| Net Interest Income |

6,812,107 |

5,596,965 |

22 |

|

7,011,578 |

5,818,928 |

20 |

| Total Operating Income |

15,864,917 |

8,815,216 |

80 |

|

11,549,041 |

14,939,091 |

(23) |

| Net Operating Income |

14,626,715 |

8,709,104 |

68 |

|

10,288,276 |

14,887,712 |

(31) |

| Operating Expenses |

4,944,203 |

4,102,193 |

21 |

|

5,563,875 |

4,496,839 |

24 |

| Profit before Value Added Tax on Financial Services |

9,682,512 |

4,606,911 |

110 |

|

4,724,401 |

10,390,873 |

(55) |

| Taxation |

1,959,276 |

1,682,953 |

16 |

|

2,061,393 |

1,897,654 |

9 |

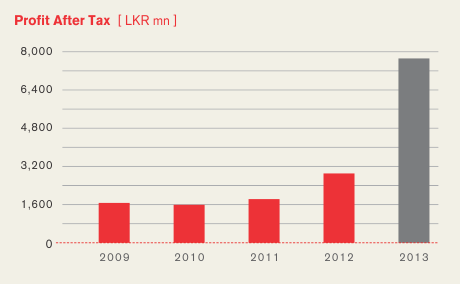

| Profit After Tax |

7,723,236 |

2,923,958 |

164 |

|

2,712,228 |

8,931,939 |

(70) |

| Profit Attributable to Shareholders |

7,723,236 |

2,923,958 |

164 |

|

2,641,925 |

8,853,821 |

(70) |

| Gross Dividends for the year |

1,646,930 |

2,463,029 |

(33) |

|

1,646,930 |

2,463,029 |

(33) |

| Revenue to Government |

1,764,828 |

1,644,953 |

7 |

|

1,871,262 |

1,859,654 |

1 |

|

|

|

|

|

|

|

|

| Assets and Liabilities (LKR '000) |

|

|

|

|

|

|

|

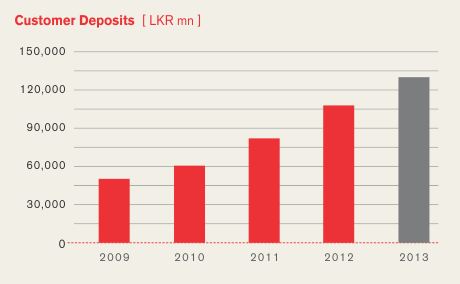

| Customer Deposits |

129,830,029 |

107,600,583 |

21 |

|

129,421,813 |

107,393,866 |

21 |

| Loans and Receivables |

141,650,632 |

120,098,824 |

18 |

|

141,710,813 |

120,145,500 |

18 |

| Investments |

52,242,395 |

29,412,686 |

78 |

|

55,690,627 |

37,913,588 |

47 |

| Total Assets |

201,258,628 |

163,474,296 |

23 |

|

206,817,121 |

174,103,071 |

19 |

| Borrowings |

46,556,578 |

34,932,507 |

33 |

|

46,526,578 |

34,892,582 |

33 |

| Total Liabilities |

181,638,150 |

148,531,895 |

22 |

|

181,455,467 |

148,393,619 |

22 |

| Retained Earnings |

15,653,260 |

12,046,256 |

30 |

|

20,731,801 |

22,216,054 |

(7) |

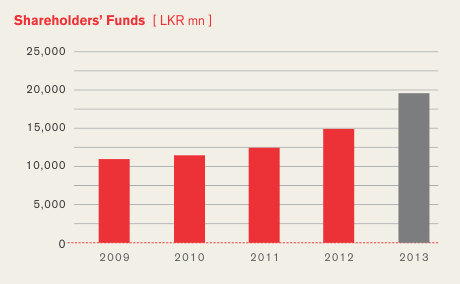

| Shareholders' Funds |

19,620,478 |

14,942,401 |

31 |

|

24,513,806 |

24,883,041 |

(1) |

|

|

|

|

|

|

|

|

| Profitability (%) |

|

|

|

|

|

|

|

| Net Interest Margin |

3.74 |

3.74 |

(0) |

|

3.68 |

3.72 |

(1) |

| Cost to Income Ratio |

31.16 |

46.54 |

(33) |

|

48.18 |

30.10 |

60 |

| Non-Performing Loans Ratio |

2.48 |

1.31 |

89 |

|

2.48 |

1.31 |

89 |

| Return on Assets |

4.24 |

1.94 |

118 |

|

1.39 |

5.59 |

(75) |

| Return on Equity |

44.69 |

21.17 |

111 |

|

10.70 |

42.35 |

(75) |

|

|

|

|

|

|

|

|

| Investor Information (LKR) |

|

|

|

|

|

|

|

| Net Asset Value per Share |

119.13 |

91.00 |

31 |

|

148.85 |

151.54 |

(2) |

| Market Value per Share - as at 31 December |

160.50 |

137.90 |

16 |

|

160.50 |

137.90 |

16 |

| Market Value per Share - Highest for the year |

182.50 |

155.00 |

18 |

|

182.50 |

155.00 |

18 |

| Market Value per Share - Lowest for the year |

138.00 |

96.00 |

44 |

|

138.00 |

96.00 |

44 |

| EPS - Basic |

46.96 |

17.81 |

164 |

|

16.48 |

55.31 |

(70) |

| EPS - Diluted |

46.95 |

17.80 |

164 |

|

16.47 |

55.29 |

(70) |

| PE Ratio (%) |

3.42 |

7.74 |

(56) |

|

9.74 |

2.49 |

291 |

| Dividend Per Share |

10.00 |

15.00 |

(33) |

|

– |

– |

– |

| Dividend Cover (Times) |

4.70 |

1.19 |

296 |

|

1.65 |

3.69 |

(55) |

| Market Capitalization (LKR '000) |

26,433,232 |

22,643,442 |

17 |

|

26,433,232 |

22,643,442 |

17 |

|

|

|

|

|

|

|

|

| Regulatory Ratios (%) |

|

|

|

|

|

|

|

| Capital Adequacy Ratio |

|

|

|

|

|

|

|

| Tier I - (Minimum Ratio of 5%) |

12.05 |

11.14 |

8 |

|

15.15 |

18.72 |

(19) |

| Tier I & II - (Minimum Ratio of 10%) |

17.87 |

12.38 |

44 |

|

21.04 |

20.66 |

2 |

| Statutory Liquid Asset Ratio |

|

|

|

|

|

|

|

| DBU |

26.22 |

22.02 |

19 |

|

26.22 |

22.02 |

19 |

| FCBU |

26.06 |

24.92 |

5 |

|

26.06 |

24.92 |

5 |

|

|

|

|

|

|

|

|

| Debt Ratios (Times) |

|

|

|

|

|

|

|

| Debt/Equity Ratio |

8.99 |

9.54 |

(6) |

|

7.18 |

5.87 |

26 |

| Total Leverage |

10.26 |

10.94 |

(6) |

|

8.44 |

7.00 |

21 |

| Interest Cover |

1.49 |

1.49 |

0 |

|

1.51 |

1.51 |

(0) |

| Interest Rate of Comparable Government Security |

10.63 |

12.02 |

(12) |

|

10.63 |

12.02 |

(12) |