students. |

| Press releases | As required | ||

| Press conferences and media briefing | As required | ||

| Informal briefings and communications | As required | ||

| Communications with the general public | As required | ||

| Public events | As required | ||

| Call centre | Continuous | ||

| Corporate website: www.combank.lk | Continuous |