Accounting for Capitals - Key Business Line Review

Personal Banking

Reaching over 3.7 Mn. customers, Personal Banking division is responsible for growing the footprint of the Bank and reaching out to all communities of the country. We process over 600,000 transactions a day facilitating economic activity and creating wealth for our customers through an innovative range of products that support evolving customer requirements. Relevant to millennials and senior citizens alike, we make it our mission to enhance the customer’s value proposition to drive growth in this key business line.

Relevance to the Bank| 63% of Operating Income | 50% of Profit before Tax | 36% of Assets | 62% of Liabilities |

Performance Highlights

Personal Banking Product Portfolio

Figure – 18

Performance

Key Performance Indicators (*)

| 2015 | 2014 | |||

|

Actual Rs. Mn. |

Target Rs. Mn. |

Actual Rs. Mn. |

Achievement (Actual over budget) % |

|

| Deposits as at December 31 | 485,458.6 | 450,469.7 | 407,509.3 | 107.8 |

| Loans and advances as at December 31 | 280,953.6 | 249,767.1 | 221,187.8 | 112.5 |

| Profit before Tax | 8,372.9 | 6,627.4 | 7,017.7 | 126.3 |

| Cost to income ratio (%) | 47.6 | 43.3 | 48.2 | |

| NPA ratio (%) | 3.5 | 5.5 | 6.8 | |

Table – 22

* Based on Management Accounts

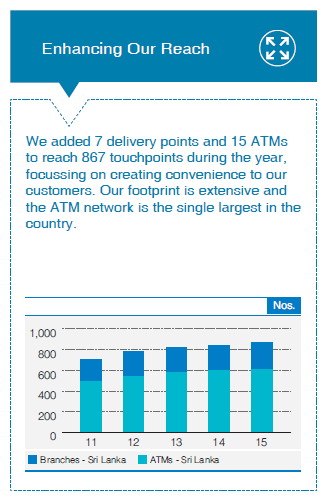

Growing Our Touchpoints

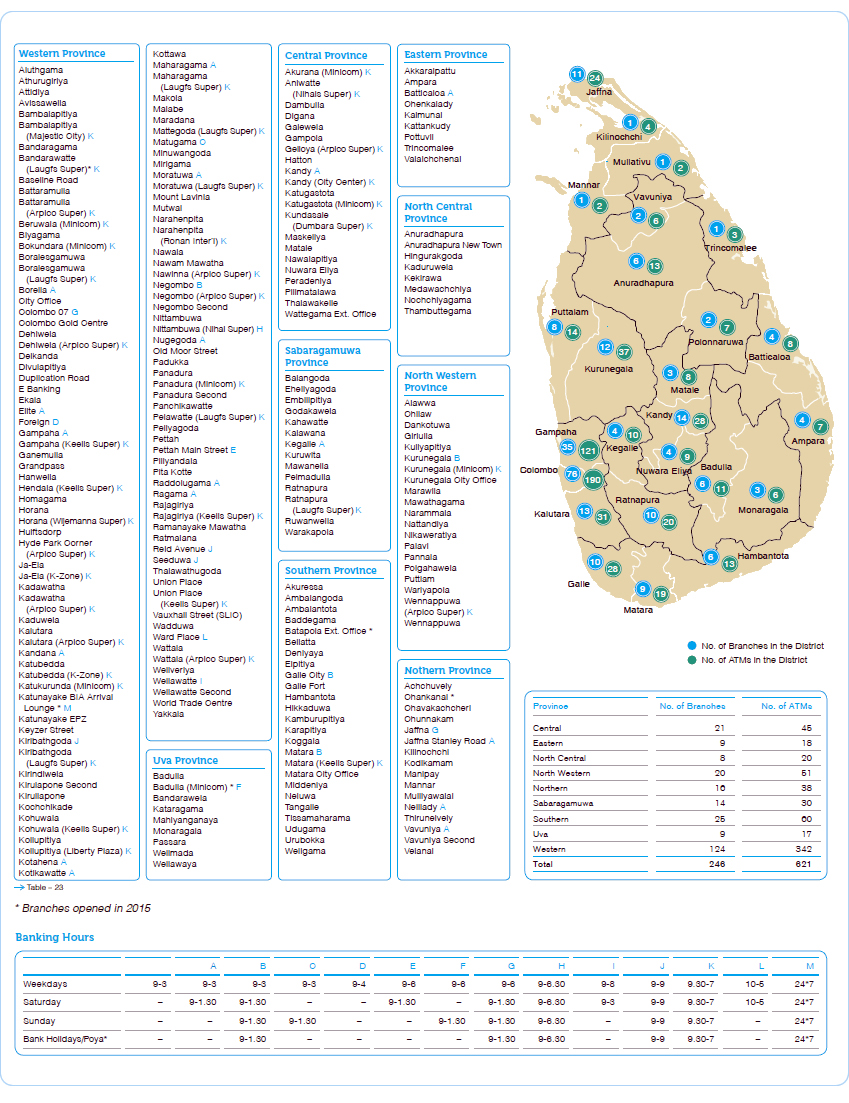

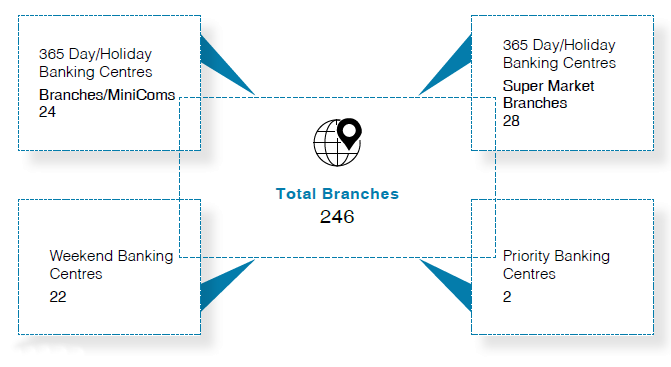

We have grown our network of branches and ATMs to 246 and 621 respectively totalling to 867 owned customer touchpoints in Sri Lanka facilitating ease of access to financial services. Strategic partnerships with institutional partners and connectivity with the common switch, takes our total customer touchpoints to an unparalleled 1.9 Mn. ATMs across over 200 countries. Our branches have also extended banking hours for the convenience of customers in identified locations which received a favourable response. Consequently, we converted a total of 52 branches to 365-Day Banking Centres and a further 22 to Weekend Banking Centres. Details of locations of branches are given on Figure 19 & 20 and Table 23. Branches outside the Western Province have grown during the year facilitating increasing penetration of financial services. Establishment of two Priority Banking Centres located in premium residential areas has enabled us to cater to a high net worth clientele, ensuring our accessability to all customers.

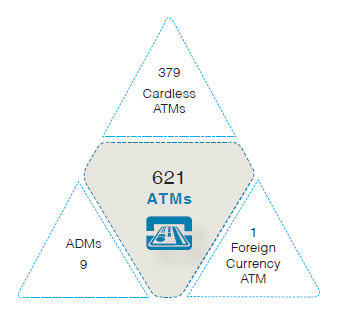

The ATM network (Table 23 & Figure 21) was upgraded to provide deposit facilities at nine locations and we expect to have the entire ATM network converted to Automated Deposit Machines (ADM) in the coming years. The number of cardless ATMs increased to 379 and was an innovation focussing on customer convenience. In November 2015, we opened an Automated 24/7 Banking Centre at the Ward Place Branch which is the first of its kind in the country, expanding the services available 24/7 to encompass opening of savings accounts and fixed deposits, access to online banking, settlement of credit card dues, as well as cash and cheque deposits with additional functionality planned in the future to encompass even submitting loan application.

Network of Delivery Points in Sri Lanka

Figure – 20

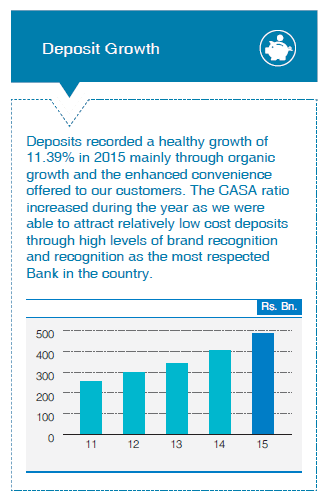

Deposit Mobilisation

A proven track record and extensive reach enabled a 11.39% growth in deposits of the personal banking to Rs. 494.225 Bn. accounting for an estimated 79.19% of deposits of the Bank. A relentless focus on customer expectations inspired innovation of products to fill emerging gaps in the portfolio arising from transitioning demographics.

Figure – 21

Accordingly, Millionaire Savings Account was launched during the year and is the first targeted savings account in the market. Divisaru was launched for micro savers to encourage monthly savings enabling them to access finance without collateral. Customer response to these products is encouraging and a notable achievement was 3000+ micro savers staying on target to meet the requirements for loan eligibility in the coming year. A wide product portfolio developed by a deep understanding of customer needs contributed to the improved CASA ratio of 51.06% which remains well above industry levels. Channel products developed by the Bank offering convenience to the customer also plays a key role in the growth of deposits. Interest rates declined during the early part of the year as reflected in the movement of AWDR and AWFDR which picked up marginally due to impact of special rates for deposits of senior citizens.

Deposit Mix – Personal BankingGraph - 54Credit Growth

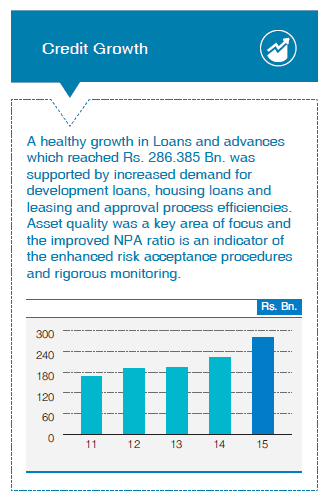

Loans and advances in the personal banking book grew by 26.82% to Rs. 286.385 Bn. during the year accounting for 54.43% of Bank's loans and advances as at the year end. High growth areas were noted in leasing, SME sector loans and home loans in line with the economic developments witnessed in the country.

Advances Mix – Personal BankingGraph - 55Growth in the leasing portfolio was supported by strong demand for vehicles as reduced tariffs introduced in latter part 2014 resulting in an increase of 181% in the number of vehicles registered between January and August 2015 in comparison to the same period in 2014. Strategic partnerships with reputed vendors coupled with promotions and internal process efficiencies provided impetus for growth in leasing.

Home loans portfolio growth was healthy reflecting increased demand for housing and enhanced disposable incomes. The Bank has worked with developers of condominium projects to extend sizeable home loan facilities to high net worth customers and Sri Lankans working overseas. Improvements made to the loan processing system enabled the Bank to revert to the customer within two days, supported the healthy growth witnessed in this portfolio.

The Bank decreased its pawning activities in 2013 and 2014 with the portfolio accounting for a mere 0.65% of the personal banking portfolio. As a party to the CBSL Credit Guarantee Scheme of Pawning Advances, we increased disbursements during the year in comparison to 2014 with enhanced prudential guidelines and increased LTV ratios, to maintain growth of the product to sustainable levels within the Bank’s defined risk appetite.

Supporting SMEs

Commercial Bank has a track record of having the highest disbursements to SMEs through its Development Credit division as described in the section on ‘Social and Network Capital’ report. This year, our Development Banking Portfolio growth was an encouraging 50.25% as we disbursed Rs. 26.553 Bn. with the year end portfolio reaching to Rs. 45.244 Bn. This vital division provides support for SMEs through the provision of agricultural, microfinance and industrial loans and supports SME capacity building through targeted seminars and workshops in collaboration with the CBSL to provide insights into growing and managing a business. This year we conducted 11 programmes covering all provinces in Sri Lanka and the response received has been encouraging with over 1,000 participants attending the workshops.

The Agriculture and Microfinance Unit of the Bank is a highly specialised unit for Agriculture supply chain financing and has structured products that are fit for this volatile and vulnerable segment. A wide array of credit schemes funded by various credit lines enabled growth in this segment at subsidised interest rates or relatively low interest rates. The Agri Leasing product launched in 2014 has also proved popular and supported growth in this portfolio. It is encouraging to observe the growing demand from commercial scale agriculture and livestock projects which will drive national agriculture production, introducing much needed improvements to agricultural practices and better management for long term growth.

Agricultural & Microfinance LoansGraph - 56Industrial loans provided access to finance for SMEs through participation in nine credit lines and our own Diribala Loan Scheme which is the only dedicated credit line offered by a private bank in Sri Lanka designed specifically to benefit the SMEs. Strong demand for industrial loans was evident, notably from construction, food processing and tourism sectors as the low interest rates enhanced the affordability of finance. We disbursed Rs. 21.072 Bn. in industrial loans during the year achieving a portfolio growth rate of 52.36% for the year. The number of loans disbursed also increased with over 1,400 customers receiving financial assistance and a vote of confidence for the economic progress of the country.

Rigorous evaluation of risk, specialised knowledge and strong customer relationships combined to improve the asset quality of the Development Credit Portfolio as evinced by the improvement in the NPA for this portfolio. Going forward, we expect further growth in this vital segment which is receiving significant attention both locally and globally to spur economic growth.

Industrial LoansGraph - 57Banking from Your Location

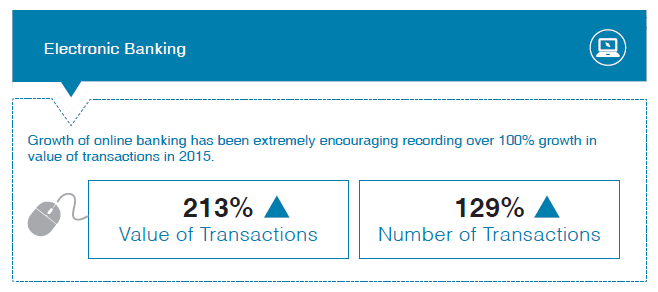

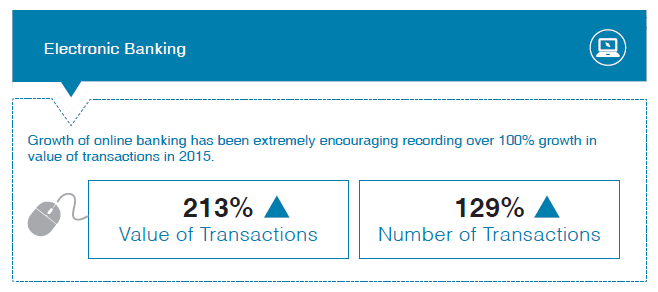

Customers increased their usage of the electronic banking channels during the year resulting in high growth rates for online Banking, mobile banking and the Bank’s flagship product for corporates, PayMaster. Key trends supporting growth in this area included the declining trend in prices of tablets, smartphones and computers resulting in higher penetration levels.

Online banking, the Bank’s Internet based payment system witnessed a growth of 11% in the value of transactions and 22% in the number of transactions evincing growing customer confidence and familiarity with this channel. These positive growth rates are an affirmation of the customer acceptance of this product, which has been developed on the Microsoft. Net platform and consists of Personal and Corporate Banking Solutions. Island-wide product awareness campaigns to promote the features of Corporate and Personal Banking Solutions to encourage usage, were a key factor in driving growth in online banking. Introduction of new features such as Multilevel Authorisation, Administrator User, Single User ID for several company accounts – shared ID etc., enhanced an already robust product.

Growth of Online BankingGraph - 58Activity across all electronic banking channels have evinced strong growth as depicted in the above graph and accounts for 13% of core banking accounts. It is attributable to high mobile penetration rates, transitioning demographics and the wide range of fit for purpose products available from the Bank.

Marketing campaigns also enhanced customer migration towards mobile banking empowering customers to bank from locations of their choice.

Mobile Banking GrowthGraph - 59Performance of ‘PayMaster’, the solution for corporates, has been particularly pleasing as graphically depicted (Graph 60). Planned enhancements for 2016 are expected to empower corporate customers to initiate and complete more transactions with enhanced security features and analytical capability.

The Bank’s performance in this segment which includes two telecom providers and 9 competing banks is creditable surpassing industry growth rates of 140% and 32% respectively for number and value of transactions as reflected in the Payment Bulletin for the 2nd quarter of 2015. Progress in this segment is vital for the remittances business of the Bank as mobile banking provides the connectivity required and secures the Bank’s dominance in this key business line.

Paymaster PerformanceGraph - 60Cards

The use of debit cards in Sri Lanka increased by 31.6% with credit cards spending growth moderating to 10.7% as reported in the Payment Bulletin for the 3rd quarter of 2015. Notably, the number of debit card transactions has exceeded the credit card transactions for the first time in 2015 although the value of transactions in credit cards remains higher. The number of POS terminals in the country also increased by 17.8% to 38,600 as at September 30, 2015 facilitating card transactions. ATM transactions in the country also increased by 15.5% in volume and 32.3% in value as at September 30, 2015. Commercial Bank’s licenses across the entire range of card services as an issuer of credit, debit cards and as a financial acquirer of payment cards provides scope and agility for growth in this lucrative segment.

As the market leader in debit card spending, the Bank continues to witness strong growth in this segment as depicted in the adjacent graph. Recording 22.07% and 14.95% growth for 2015 in debit and credit card spend, we strengthened our position in this high growth area as popularity of debit cards increased. During the year, we continued to focus on improving the security of debit and credit cards transactions resulting in increased customer acceptance of this key channel product. Promotions with popular retailers added to the attractiveness of our card driving growth in spending. At the end of the year cash dispensed through our ATMs grew by 13.44% and Bank accounted for 22% of the total ATM cash dispensed through ATMs in the country. Key factors attributable to growth in this area include increased range of services offered at ATMs, cardless transactions enabled at our ATMs and expansion of the capacity. In order to comply with card scheme requirements, the ATM network was upgraded to enable the processing of ATM transactions through the use of an integrated chip and by year-end we had almost 200 ATMs upgraded to this capability.

CardsGraph - 61Bancassurance

Growth in bancassurance fee income was 38.6% despite the drop in the number of policies issued by the Bank due to revised bancassurance mandate that the life policies being issued only to the account holders of the Bank. The segregation of general insurance business and long term insurance business resulted in growth of partners although the product offering remains largely unchanged. Bancassurance offers convenience to our customers and provides our partners unmatched reach to our customers through our branches.

BancassuranceGraph - 62Way Forward

Personal banking is expected to grow at an increased pace in the coming year supported by our growing customer touchpoints, technology, targeted products and a strong brand. Additionally, the Government budget proposals for 2016 also support customer acquisition and growth in card transactions. A strong pipeline of e-banking innovations empowering customer supports increased customer migration to electronic platforms driving operational efficiencies. The Bank’s unparalleled networks and island- wide reach coupled with increasing functionality in its e-banking and mobile banking channels provide a strong competitive edge to outperform market growth rates.

Our highly trained team will continue to enhance the customer value proposition to ensure sustainable growth in retail banking at Commercial Bank.

Corporate Banking

Accounting for over 34% of the Bank’s loans and advances, the Corporate Banking division facilitates large scale economic activity, supporting the highly specialised requirements of corporate customers. A history of financing some of the largest projects in Sri Lanka and facilitating trade for over 95 years coupled together with the professionalism of our team gives us exceptional capability and agility to compete effectively.

Relevance to the Bank| 24% of Operating Income | 32% Profit before Tax | 24% of Assets | 18% of Liabilities |

Performance Highlights

Our Products

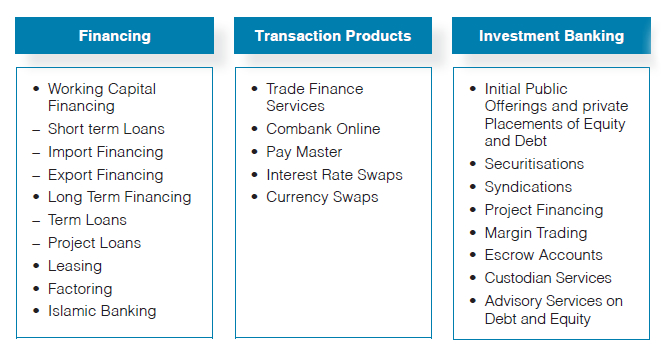

Figure – 22

The Corporate Banking portfolio (Figure 22) is diverse, deriving revenue from its loans and advances portfolio, trade finance activities, off-shore banking activities, the Bank’s Islamic Banking portfolio and also managing overseas branches. This enables the Bank to offer customised solutions to demanding corporates supporting their growth through a wide range of services that cater to all their investment, financing and transactional needs and a global network of correspondent banks. We seek to be the ‘most preferred corporate banking solutions provider’ with high levels of customer satisfaction facilitating customer retention driving our growth and performance.

Key Performance Indicators (*)

| 2015 | 2014 | |||

|

Actual Rs. Mn. |

Target Rs. Mn. |

Actual Rs. Mn. |

Achievement (Actual over Target) % |

|

| Loans & advances portfolio as at December 31 | 179,964.1 | 178,856.6 | 155,314.7 | 100.6 |

| Profit before Tax | 5,606.6 | 5,150.1 | 5,463.8 | 108.9 |

| Import turnover | 236,535.7 | 210,012.0 | 208,103.6 | 112.6 |

| Export turnover | 279,218.6 | 303,607.7 | 272,229.0 | 92.0 |

| Cost to income ratio (%) | 19.7 | 22.6 | 19.9 | |

| NPA ratio (%) | 1.0 | 1.0 | 0.8 | |

Table – 24

Performance

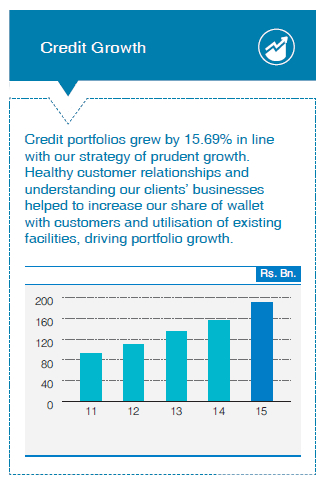

Portfolio growth was robust at 15.69% closing the year at Rs. 180.628 Bn. driven by increased demand for credit particularly in the latter half of the year. Tourism and leisure in Sri Lanka and Maldives were the key sectors of growth for corporate banking in addition to health care, Non Banking Financial Institutions and Consumer Durables as loans disbursed to these sectors increased during the year. The Bank’s focus on its core areas of innovation, professionalism, service quality and optimising earnings enabled us to further strengthen our leadership in vital segments supporting growth. Customer acquisition and retention was key to our growth strategy and success in this area is attributable to effective relationship management, a strong franchise, our ability to customise solutions to customers using a wide range of products and streamlined operations backed by reliable IT.

Structural changes during the year supported higher levels of customer service and satisfaction as the Economic Research Unit and the Trade Finance Departments were brought under the purview of the Corporate Banking. This has enabled us to respond more efficiently to customer requirements and also access the highly specialised knowledge of the trade team in understanding customer needs or customising solutions for them. Need based research has enhanced the team’s professionalism and supported decision-making as we access up to date trends and information on various aspects of the economy.

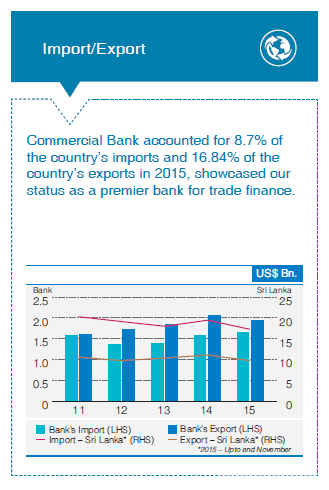

Total operating income increased by Rs. 355.008 Mn. as volume growth in portfolio and trade finance offset narrowing interest spreads and margins on fee-based income. Import and export turnover was driven by encouraging higher utilisation of established limits with existing customer and targeted client acquisition. Import turnover increased by 4.2% in US$ terms during the year as import of vehicles and consumer goods increased and our market share in key import segments increased. Export turnover of the Bank recorded a marginal drop in US$ terms in line with the drop in volumes of exports of the country for the first nine months of 2015. Substantial market share of imports and exports providing undisputable evidence to our expertise and customer satisfaction in this vital aspect of corporate banking.

Loans Screened by the SEMS CordinatorGraph - 63Online banking solutions for corporate customers continued its positive growth trajectory driven by user friendly technology, allaying of security concerns and customer strategies to streamline their own operations. Commercial Bank accounts for approximately 60% of online EPF and ETF remittances of the country which is a strong indication of the business customer acceptance of the product and the Bank’s market share. Paymaster was re-launched during the year with enhanced capability and received an encouraging response from our customers as described above under the Personal Banking Report. Increasing interest from corporates will be matched by investments and innovations in this growing area of operations building on our success.

All loans were screened for environment and social compliance in accordance with the Bank’s SEMS policy and progress monitored in accordance with terms and conditions included in loan agreements to ensure continued compliance. This is perhaps the Bank’s most significant contribution to sustainability which is done through a structured process with dedicated resources for the purpose. We provide feedback received from the SEMS co-ordinator to clients and work together to resolve the issues that may arise, minimising overall risks related to investments.

We also implemented several initiatives to enhance customer satisfaction and improve operational efficiencies during the year. Improved management information systems in turn positively impacted employee productivity. Additionally, we focussed on training our staff on a variety of technical and soft skills topics to ensure they deliver on changing customer expectations.

Investment Banking

Our Investment Banking Unit had a successful year with growth across many areas of activity, including structuring and management of equity and debt, investing in corporate debt, project financing and executing syndicated loan assignments. The strong relationships established with customers by the Investment Banking Team and other departments of the Bank, have helped in generating new business volumes.

The Investment Banking Unit structured and managed multiple debt assignments in 2015, inclusive of a listed debenture issue and several securitisations, raising Rs. 8.0 Bn., and was also able to commence work on several equity fund raising assignments during the year.

We were active in arranging syndicated debt during the year, helping raise US $ 45 Mn. in 2015 through execution of syndicated debt deals in which the Bank also participated as the Lead Bank. As part of its project financing activities, Bank’s Investment Banking Unit financed a solar power project and a bio-mass power project, as well as several hydro power projects.

The equity market during the year was characterised by a decline in the main index and the margin trading portfolio and the equity portfolios of the Bank recorded subdued performances during the year.

The Investment Banking Unit intends to expand its activities in 2016, with a focus on selectively canvassing business, while engaging in the assignments for which the Unit has been mandated.

Islamic Banking

Bank’s Islamic Banking service operates on the concept of ‘profit and loss sharing’ as an alternative to conventional interest based financial transactions as Islamic Sharia Law prohibits the charging of interest. Our Islamic Banking window, Al Adalah, has been in operation since June 2011.

The Bank’s Islamic Banking Unit is supervised by the CBSL and also by a Sharia Supervisory Board, to ensure that all transactions conform to traditional law. The Sharia scholars appointed to the Board help to carry out periodic reviews and audits.

The Islamic Banking deposit products available throughout Sri Lanka include Mudaraba savings accounts and investment accounts. The asset products offered are Murabaha, Musawamah, Wakala, Musharaka, Diminishing Musharaka and Ijara (leasing) for financing requirements which are accessible through the branch network. Furthermore, the Islamic Banking Unit also continued to provide financing under Offshore banking and is in the process of developing products that support Islamic export bill discounting, construction based financing.

In 2015, the Bank’s Islamic Banking Unit won the Gold Award for the ‘Islamic Finance Deal of The Year’ at the 4th Sri Lanka Islamic Banking and Finance Industry (SLIBFI) Awards which recognise individuals and institutions that have made a significant contribution to the industry.

After less than five years in this sector, Commercial Bank has about a 7% share of the Islamic Banking market – a number that we expect will continue to grow as we pursue new initiatives.

Way Forward

The annual customer survey was structured to identify areas for improvement in addition to monitoring satisfaction levels and this served as a look in the mirror for us. The results were extremely gratifying concluding that we have a large base of loyal and satisfied customers. We have also addressed the areas of concern raised in the survey, in order to enhance our customer satisfaction level and expect to reap the rewards in the coming year. Strengthening our franchise and improving earnings will be a key focus as we seek to entrench our position as the leading primary bank.

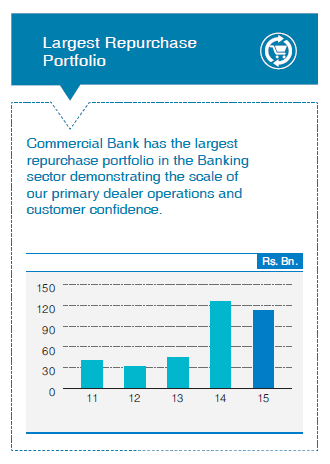

Treasury

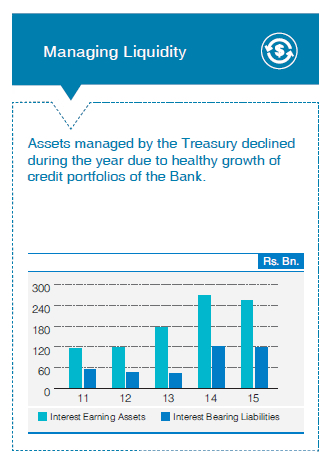

Managing the funding operations of the Bank, the Treasury division continued to support the retail and corporate banking units in their LKR funding requirements whilst managing the foreign currency flows arising out of their business. Considered as a significant player in Interbank FX and Fixed Income Securities market, our operation is segregated into Treasury Sales, Fixed Income Trading, Interbank & ALM and oversees the – operations of the Bangladesh branch Treasury with guidance from the ALCO. The Treasury also effectively managed the Bank’s Interest Risk, Liquidity Risk and the Foreign Exchange Risk in a year which saw movements in both exchange and interest rates and ensured adequate margins.

Relevance to the Bank| 3% of Operating Income | 3% of Profit before Tax | 30% of Assets | 14% of Liabilities |

Performance Highlights

Treasury operations comprise three highly specialised areas, namely, Forex and Corporate Sales, Fixed Income Securities and ALM Operations which are headed by a Chief Dealer who reports to the Head of Global Markets and Head of Global Treasury.

Key Performance Indicators (*)

| 2015 | 2014 | |||

|

Actual Rs. Mn. |

Target Rs. Mn. |

Actual Rs. Mn. |

Achievement (Actual over Target) % |

|

| Forex Profit | 1,004.4 | 950.1 | 672.9 | 105.7 |

| Profit before Tax | 731.0 | 985.2 | 863.8 | 74.2 |

| Interest-Earning Assets as at December 31, | 254,038.1 | 315,916.1 | 270,384.2 | 80.4 |

| Interest-Bearing Liabilities as at December 31, | 117,904.1 | 154,479.9 | 120,998.5 | 76.3 |

| Cost to Income Ratio | 43.3 | 34.2 | 25.7 | |

Table – 25

* Based on Management Accounts

Fixed Income Securities

The Bank’s significant Fixed Income Securities portfolio accounts for 28.51% of the Bank’s total assets and 30.98% of the Bank’s total liabilities. Performance of this desk was impacted by the movement of interest rates which are determined mainly by the country’s monetary policy and market liquidity.

The CBSL continued to maintain its relaxed monetary policy stance during 2015, with several adjustments to provide the necessary impetus to economic activity facilitating credit flows to the private sector. Overnight interest rates moved upwards and settled close to the lower bound of the policy rate corridor with the removal of the restriction on access to CBSL’s Standing Deposit Facility (SDF) in March 2015. The CBSL reduced its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) by 50 basis points each in April 2015 to 6.00% and 7.50% respectively in response to intermittent increase in interest rates in certain market segments following the removal of restrictions on the SDF and also the sharp decline in inflation and they remained at these levels throughout the year. These measures resulted in a surge of demand in private sector credit in the latter half of the year with credit growth outstripping deposit growth after the lapse of many years. The resultant normalising of excess liquidity in the market also added pressure on interbank rates, AWDR and AWPLR which moved up during the same period. The Bank’s ALCO was compelled to revise both lending and deposit rates upwards although the NIM reflects a marginal decline given the intense competition in the market for private sector credit and related business.

Upward movement of interest rates gave rise to fair value losses on remeasuring financial instruments classified as Available-for-sale, a feature observed across the Banking sector although interest income flows remain unaffected.

Foreign Exchange and Corporate Sales

This desk provides vital support to the Retail, Corporate Banking and Trade Finance businesses managing the foreign exchange requirements of their customers and the Bank’s forex risk. Operations of this division are impacted mainly by movements in the exchange rate, the volume of import and export business and remittances channelled through the Bank.

The Sri Lankan Rupee was under pressure along with other peer countries, devaluing by 9.09% from Rs.132.10 at the beginning to Rs.144.10 by the close of the year. The Sri Lankan Rupee remained broadly stable during the first eight months of the year supported by the CBSL intervention, depreciating thereafter as the CBSL allowed greater flexibility in the determination of the exchange rate. The increased demand for foreign exchange was mainly due to higher imports and debt service payments, reversal of foreign investments in the Government Rupee securities market and moderation of workers’ remittances which added pressure on the exchange rate.

The Bank’s forex profit was strongly supported by increased volumes of import export business and remittances. Notably, The Bank’s Treasury was the market leader in Interbank FX Operations, providing liquidity in spot, forward and swap transactions.

Way Forward

The IMF believes that there is little scope for further monetary easing due to recent acceleration in private sector credit growth and rising core inflation and suggests that the CBSL should be prepared to tighten monetary policy in the coming months given the deterioration in the balance of payments and pressures on the Rupee. Additionally, the increase in rates by the Federal Reserve Bank in the US in December, 2015 is likely to cause ripples around the world leading to higher borrowing costs for developing economies, many of which are already seeing slow growth. In Sri Lanka, interest rates are expected to increase in 2016 as global borrowing costs increase, forcing the Government to rely more on domestic sources to satisfy its borrowing requirements. The Rupee is likely to depreciate further as the US Dollar strengthens in the aftermath of the increase in rates and a challenging external environment coupled with poor export performance.

Moderating trade flows and volatile interest and exchange rates indicate higher levels of uncertainty for Treasury activities and conservative positions which is likely to result in a moderation of profitability in 2016.

International Operations

We were able to lay solid foundations for growth of our international operations in 2015, with the opening of a representative office in Myanmar and approvals received to commence operations in Maldives and Italy. As at date, our results in this segment focus on the Bangladesh operation now in its 12th year as our first overseas venture, e-remittance business and offshore banking operations.

Relevance to the Bank| 10% of Operating Income | 15% of Net Profit | 10% of Assets | 6% of Liabilities |

Performance Highlights

Overview of Bangladesh Economy

Bangladesh is one of the most densely-populated countries in the world with a population estimated at 166 Mn. The country has experienced strong economic growth since 1990 and witnessed improvements across a range of social indicators which include primary school enrolment, gender parity in primary education and declining infant mortality. Bangladesh has maintained a Ba3 stable rating by Moody’s and BB- from Standard & Poor sovereign rating with stable outlook for six consecutive years since 2010.

GDP growth of 6-7% in the recent past has boosted per capita income in 2014/15 fiscal year to US $ 1,314 in a rapidly developing market-based economy. More than half of the GDP is generated by the services sector although nearly half the population is employed in the agriculture sector. Remittances from Bangladeshis working overseas and apparel exports constitute the principal sources of foreign exchange for the country.

Strongly divided politics have deterred foreign investment during the year with GDP growth strongly supported by growing domestic consumption, private sector wages and public investments. Inflation moderated below 6.1% during the year in comparison to 6.5% a year earlier, reflecting large public stocks of food grains, healthy weather, supportive monetary policy and low global food and commodity prices recorded in the year 2015. The local currency depreciated only by 0.70% against the US Dollar during the year despite pressure from large regional economies mainly due to healthy current account surplus and all time high external reserves.

Export growth moderated from 12.1% in 2014 to a mere 3.3% in 2015. Import growth accelerated from 8.9% in 2014 to 11.2% in 2015 due to increased imports on machinery, fertilizer and industrial raw materials. The resultant widening of trade gap was largely offset by remittance flows which crossed $ 15 Bn. mark in 2015.

Figure – 23

Banking Sector in Bangladesh

Bangladesh Bank (BB) is the regulator of the country’s financial system which comprises 56 banks further categorised into six nationalised commercial banks, Two Government owned specialised banks, 39 domestic private banks, nine foreign banks and 31 non-bank financial institutions. The Banking sector witnessed growth of 10.53% in 2014/15 recording the second highest sector growth rate reflecting the vibrancy of the sector.

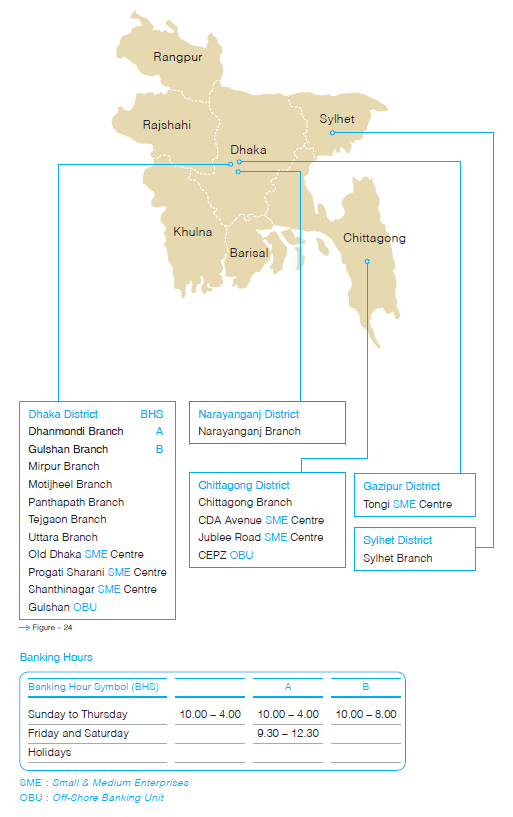

Our Performance

Commercial Bank of Ceylon (CBC) commenced its operations in Bangladesh by acquiring the banking business of Credit Agricole Indosuez in November 2003. Since commencement, CBC has established its position well above the other Regional Banks operating in the country growing from two branches and two booths to 10 branches, 6 SME Centres and 2 Offshore Banking Units (Figure 24). The number of employees has also grown from 126 at inception to 255 as at close of 2015. Operating mainly as a corporate bank, CBC Bangladesh competes with SCB, HSBC and Citi Bank and is positioned ahead of other regional banks operating in Bangladesh.

Growth in Assets/Liabilites – BangladeshGraph - 64

Key Performance Indicators (*) – International Operation

| 2015 | 2014 | |||

|

Actual Rs. Mn. |

Target Rs. Mn. |

Actual Rs. Mn. |

Achievement (Actual over Target) % |

|

| Deposits as at December 31 | 54,071.8 | 48,767.3 | 44,092.0 | 110.9 |

| Loans and Advances as at December 31 | 58,857.6 | 48,277.3 | 40,175.3 | 121.9 |

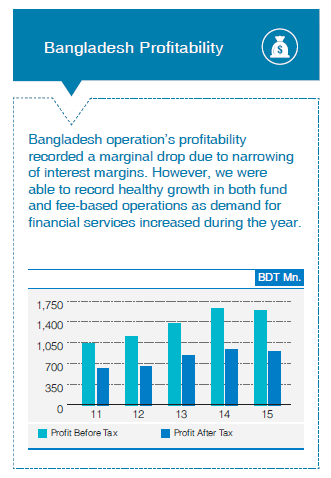

| Profit before Tax | 2,811.9 | 2,849.3 | 2,759.8 | 98.7 |

| Cost to Income Ratio | 27.2 | 29.5 | 28.1 | |

| NPA Ratio as at December 31 | 4.1 | 3.4 | 5.3 | |

Table – 26

* Based on Management Accounts.

Key Performance Indicators (*) – Bangladesh Operation

| 2015 | 2014 |

Achievement (Actual over |

||

| Actual | Target | Actual |

Target) % |

|

| Deposits (BDT ’000) | 21,936 | 24,000 | 18,624 | 91.40 |

| Loans & advances (BDT ’000) | 22,621 | 21,000 | 18,328 | 107.72 |

| Total Assets (BDT ’000) | 34,405 | 38,775 | 32,064 | 88.73 |

| Total Operating Income (BDT ’000) | 2,398 | 2,551 | 2,332 | 94.00 |

| Cost to Income Ratio (%) | 24.98 | 31.87 | 28.15 | |

| ROA (%) | 4.63 | 4.35 | 5.09 | |

| ROE (%) | 12.61 | 13.22 | 14.86 | |

Table – 27

* Based on Management Accounts

Bangladesh operations recorded a substantial credit growth of 23% amidst the lackluster demand for credit as some corporates deferred investment in the market due to political unrest. Excess liquidity in the market resulted in reducing interest rates, however, our Bank recorded an impressive deposit growth of 18% during the year. Client acquisition initiatives were successful with deposits diversifying further, reducing the dependency on the top 50 depositors and auguring well for growth in the future. Total operating income declined due to pressure on margins as interest rates declined exacerbated by reduced import and export turnover. Credit quality deteriorated throughout the industry which has been a key area of focus for improvement through increased rigour in monitoring. The cost to income ratio of Bangladesh Operations decrease by 3.17% to 24.98% for 2015.

CBC is well-positioned in the Banking sector in Bangladesh with the highest rating of AAA given to a regional bank for the fifth consecutive year. The country’s GDP growth rate is expected to moderate marginally to 6.5% in 2016 as forecasted by IMF in its January 2016 update of the World Economic Outlook. We continue to monitor the developments in this market closely to ensure our strategies are aligned to opportunities in the market and are confident of strengthening our position in 2016.

E-Remittances

E-Remittance to Accounts – GrowthGraph - 65It is noteworthy that we were able to grow our e-Remittances to accounts despite the decline witnessed in the country’s remittances as we implemented a strategy of expanding to new markets and providing meaningful benefits for both the remitter and the beneficiary. Growth in the country’s foreign remittances was negative with 0.5% to US$ 6.980 Bn. during the year 2015 compared to 9.5% in the previous year. This was largely attributable to the decline in oil prices impacting key labour markets in the Middle East and decrease of 14.8% in labour migration in the first half of the year in unskilled categories. However, skilled categories recorded an increase of 8.3% during the year. This change in migration patterns is likely to have a significant impact on the pattern of overseas remittances.

Key success factors in this vibrant segment include campaign to increase awareness on the benefits of receiving remittances to accounts and providing a specialised service through dedicated counters manned by well-trained staff. A joint campaign carried out with the Sri Lanka Bureau of Foreign Employment also contributed significantly as we were able to target prospective migrant workers. Initiatives targeting professionals increasing the network to 108 direct e-Exchange agents and a strong network of global remittance players such as Moneygram, RIA, Xpress Money enabling us to connect with Sri Lankan expatriates and diaspora in all corners of the world including North America, Canada and EU. Improvements in technology enabled the Bank to allow common payout modes for most of the leading agent partners making e-Exchange a convenient but reliable product for both agents and customers. The Bank was successful in placing 18 business promotion officers in 11 countries on permanent and temporary basis including in some of the new and emerging corridors i.e., Malaysia, Israel and Singapore during 2015.

Offshore Banking

2015 has been a year of success for expanding our global footprint to Myanmar, Maldives and Italy. Each location provides a unique opportunity for growth, matching our strengths with perceived opportunities in the market identified after careful study. Consequently, our proposals for growth include an SME strategy for Myanmar, a high tech strategy for Maldives and an exchange house in Italy.

The Bank opened its representative office in Yangon in June, formally launching its operations in Myanmar, becoming the first Sri Lankan Bank to be granted a licence by the Central Bank of Myanmar. This operation will initially offer-advisory services to Sri Lankan and Bangladeshi businesses wishing to enter Myanmar, arrange Banking and Advisory facilities, funds transfers and encashment services. There is significant potential to increase bi-Iateral trade between Myanmar and Sri Lanka and interest among Sri Lanka's leading apparel exporters and other industries to set up operations in Myanmar and the Bank is well positioned to be the catalyst.

The Bank also received a licence from Maldives Monetary Authority and approval from the CBSL to establish a fully-fledged Tier I Bank in the Maldives. It will hold the majority stake in a new Subsidiary, Commercial Bank of Maldives (Pvt) Ltd., with a leading Maldivian Group holding the remaining stake.

We also received approval from the Italian Government to establish an Exchange House in Rome through our subsidiary Commex Sri Lanka S.R.L. providing a base in EU for expansion within the EU. This is particularly gratifying as the Bank was able to meet stringent requirements of the EU financial system.

Way Forward

International operations provides a new direction of growth for the Bank which is expected to provide stability in earnings in the future, as we increase our geographical diversity. Bangladesh is a market that is projected to increase its pace of growth in 2016 and 2017 and presents an exciting opportunity. Approvals obtained for new overseas ventures will see us commencing operations in the Maldives and Italy during 2016 and we will continue to explore new markets in the coming year.

The Bank is also well-positioned to grow its remittance volumes through increased digitisation and a growing presence in key migrant markets. As the pioneer local Bank to introduce its own electronic instance remittance service product to Sri Lanka in 2003, the Bank has now set up all the necessary strategies to become the first ever Sri Lankan Bank to introduce itself as a Remittances Service Provider (RSP) with a global product in 2016.

Subsidiaries and Associates

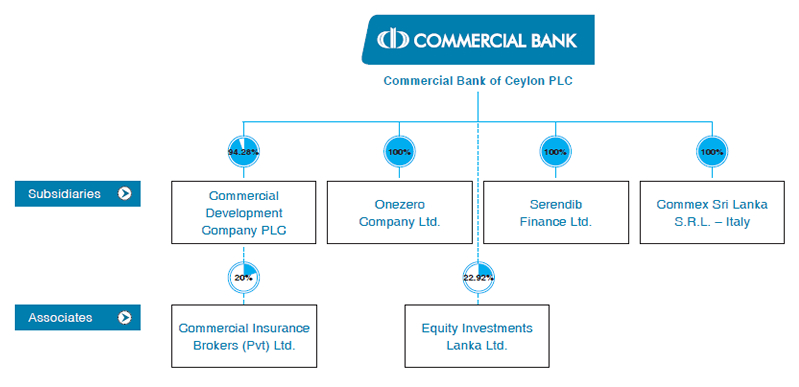

Figure – 25

Commercial Development Company PLC

Commercial Development Company PLC (CDC) was formed in 1980 as the first subsidiary of the Bank to build the present Head Office building of Commercial Bank. At present, the Bank holds 94.28% stake of the CDC. Today, CDC is one of the principal utility service providers to the Bank. The Company derives most of its income from renting space in the ‘Commercial House’ building and outsourcing staff.

CDC recorded a post-tax profit of Rs. 259.795 Mn. for the year ended December 31, 2015 compared to Rs. 275.434 Mn. recorded in the previous year, a drop of 5.68%. However, its operating profit when discounted for the fair value gain recognised on investment properties in the previous year, grew by 10.5% mainly due to the revision of building rent in line with comparable market rates and expansion of its staff outsourcing business. It is noteworthy to mention that the Company was able to maintain its administrative cost intact with a marginal increase of 2.3% amidst the general increase in the overhead cost structures in the country. The Company has already drawn up plans to improve its profitability during 2016.

ONEzero Company Ltd.

ONEzero Company Ltd., a wholly-owned subsidiary of Commercial Bank, provides information technology services and solutions to the Bank. The Company has three main lines of businesses: outsource professional and skilled manpower resources to the Bank, providing hardware and software related support services and supply of computer hardware and software to the Bank. The Company now provides support services to 9 regions with the addition of two more regions during the year.

ONEzero recorded a post-tax profit of Rs. 27.523 Mn. in 2015, a decrease of 9.12% compared to the previous year mainly due to a certain additional income recognised in 2014. Discounting the above, the Company recorded a profit growth of 14.15% compared to 2014. ONEzero is exploring the possibility of enhancing its services provided to the Bank and certain actions has already been taken in this regard.

Commex Sri Lanka S.R.L. – Italy

Commex Sri Lanka, a fully-owned subsidiary of the Bank, incorporated in Rome to serve the funds transfer needs of Sri Lankan expatriates in Italy. However, due to long delays experienced in obtaining the licenses from the Bank of Italy to handle remittances, Commex engage in facilitating remittances through other International money transfer organisations.

Commex received the regulatory approval from the Bank of Italy towards end of the year. The Bank is really pleased in meeting stringent European Union financial system requirements in obtaining the approval. Now the Company is in the process of laying the ground work to start its operations from early 2016.

Serendib Finance Ltd.

Commercial Bank acquired 100% stake in Indra Finance Ltd., a Licensed Specialised Leasing Company, under the consolidation road map of the CBSL in 2014. The Company currently operates under the name of Serendib Finance Ltd. (SFL) which focuses mainly on leasing, hire purchase etc. SFL has a network of 11 branches.

SFL recorded a loss of Rs. 72.676 Mn. for 2015 mainly due to the increase in impairment provision subsequent to the re-alignment of impairment and other accounting policies and practices to be in line with the Bank. The Company formulated a robust plan and expects a remarkable turnaround of its fortunes during the coming year.

Commercial Insurance Brokers (Pvt) Ltd. (CIBL)

The Bank has an indirect stake of 18.86% in Commercial Insurance Brokers (Pvt) Ltd., through its Subsidiary Commercial Development Company PLC. The Company was incorporated in 1987 and is one of the country’s premier brokering firms for both life and general insurance policies. CIBL has built strong partnerships with US-based CA Technologies, as well as Pronto XI ERP of Australia, making it one of the most tech savvy firms in the Sri Lankan Insurance industry. This partnership helps to provide appropriate solutions to all stakeholders of the company in par with world class standards.

In 2015, CIBL witnessed a significant growth of Rs. 11.990 Mn. in post-tax profit to reach Rs. 19.683 Mn. for the year 2015, mainly due to increase in its revenue from commission income.

The company is well equipped and geared to face the stiff competition faced by the industry through the personalised services.

Equity Investments Lanka Ltd. (EQUILL)

EQUILL is a venture capital company set up in August 1990 and provides financing to local entrepreneurs and businesses in the form of equity and equity featured debt instruments. Commercial Bank holds a 22.92% stake in EQUILL.

Despite the decline in share market performance during 2015, EQUILL was able to realize capital gains through the sale of its long term held quoted shares. Company recorded a substantial increase in dividend income too, due to the investments made in high dividend paying companies, specially in the power sector.

EQUILL recorded substantial growth of 94.11% in post-tax profit to reach Rs. 43.264 Mn. in 2015.

The company is actively seeking new investments in diversified sectors but intends investing on a more selective basis in order to maximize returns and to avoid impairment.

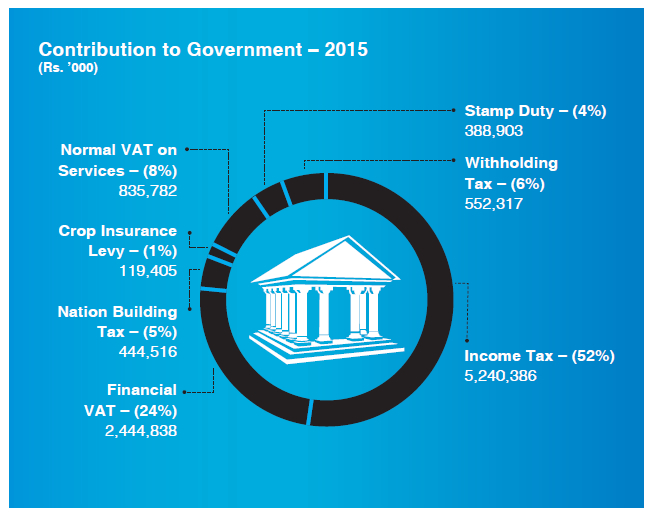

Detailed below are some of the Fiscal and Regulatory proposals presented by the Government Budget 2016, which will have an impact on the Banking Industry. Few of these proposals have been enacted as at the date of this Report and some are pending. Our Bank is aware of the implications arising out of these proposals and therefore geared to meet the challenges/requirements that may arise in the future.

| Fiscal Proposals | |

| Income Tax | Profits from Banking and Finance services to be liable to the higher Income Tax of 30% which is 2% above the current rate. |

| Financial VAT & NBT | Financial VAT and Nation Building Tax paid by banks on the adjusted profit of financial services to be increased by 1.5% and 2% respectively. |

| Stamp Duty | Local use of credit cards exempt from Stamp Duty. Stamp Duty on use of credit cards for foreign transactions to be increased to Rs. 25/- for every Rs.1,000/- or part thereof. |

| Regulatory Proposals | |

| Branch Expansion | All banks to expand the branch network by 15% in lagging regions. Each of these branches to be operated by a minimum of six employees. |

| Bank Lending Requirements | Pawning business to be restricted to 5% of the loan portfolio. Minimum required lending to Agriculture Sector set at 10%, SME Sector at 5% and Women & Youth of 5% of the loan portfolio. |

| CBSL guarantee for deposits of registered Finance Companies | The Central Bank of Sri Lanka to issue a 100% guarantee on all deposits held by registered finance companies. |

| Cap on interest rates offered by the Finance Companies | A cap on interest rates offered by the Finance Companies to prevent undue concentration of deposits in one sector. |

| Dormant Account Balances | Proposed to transfer all balances lying in Dormant Accounts of banks to the Central Bank. |

| Revision of the Exchange Control Bill | A revised investor friendly Foreign Exchange Management Bill to be introduced. |

| Financial Institutions Restructuring Agency (FIRA) | Establishment of Financial Institutions Restructuring Agency (FIRA) to assist failing finance companies. |

Table – 28