A series of online videos featuring DFCC Senior Management are now available on the DFCC Bank website. The videos include a video of Mr. Lakshman Silva – CEO, Mr. Thimal Perera – DCEO, and Ms. Anomie Withana – EVP/Company Secretary/Secretary to the Board, discussing different aspects of the Bank to familarise stakeholders and the general public with the Bank and its operations.

Our three key focus areas for 2017 will be Consumer Banking, Digital Strategy and Small Enterprise Strategy.

In Consumer Banking, we aspire to; amidst all, effectively denote customer segmentations, deploy foot soldiers for more individualised customer experiences and identify and introduce new products and value additions to customers. We equally aim to structure Consumer Banking at a Branch level, implement an effective channel strategy and establish a strong Brand presence through marketing and advertising.

With our Digital Strategy, we will oversee the introduction of new credit card systems, flow management systems, and payment and cash management solutions.

Our Small Enterprise Strategy will focus on, amongst all, in the centralising of the loan approval process to enhance the effectiveness of appraisals and documentation. We will also organise capacity building workshops in the North Western, Central and Western Provinces. We will equally introduce marketing campaigns to drive awareness of our products amongst the rural and semi-rural business communities.

A more comprehensive list of information about the above can be accessed from our Annual Report 2016, available online.

Global growth, at a rate of 3.1%, was at a standstill in 2016, following on from the previous year. This was due to contrasting trends in advanced and developing economies. In spite of this, economic activity was set to accelerate, with growth projections for 2017 and 2018 estimated at 3.4% and 3.6% respectively.

The World Bank denoted a ‘relatively favourable outlook’ for Sri Lanka in 2017, chiefly due to reforms in key policy issues. GDP was expected to grow at 5%, backed largely by private consumption and deferred foreign direct investments (FDIs). Nevertheless, the economy could be prone to external shocks; from a multitude of arenas; including but not limited to, slowdowns in key export markets, shifts in tourism and investments and latent increases in global commodity prices.

The asset base of the Sri Lankan banking sector contained to expand during the year of 2016, while maintaining capital and liquidity at required levels. The profits for the sector increased during the first eight months of 2016, compared with the corresponding period for 2015, owing to an increase in net interest income.

The Bank’s chief lines of business are Corporate Banking , Branch and SME Banking, Small Business Enterprise Banking, Business Banking, Consumer Banking, and Treasury and International Banking. These lines are complemented by our subsidiaries, a joint venture and associate company for services in consultancy, information technology, industrial estate management, investment banking and fund management.

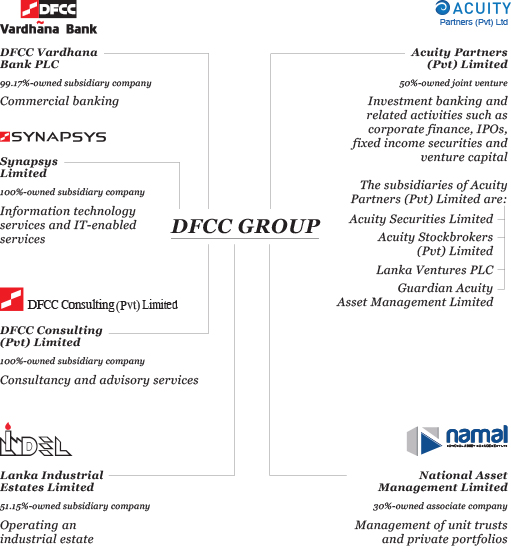

Our operations consist of DFCC Bank PLC; alternatively referred to as DFCC Bank or DFCC, and the DFCC Bank Group. The DFCC Bank Group consists, in addition to the Bank, the subsidiary companies DFCC Consulting (Pvt) Limited, Lanka Industrial Estates Limited, and Synapsys Limited; the joint venture of Acuity Partners (Pvt) Limited; and the Associate Company of National Asset Management Limited.

All of the above entities conclude their financial year on the 31st of December, excluding the subsidiary Lanka Industrial Estates Limited.

See: Our strategic direction in our Annual report 2015.

See: Operating Environment in our Annual report 2015.

Operationally, the Bank’s primary lines of business are Corporate Banking, SME Banking, Business Banking, Personal Banking, Treasury and International Banking. The business lines are complemented by its subsidiaries, a joint venture and an associate company for services in consultancy, information technology, industrial estate management, investment banking and fund management.

Additional information on these are given under Our Portfolio in our Annual Report 2015.

The DFCC Group comprises of 3 subsidiaries, a joint venture company and an associate company after the amalgamation. Additional information on these are given under Group Structure in our Annual Report 2015.

“To be the leading financial solutions provider sustainably developing individuals and businesses”

“To provide innovative and responsible solutions true to our Values with the expertise of our multidisciplinary team of professionals and synergies of our financial services group”

Founded in 1955, DFCC Bank is one of the oldest development banks in Asia.

A unique institution; private sector in form but more like a public-private partnership in outlook, DFCC Bank was set up under an act of Parliament, to give rise to the post independent industrial growth through private sector participation.

Setting off to accomplish its mandate in unchartered territory, against a tapestry of changing political and economic scenarios, DFCC has for well over half a century played an innovative and catalytic role in the development of the private sector with special support from the government which continues to date. DFCC's role has not been confined to providing long term loans alone but one that has extended to capacity building and business facilitation.

DFCC Bank is proud to have been the wind beneath the wings of many trail-blazing entrepreneurs and enterprises in the country, particularly during their early and risky start-up stages. Today many of them are leading players in sectors such as agriculture, apparel, construction, food and beverages, healthcare, manufacturing, power, telecom and tourism.

The Bank has been a true pioneer, daring to lead the development of key sectors such as small and medium enterprises, resort hotels, mobile telecommunication and more recently renewable energy. The Bank also ventured into new and complimentary areas of business such as investment banking, unit trusts, stock broking, venture capital and industrial estate management.

With its original mandate still high on the agenda, DFCC Bank continued in to the new Millennium with a paradigm shift in its business model. New subsidiaries engaged in Consulting and IT services were launched and the investment banking business was re-engineered through a joint venture to be a fully fledged universal investment banking group.

The defining moment in the last decade was the launch and development of DFCC Bank’s commercial banking subsidiary named DFCC Vardhana Bank. A unique two banks in one structure transformed DFCC from a single product bank that only connected with businesses, to a bank that also catered to individuals from all walks of life. A portfolio of enhanced personal financial services asset and liability products was designed and introduced.

Throughout its journey DFCC Bank never lost sight of its special role in the development agenda of the country. It continued to be in the forefront of sustainable development financing being a net transferor of financial resources especially to the provinces, transforming rural economies and thereby supporting livelihoods, employment generation and capital formation. The small and medium enterprise sector is the key driver of this transformation and DFCC remains committed as always to the development of this sector.

Through the years DFCC has been recognised for its work especially in the development and corporate social responsibility areas. However, what is special is the recognition from the international financial community. The World Bank has stated that DFCC Bank is one of a small number of development finance institutions that was not only viable, but also successful in transforming itself into a multi-product and robust financial institution in a changing international and local environment. DFCC’s special status means that it is the preferred conduit for funding from multilateral institutions.

Over the years, DFCC has evolved, diversified and grown to meet the changing needs and aspirations of a resurgent economy, its institutions and its people.

In January 2015, DFCC became a Public Quoted Company incorporated under the Companies Act No. 07 of 2007, transforming into DFCC Bank PLC.

In October 2015, in a landmark event in Sri Lanka’s banking and financial sector, DFCC Bank PLC and its subsidiary - DFCC Vardhana Bank amalgamated to form a fully-fledged commercial bank supervised by the Central Bank of Sri Lanka. The joint synergies and the combined development banking and commercial banking resources of the merged entities, strengthen and position DFCC Bank PLC as a force to be reckoned with in the financial services industry. The combined entity offers a full range of banking services across all economic sectors and geographies in the country, with sustainable value creation as a core objective.

As a financial services group, DFCC Bank PLC continues to grow and draw synergies from its complementary areas of business such as investment banking, unit trusts, stock broking, venture capital, industrial estate management, consulting and IT services through its subsidiaries, joint venture and associate company.

The Bank presently operates 137 branches across the country, and customers are serviced by over 1,500 dedicated employees with expertise in various disciplines.

DFCC Bank was developmental by design;

but resilient by choice;

and are staying relevant for the future...

The Bank will remain focused on developing individuals and businesses to grow through innovative and responsible financial solutions that lead to sustainable progress and prosperity for all.

Let's keep growing...

On the 1st of October 2015, Sri Lanka’s banking and financial sector made a landmark development with the amalgamation of DFCC Bank and DFCC Vardhana Bank.

The new entity is a full-service bank which offers a wide range of products and services such as development commercial banking, development banking and personal financial services. The two banks which share a common vision, mission and ethos have also introduced a new logo which symbolizes simplicity and ease of access to all its customers.

Subsequent to the amalgamation, the entity will have approximately 1500 employees, 137 branches island-wide and a combined asset base of Rs 210 billion as at March 2015.

The merger is in keeping with the national objectives of the country as it showcases the country as a vibrant economy and an attractive destination for investment.

DFCC Bank PLC will carve a new financial future for Sri Lanka and its future. It will also prove to be a banking leader of international standing.

At the Annual General Meeting held on the 28th of August, the amalgamation proposal for DFCC Bank PLC and DFCC Vardhana Bank PLC was unanimously approved by the shareholders of the two companies.

DFCC Bank PLC will make an offer to purchase the shares of the minority shareholders of DFCC Vardhana Bank PLC at a price of Rs 52/- for every one ordinary voting share held.

The amalgamation of the two complementary businesses will offer integrated financial solutions to a range of clients through 137 branches situated island-wide. This remarkable milestone will be achieved the very same year DFCC celebrates its Diamond Jubilee. The merger will build on 60 years of expertise and will deliver value and convenience to all its stakeholders. The future of the Bank is well mapped out and will bring together the best in talent and practice.DFCC Bank PLC, originally founded as Development Finance Corporation of Ceylon, is one of the oldest development banks in Asia.

We are a quoted public company with limited liability incorporated by DFCC Act No. 35 of 1955 and with the enactment of the DFCC Bank (Repeal and Consequential Provisions) Act No. 39 of 2014, incorporated under the Companies Act No. 07 of 2007 with the name 'DFCC Bank PLC' with effect from 6 January 2015. Additional information is given under Corporate Information and Note 1 to the Financial Statements in our Annual Report 2014/15.

We are a licensed specialised bank. However, through an operational merger with our 99%-owned commercial banking subsidiary, DFCC Vardhana Bank, we provide a full suite of banking services across a broad spectrum of customers and sectors throughout Sri Lanka. We call it the DFCC Banking Business.

To be Sri Lanka’s premier financial services group by providing superior financial solutions, nurturing business enterprises, and delivering value to our customers, shareholders, employees and the nation.

Our seven core values are the guiding principles for our 'ACTIONS' that shape the way we do business.

The DFCC Group comprises four subsidiaries, a joint venture company and an associate company as shown below.

Additional information is given under Group Structure and Note 1 to the Financial Statements in our Annual Report 2014/15.

The DFCC Banking Business is focused on corporate banking, small and medium enterprise (SME) financing, personal financial services, treasury and international banking. The business lines are complemented by its subsidiaries, a joint venture and an associate company for services in consultancy, information technology, industrial estate management, investment banking and fund management.

Additional information is given under Our Portfolio in our Annual Report 2014/15.

See: Operating Environment in our Annual Report 2014/15.

Other useful sources:

With our vision and mission in mind, we focus on the needs of our customers and local communities, create sustainable value for our stakeholders and ourselves, and thereby strive to fulfil our twin goals of supporting national economic development with profitable growth of the Bank and Group.

Our immediate priority is on concluding the amalgamation of DFCC Bank and DFCC Vardhana Bank, while in parallel the Bank will pursue the five strategic imperatives noted below.

On the business side, we aim for sustainable and profitable growth by

Internally, we will focus on operational efficiencies and effectiveness by

The above are discussed under Strategic Direction in our Annual Report 2014/15.